GOLD Trading Predictions

1 Day Prediction

Target: July 22, 2025$3355

$3350

$3370

$3340

Description

The stock shows a slight bullish trend with recent support at 3340. The RSI is neutral, and MACD indicates potential upward momentum. However, volatility remains, suggesting caution.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support at 3340 and resistance at 3370. Volume spikes indicate interest, but overall sentiment is mixed. Technical indicators suggest potential for a short-term bounce.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, and a reversal is possible if selling pressure increases.

1 Week Prediction

Target: July 29, 2025$3360

$3355

$3385

$3330

Description

The stock is expected to stabilize around 3360, with potential resistance at 3385. The Bollinger Bands indicate a tightening range, suggesting a breakout could occur soon.

Analysis

GC=F has been trading sideways with a slight bearish bias. The recent price action shows a struggle to maintain above 3350. Technical indicators are mixed, with the MACD showing potential for a bullish crossover, but overall market conditions remain uncertain.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could impact market sentiment, leading to increased volatility.

1 Month Prediction

Target: August 21, 2025$3400

$3350

$3450

$3300

Description

A gradual recovery is anticipated as the stock approaches 3400, supported by bullish divergence in RSI. However, resistance at 3450 may limit upside potential.

Analysis

The stock has shown volatility with a bearish trend recently. Key support at 3300 and resistance at 3450. The market sentiment is cautious, and while there are signs of recovery, external factors could influence price direction.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could lead to unexpected price movements, affecting the forecast.

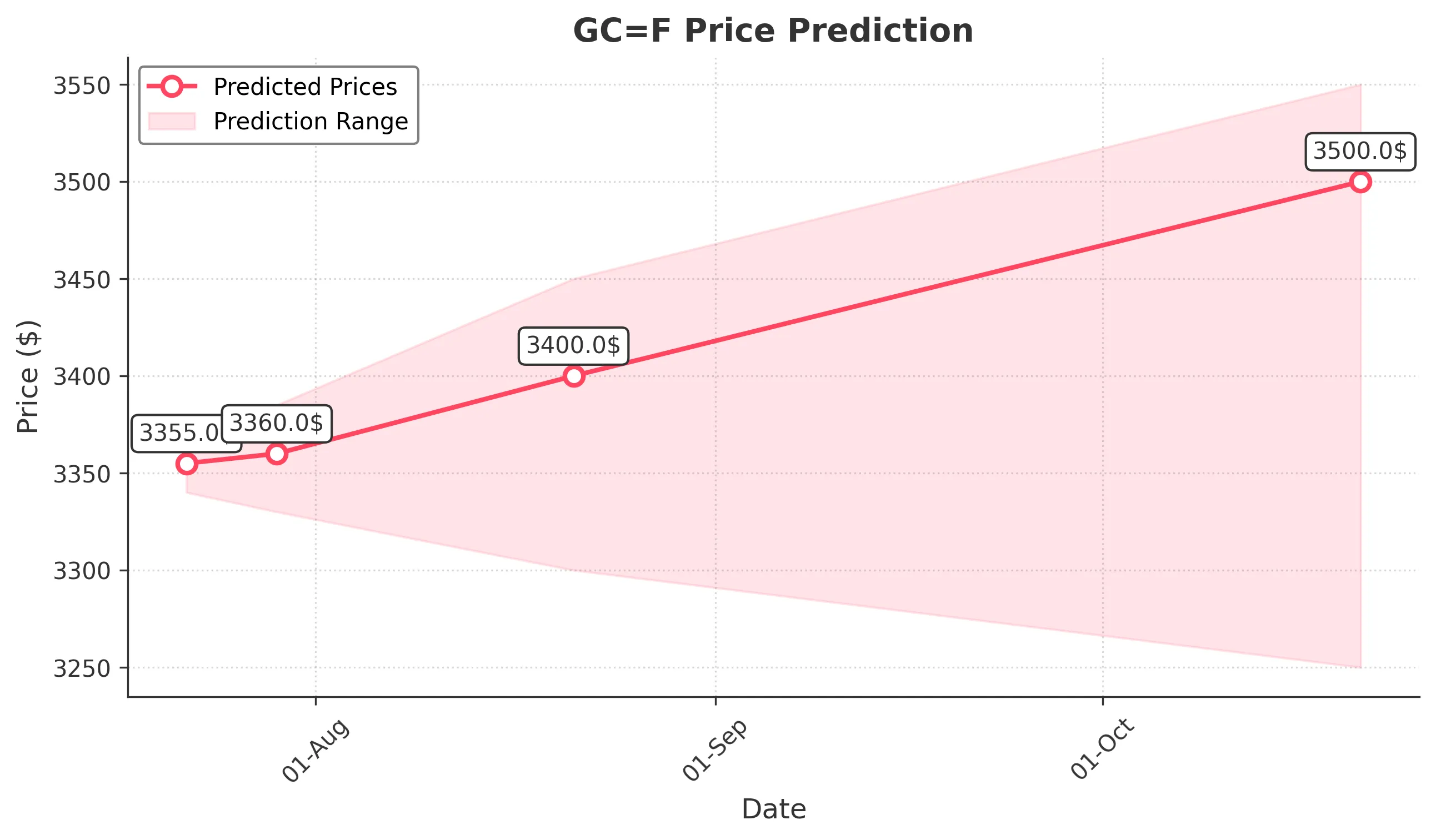

3 Months Prediction

Target: October 21, 2025$3500

$3400

$3550

$3250

Description

Long-term outlook suggests a potential rally towards 3500, driven by improving market conditions. However, significant resistance at 3550 could pose challenges.

Analysis

GC=F has experienced a bearish phase with significant price swings. The overall trend remains uncertain, with key support at 3250 and resistance at 3550. Technical indicators suggest potential for recovery, but external factors could heavily influence future performance.

Confidence Level

Potential Risks

Market volatility and economic uncertainties may hinder price recovery, leading to potential downward adjustments.