GOLD Trading Predictions

1 Day Prediction

Target: July 23, 2025$3405

$3390

$3420

$3380

Description

The stock shows bullish momentum with a recent close above the 50-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 3380 may hold, leading to a slight upward movement.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant support at 3380 and resistance around 3420. The recent price action indicates a consolidation phase, with volume spikes suggesting increased interest. Technical indicators like MACD are bullish, but RSI indicates overbought conditions.

Confidence Level

Potential Risks

Potential reversal due to overbought RSI and market volatility could impact the prediction.

1 Week Prediction

Target: July 30, 2025$3420

$3400

$3440

$3350

Description

The stock is expected to maintain its bullish trend, supported by recent price action. However, the RSI suggests potential overbought conditions, which could lead to a pullback. Key resistance at 3440 may limit upside potential.

Analysis

GC=F has been in a bullish trend, with key support at 3380 and resistance at 3440. The MACD is positive, indicating upward momentum, but the RSI is approaching overbought territory. Volume patterns show increased activity, suggesting strong interest.

Confidence Level

Potential Risks

Market sentiment and external economic factors could lead to unexpected volatility, impacting the prediction.

1 Month Prediction

Target: August 22, 2025$3350

$3400

$3400

$3300

Description

A potential correction is anticipated as the stock approaches resistance levels. The RSI indicates overbought conditions, and profit-taking may occur. Support at 3300 is critical for maintaining the bullish trend.

Analysis

The stock has shown a bullish trend but is facing resistance at 3400. The RSI is overbought, suggesting a possible pullback. Volume analysis indicates strong interest, but the potential for profit-taking could lead to a correction. Key support at 3300 will be crucial.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could lead to a sharper decline than expected.

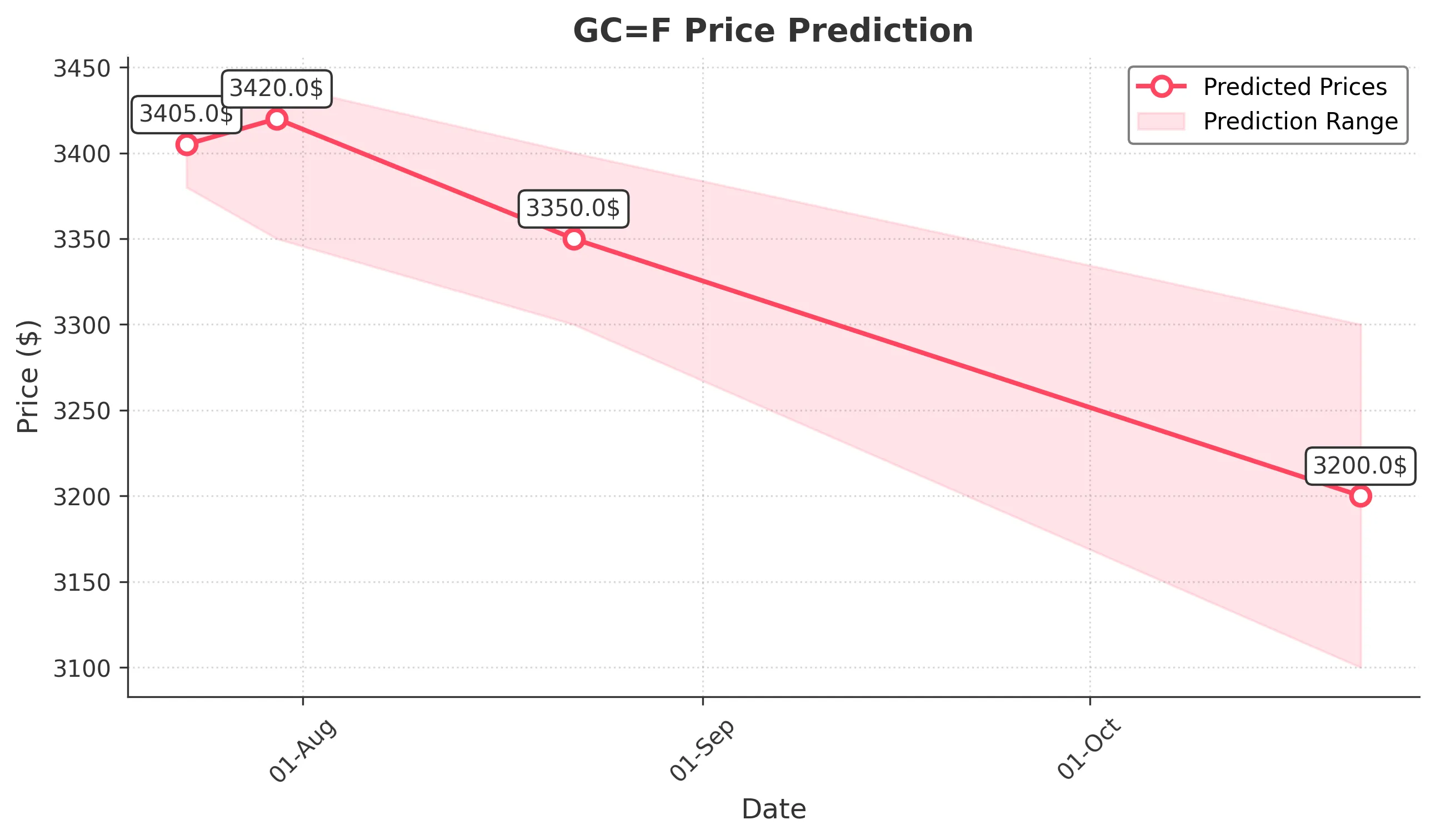

3 Months Prediction

Target: October 22, 2025$3200

$3250

$3300

$3100

Description

A bearish outlook is anticipated as the stock may face significant resistance and potential profit-taking. The RSI indicates a correction phase, and macroeconomic factors could further pressure prices.

Analysis

GC=F has shown a bullish trend but is now facing resistance. The RSI suggests overbought conditions, and potential profit-taking could lead to a decline. Key support levels at 3100 will be critical, and macroeconomic factors may influence future performance.

Confidence Level

Potential Risks

Market volatility and external economic conditions could lead to unexpected price movements, impacting the prediction.