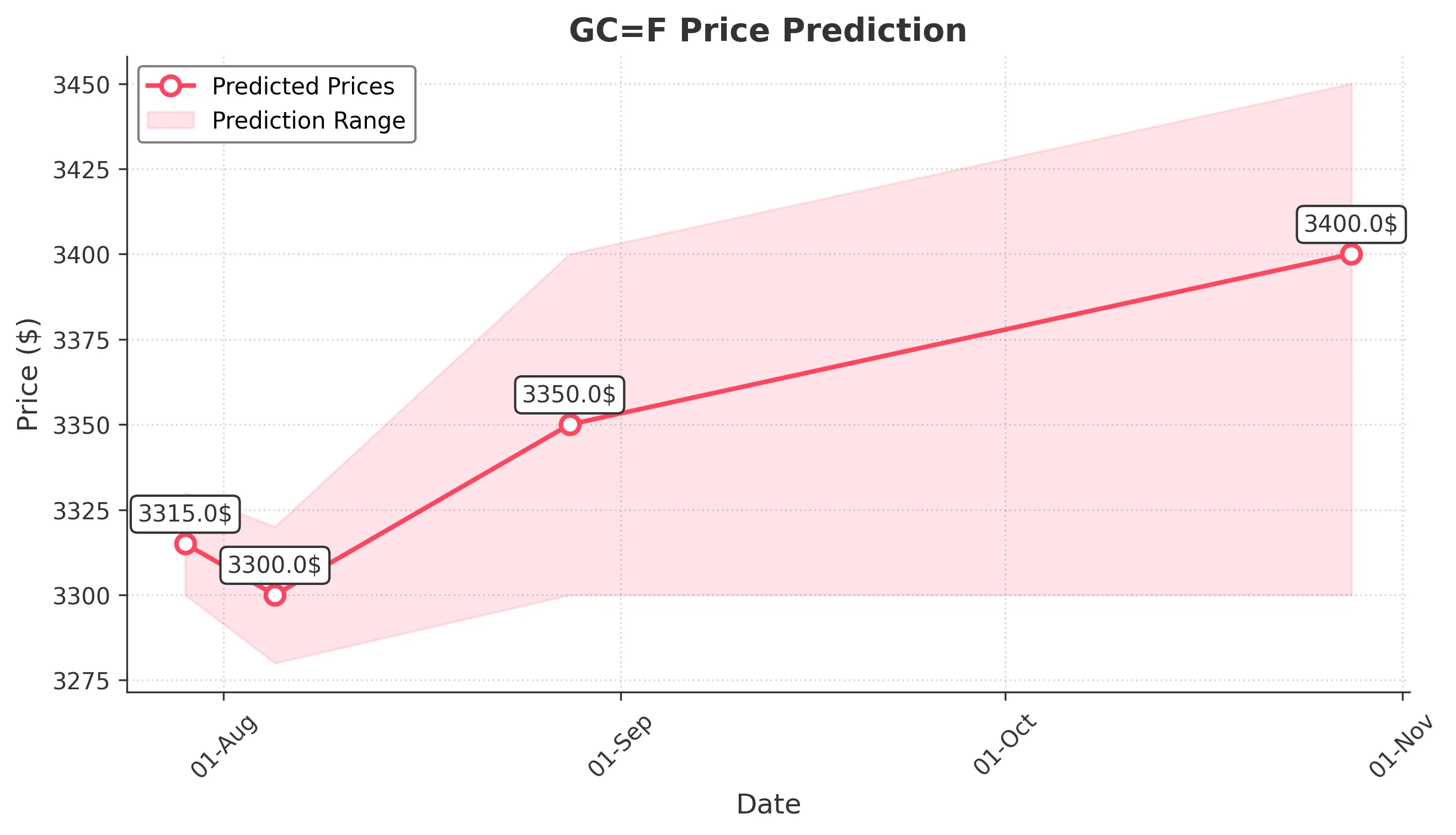

GOLD Trading Predictions

1 Day Prediction

Target: July 29, 2025$3315

$3310

$3330

$3300

Description

The recent price action shows a slight bearish trend with a potential support around 3300. The RSI indicates oversold conditions, suggesting a possible bounce. However, the MACD is bearish, indicating caution.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support is around 3300, while resistance is near 3400. The RSI is fluctuating, indicating indecision, and volume has been inconsistent, suggesting potential volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 5, 2025$3300

$3310

$3320

$3280

Description

The price is expected to stabilize around 3300, with potential for a slight recovery. The Bollinger Bands suggest a tightening range, indicating a potential breakout. However, bearish sentiment persists.

Analysis

The stock has been in a bearish phase, with recent lows indicating weakness. The MACD is showing a bearish crossover, while the ATR suggests increasing volatility. Volume spikes have been noted, indicating potential accumulation or distribution.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price changes.

1 Month Prediction

Target: August 28, 2025$3350

$3315

$3400

$3300

Description

A potential recovery towards 3350 is anticipated as the market may react positively to upcoming economic data. The Fibonacci retracement levels suggest support at 3300, while the RSI may indicate a bullish divergence.

Analysis

The stock has shown signs of recovery, with key resistance at 3400. The RSI is approaching neutral territory, indicating potential for upward movement. Volume trends suggest accumulation, but caution is warranted due to overall market conditions.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could alter market sentiment.

3 Months Prediction

Target: October 28, 2025$3400

$3350

$3450

$3300

Description

In three months, a gradual recovery to 3400 is expected as market sentiment improves. The MACD may show bullish momentum, and the RSI could stabilize above 50, indicating a potential trend reversal.

Analysis

The overall trend has been bearish, but signs of recovery are emerging. Key resistance levels are at 3400, with support around 3300. The market's reaction to economic data will be crucial in determining the stock's trajectory.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic shifts and market sentiment changes.