GOLD Trading Predictions

1 Day Prediction

Target: July 30, 2025$3315

$3310

$3330

$3300

Description

The stock shows a slight bullish trend with a potential close around 3315. The recent candlestick patterns indicate indecision, while the RSI is neutral. Volume is expected to increase slightly, reflecting market interest.

Analysis

Over the past 3 months, GC=F has shown a mix of bullish and bearish trends, with significant resistance around 3400. The RSI indicates neutral momentum, while MACD shows potential for upward movement. Recent volume spikes suggest increased trading activity, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if selling pressure increases.

1 Week Prediction

Target: August 6, 2025$3320

$3315

$3350

$3290

Description

Expect a close around 3320 as the stock stabilizes after recent fluctuations. The Bollinger Bands indicate potential for a breakout, while the MACD suggests a bullish crossover. Volume is likely to remain steady.

Analysis

The stock has been trading sideways with resistance at 3400 and support around 3300. Technical indicators show mixed signals, with the MACD hinting at bullish momentum. Volume patterns indicate cautious trading, reflecting market uncertainty.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility. A bearish trend could emerge if support levels are breached.

1 Month Prediction

Target: August 29, 2025$3350

$3325

$3400

$3300

Description

A potential close of 3350 suggests a gradual recovery. The Fibonacci retracement levels indicate support at 3300, while the RSI is approaching overbought territory, signaling caution. Volume may increase as traders react to market conditions.

Analysis

GC=F has shown resilience with a bullish trend, bouncing off support levels. The MACD indicates upward momentum, while the RSI suggests caution as it nears overbought levels. Volume trends are stable, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment could shift due to economic data releases or geopolitical events, impacting the price direction.

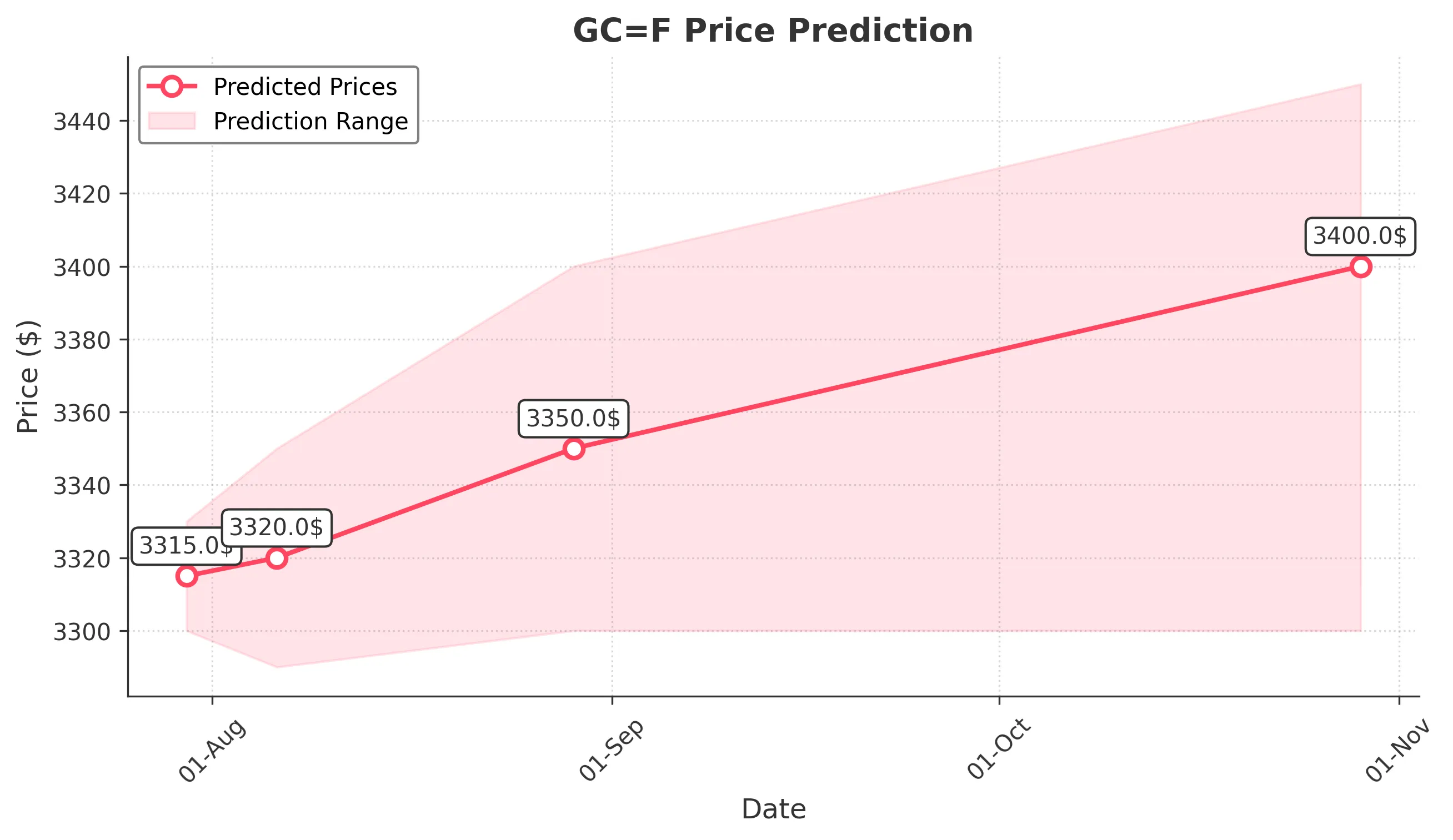

3 Months Prediction

Target: October 29, 2025$3400

$3350

$3450

$3300

Description

A close around 3400 indicates a bullish outlook, supported by strong technical indicators. The MACD shows sustained upward momentum, while the RSI remains healthy. Volume is expected to rise as market sentiment improves.

Analysis

The stock has demonstrated a bullish trend with key support at 3300 and resistance at 3400. Technical indicators are favorable, with the MACD indicating strong momentum. Volume patterns suggest increasing interest, but external economic factors could pose risks.

Confidence Level

Potential Risks

Potential market corrections or economic downturns could reverse this trend. Monitoring external factors is crucial.