GOLD Trading Predictions

1 Day Prediction

Target: July 25, 2025$3355

$3350

$3370

$3340

Description

The stock shows a slight bullish trend with recent higher lows. The RSI is neutral, indicating no overbought conditions. A potential Doji pattern suggests indecision, but overall sentiment remains cautiously optimistic.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant support around 3300. Recent volume spikes indicate increased interest. However, the market remains sensitive to macroeconomic factors, which could lead to fluctuations.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: August 1, 2025$3360

$3355

$3385

$3330

Description

The stock is expected to maintain its upward momentum, supported by recent bullish candlestick patterns. The MACD shows a positive divergence, indicating potential for further gains, but caution is advised due to resistance levels.

Analysis

GC=F has been fluctuating around the 3350-3400 range, with key support at 3300. The RSI indicates a neutral stance, while the MACD suggests potential bullish momentum. However, external factors could introduce volatility.

Confidence Level

Potential Risks

Resistance at 3385 may limit upward movement; any negative news could reverse the trend.

1 Month Prediction

Target: August 24, 2025$3400

$3350

$3450

$3320

Description

A bullish outlook is anticipated as the stock approaches key Fibonacci retracement levels. The overall market sentiment is positive, but caution is warranted due to potential resistance at 3450.

Analysis

The stock has shown a bullish trend with significant support at 3300. The MACD and RSI indicate upward momentum, while volume patterns suggest increased buying interest. However, external factors could introduce risks.

Confidence Level

Potential Risks

Market corrections or geopolitical events could impact the price trajectory.

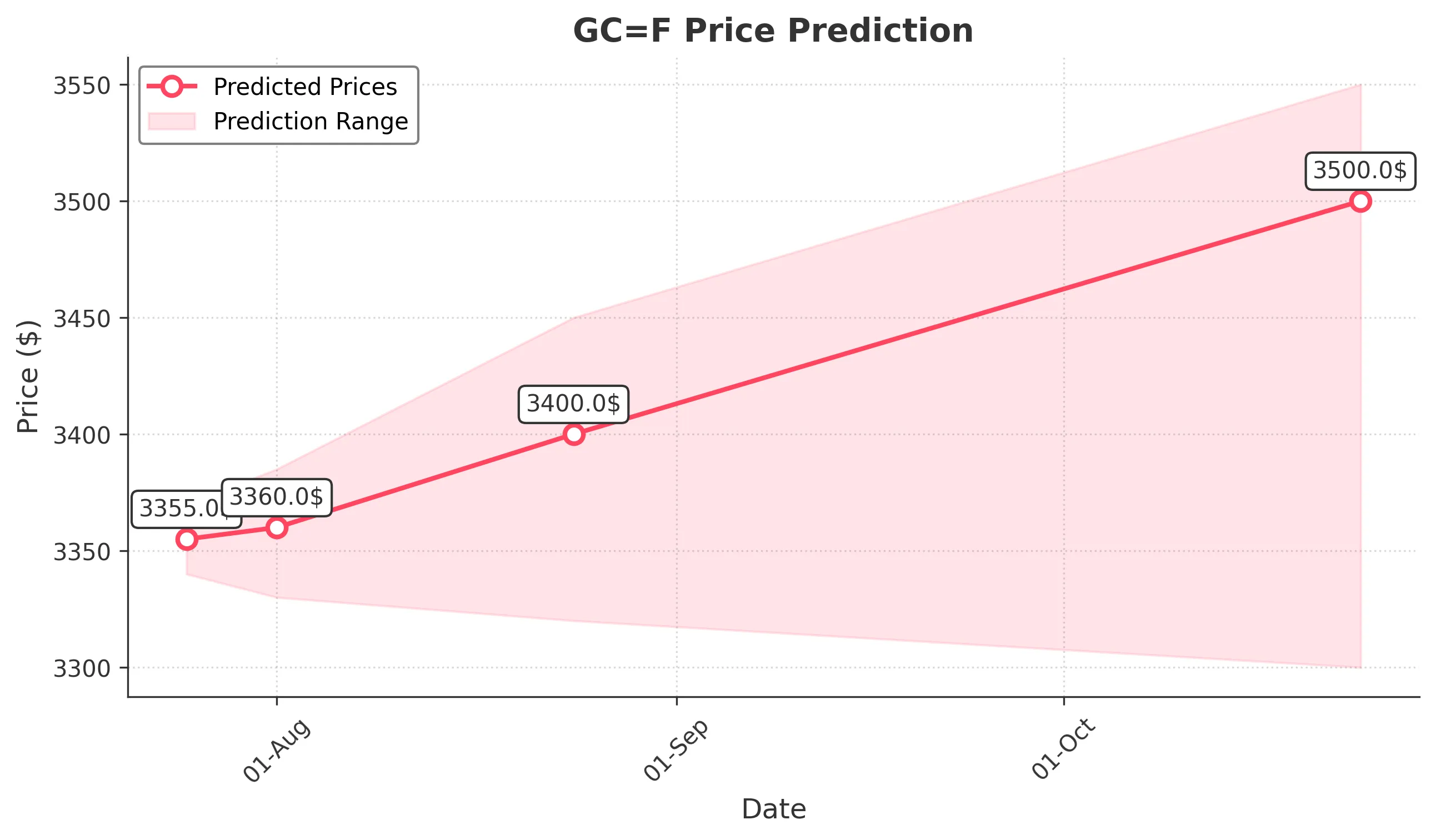

3 Months Prediction

Target: October 24, 2025$3500

$3400

$3550

$3300

Description

Long-term bullish sentiment is supported by strong technical indicators and market trends. However, potential economic downturns or policy changes could pose risks to this forecast.

Analysis

GC=F has maintained a bullish trend with key support at 3300 and resistance at 3450. The MACD and RSI indicate positive momentum, but external economic factors could introduce volatility. A balanced view is necessary.

Confidence Level

Potential Risks

Economic uncertainties and market corrections could lead to price volatility.