GOLD Trading Predictions

1 Day Prediction

Target: August 8, 2025$3440

$3445

$3460

$3420

Description

The recent bullish momentum, indicated by the upward trend and strong closing on 08-07, suggests a continuation. RSI is approaching overbought, but MACD remains positive. Expect slight volatility due to market sentiment.

Analysis

The stock has shown a bullish trend over the past three months, with significant support at 3300 and resistance around 3440. Recent volume spikes indicate strong buying interest. However, the RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential profit-taking could lead to a pullback, and external market factors may influence price.

1 Week Prediction

Target: August 15, 2025$3455

$3440

$3480

$3400

Description

The bullish trend is expected to persist, supported by strong recent closes. However, the RSI indicates potential overbought conditions, which could lead to a correction. Watch for volume trends for confirmation.

Analysis

The stock has maintained a bullish trend, with key support at 3400. The MACD remains positive, but the RSI suggests caution. Volume patterns indicate strong interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and profit-taking could impact the price, leading to potential corrections.

1 Month Prediction

Target: September 7, 2025$3400

$3440

$3450

$3350

Description

Expect a slight pullback as the stock approaches resistance levels. The RSI indicates overbought conditions, and profit-taking may occur. However, strong support at 3350 should provide a buffer.

Analysis

The stock has shown a strong upward trend, but the RSI indicates potential overbought conditions. Key support at 3350 and resistance at 3450 are critical levels to watch. Volume trends suggest sustained interest, but caution is warranted.

Confidence Level

Potential Risks

Market sentiment and external economic factors could lead to unexpected volatility.

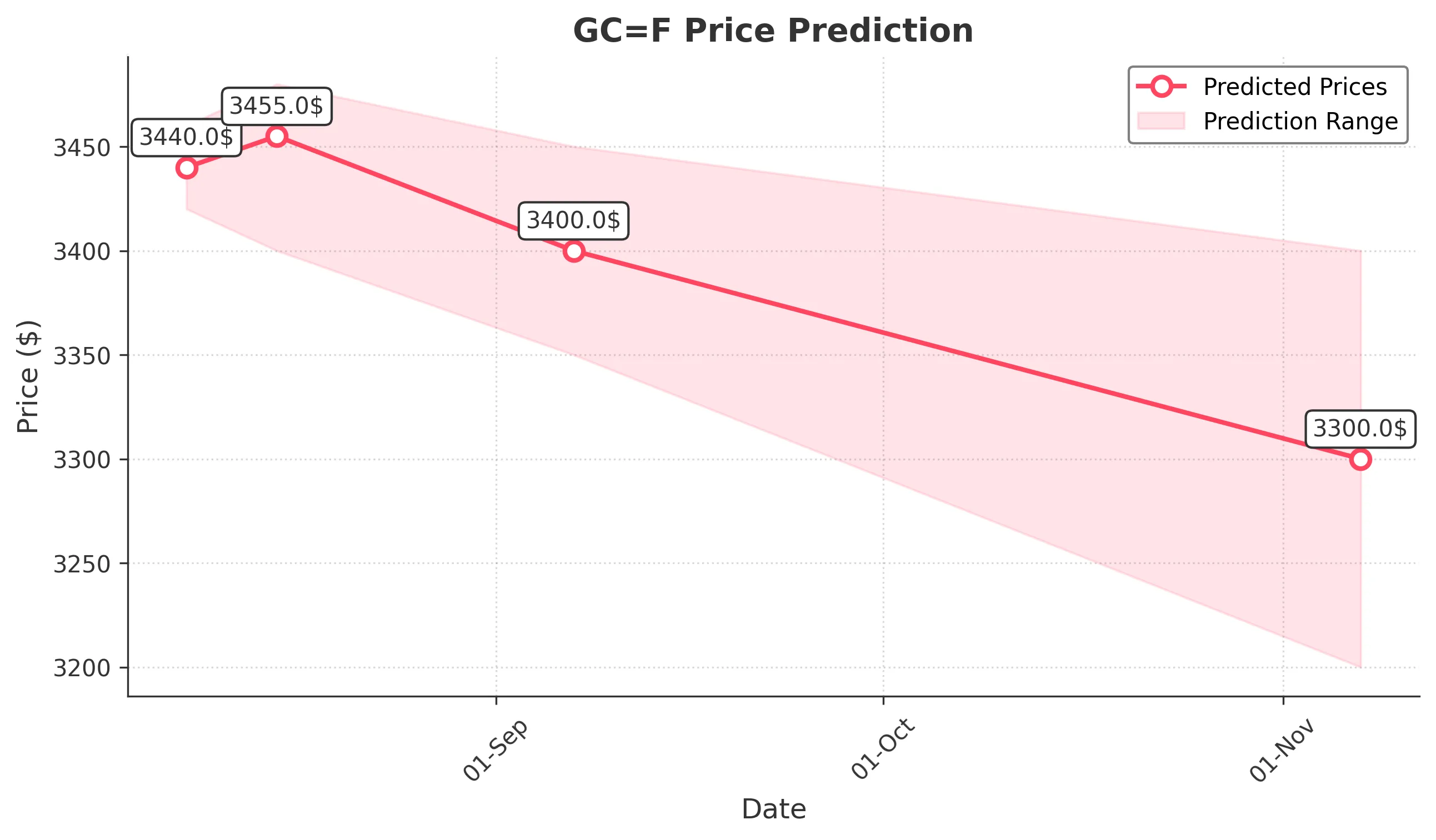

3 Months Prediction

Target: November 7, 2025$3300

$3350

$3400

$3200

Description

A bearish trend may develop as profit-taking and market corrections set in. The RSI indicates potential overbought conditions, and external economic factors could weigh on prices.

Analysis

The stock has shown volatility with a recent bullish trend, but signs of potential reversal are emerging. Key support at 3200 and resistance at 3400 are critical. The market sentiment is mixed, and external factors could lead to downward pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could significantly impact the prediction.