GOLD Trading Predictions

1 Day Prediction

Target: July 21, 2025$3355.6

$3355.6

$3365

$3340

Description

The stock shows a slight bullish trend with recent support at 3340. The RSI indicates neutrality, while MACD is close to crossing above the signal line. Volume remains stable, suggesting a potential upward move.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support is around 3340, while resistance is near 3375. The RSI is neutral, and MACD is showing potential bullish divergence. Volume patterns indicate some accumulation.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 28, 2025$3360

$3355.6

$3380

$3330

Description

The stock is expected to maintain a bullish sentiment with a slight upward trend. The Bollinger Bands suggest a potential breakout, while the MACD remains positive. Volume is expected to increase as traders react to market sentiment.

Analysis

GC=F has been trading sideways with a slight bullish bias. Key resistance at 3380 and support at 3340. The ATR indicates moderate volatility, and recent candlestick patterns suggest indecision among traders.

Confidence Level

Potential Risks

Potential market corrections or geopolitical events could lead to unexpected price movements.

1 Month Prediction

Target: August 21, 2025$3400

$3360

$3450

$3300

Description

A bullish trend is anticipated as the stock approaches key Fibonacci retracement levels. The MACD is showing a bullish crossover, and the RSI is moving towards overbought territory, indicating potential upward momentum.

Analysis

The stock has shown resilience with a gradual upward trend. Key support at 3300 and resistance at 3450. The RSI is approaching overbought levels, and volume patterns indicate increased interest from buyers.

Confidence Level

Potential Risks

Economic data releases and market sentiment shifts could impact the forecast.

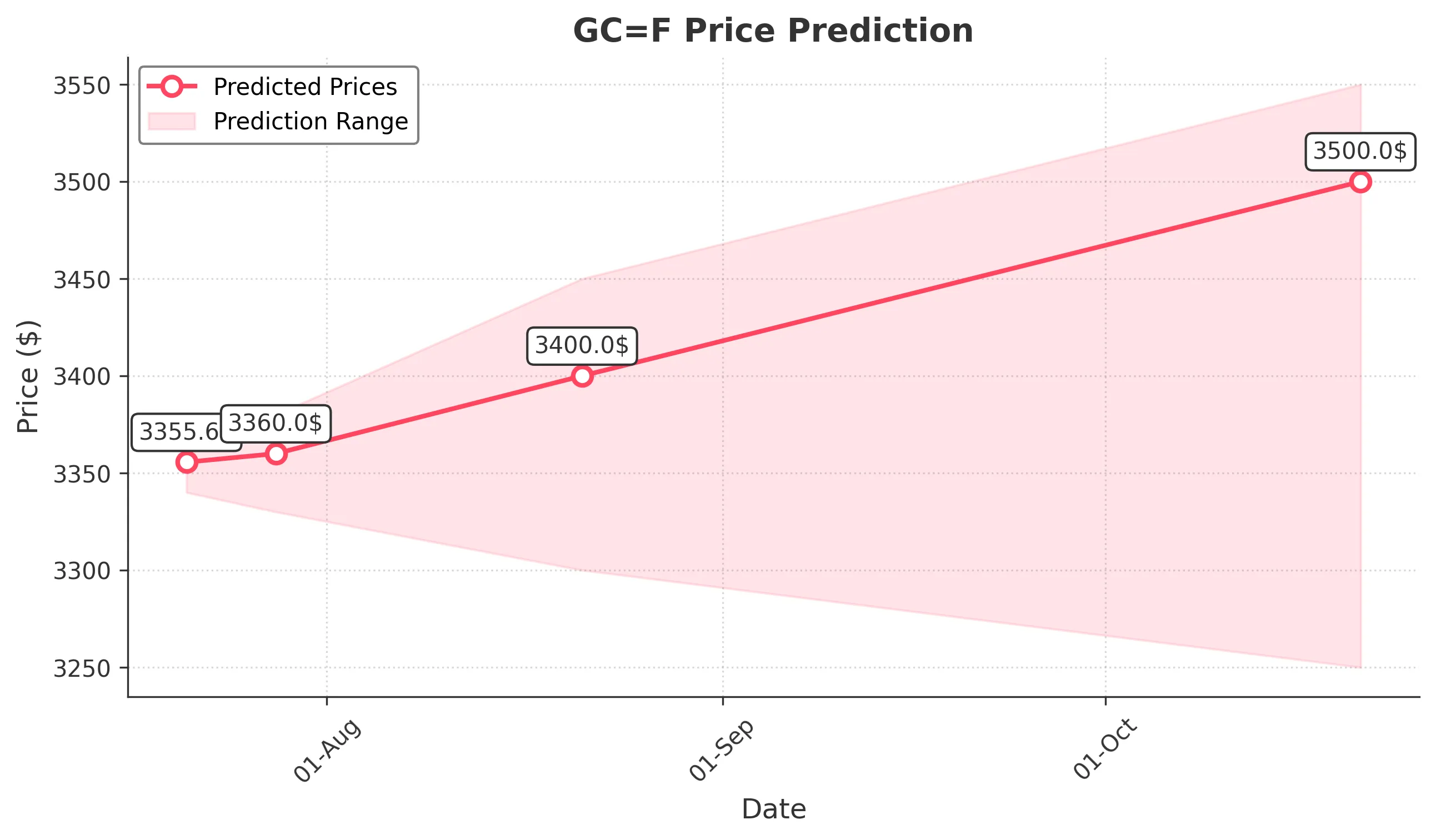

3 Months Prediction

Target: October 21, 2025$3500

$3400

$3550

$3250

Description

Long-term bullish sentiment is expected as the stock breaks through resistance levels. The MACD indicates strong momentum, and the RSI suggests sustained buying interest. Volume is likely to increase as market conditions improve.

Analysis

GC=F has shown a recovery pattern with potential for further gains. Key resistance at 3550 and support at 3250. The overall market sentiment is cautiously optimistic, but external factors could introduce volatility.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic changes and unforeseen events that could alter market dynamics.