GOLD Trading Predictions

1 Day Prediction

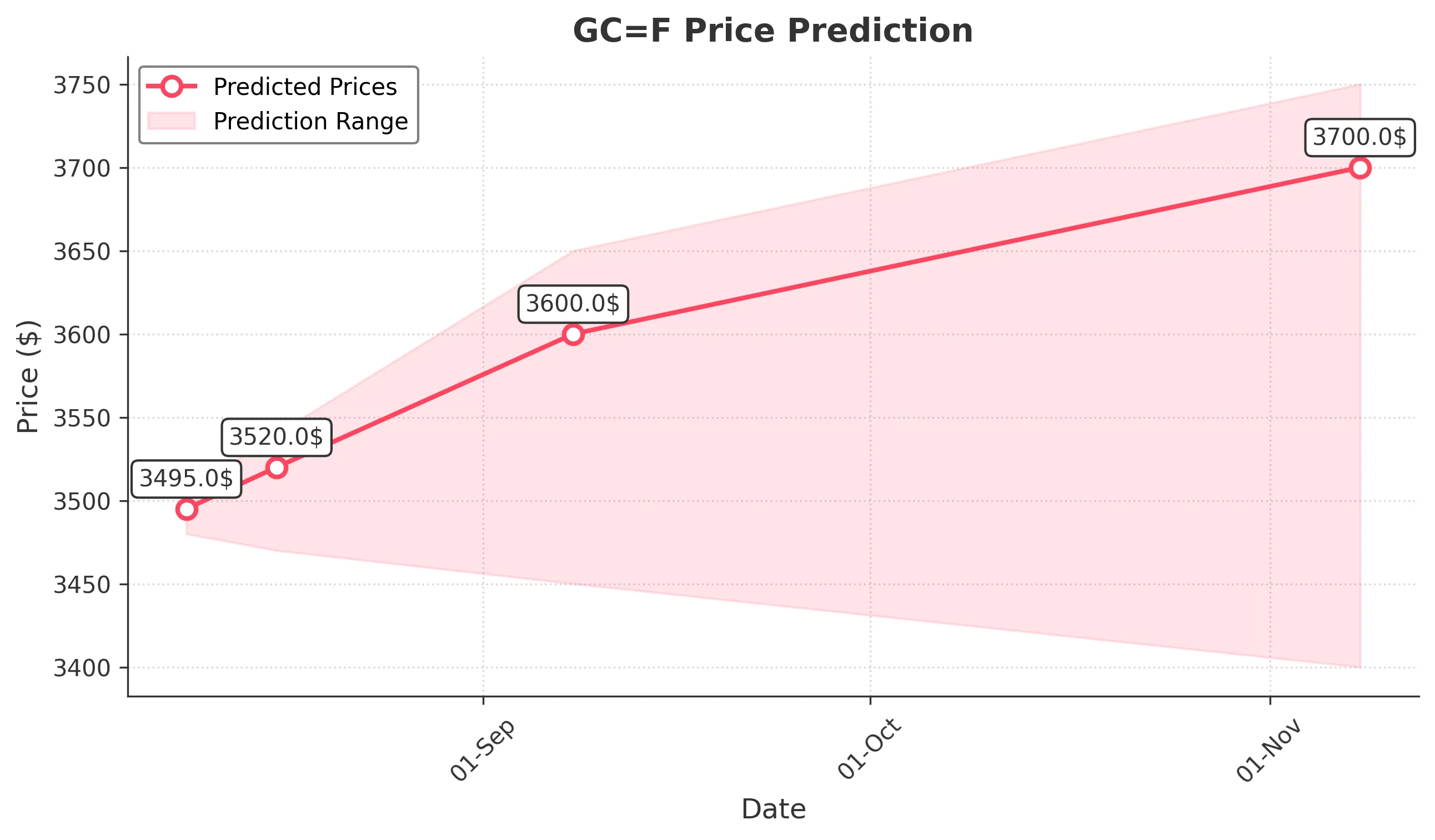

Target: August 9, 2025$3495

$3485

$3505

$3480

Description

The recent bullish momentum, indicated by the strong close and high volume on 08-08, suggests a continuation. RSI is approaching overbought, but MACD remains positive. Expect slight pullback but overall upward trend.

Analysis

The past 3 months show a bullish trend with significant support at 3300 and resistance around 3500. Volume spikes on up days indicate strong buying interest. Technical indicators like MACD and Bollinger Bands support further upward movement.

Confidence Level

Potential Risks

Potential profit-taking could lead to volatility. Watch for any bearish reversal patterns.

1 Week Prediction

Target: August 16, 2025$3520

$3500

$3540

$3470

Description

With the bullish trend continuing, the price is expected to test higher resistance levels. The MACD remains bullish, and the RSI indicates room for growth. Watch for any bearish divergence.

Analysis

The stock has shown resilience with a clear upward trend. Key support at 3400 and resistance at 3550. Volume analysis indicates strong buying pressure, but caution is warranted as the RSI approaches overbought territory.

Confidence Level

Potential Risks

Market sentiment can shift quickly; geopolitical events or economic data releases could impact prices.

1 Month Prediction

Target: September 8, 2025$3600

$3550

$3650

$3450

Description

The bullish trend is expected to persist, with potential for new highs. Fibonacci retracement levels suggest strong support at 3400. However, watch for signs of exhaustion in the rally.

Analysis

The stock has been in a strong uptrend, with significant resistance at 3650. Technical indicators support further gains, but the RSI indicates potential overbought conditions. Volume patterns suggest sustained interest.

Confidence Level

Potential Risks

Market corrections are common; any negative news could trigger a pullback.

3 Months Prediction

Target: November 8, 2025$3700

$3650

$3750

$3400

Description

Long-term bullish sentiment remains, but potential for volatility exists. The market may face headwinds from macroeconomic factors. Watch for any bearish signals in the coming weeks.

Analysis

The stock has shown a strong upward trajectory, but the potential for a market correction exists. Key support at 3400 and resistance at 3750. Technical indicators suggest caution as the market may be overextended.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could impact market stability.