GOLD Trading Predictions

1 Day Prediction

Target: August 13, 2025$3390

$3385

$3405

$3375

Description

The stock shows a bullish trend with recent upward momentum. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3375 suggests limited downside risk.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance at 3440 and support around 3300. The MACD indicates upward momentum, while volume spikes suggest strong buying interest. Recent candlestick patterns show bullish engulfing formations.

Confidence Level

Potential Risks

Potential market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: August 20, 2025$3405

$3390

$3420

$3380

Description

The upward trend is expected to continue, supported by bullish sentiment and strong volume. However, the RSI indicates overbought conditions, which may lead to a short-term correction.

Analysis

The stock has been trending upward, with key resistance at 3440. The MACD is bullish, and the ATR indicates moderate volatility. Recent candlestick patterns suggest bullish sentiment, but caution is warranted due to potential overbought conditions.

Confidence Level

Potential Risks

Market corrections or negative news could reverse the trend, impacting the prediction.

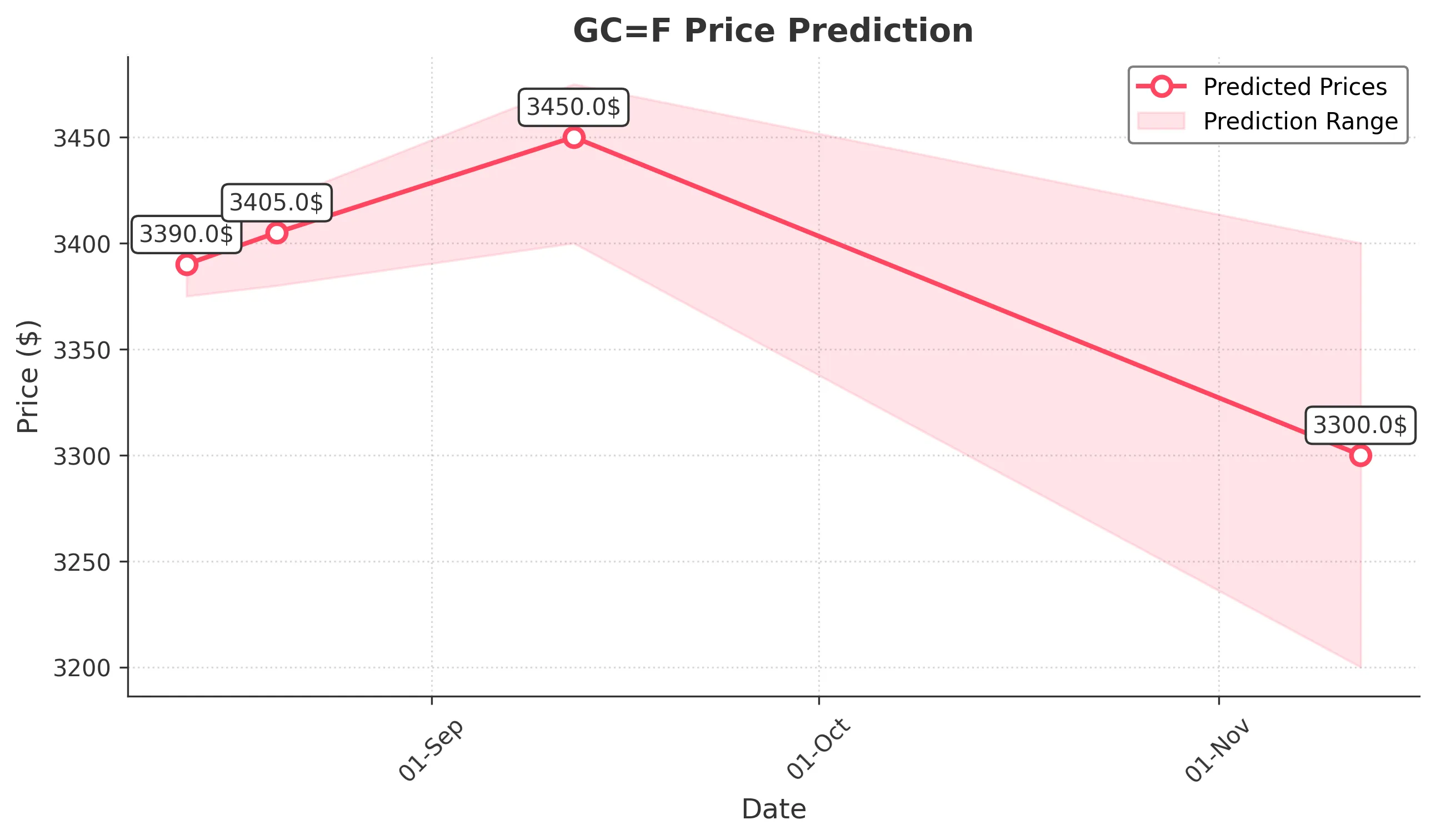

1 Month Prediction

Target: September 12, 2025$3450

$3420

$3475

$3400

Description

The stock is likely to reach new highs as bullish momentum persists. However, the RSI suggests a potential pullback, and traders should watch for signs of exhaustion.

Analysis

GC=F has shown a strong bullish trend with significant support at 3400. The MACD remains positive, and volume patterns indicate strong buying interest. However, the stock is approaching overbought territory, which could lead to volatility.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may influence price movements.

3 Months Prediction

Target: November 12, 2025$3300

$3350

$3400

$3200

Description

A potential correction is anticipated as the stock may face resistance at higher levels. The market sentiment could shift due to macroeconomic factors, leading to a decline.

Analysis

The stock has shown volatility with a recent peak at 3440. The overall trend remains bullish, but signs of exhaustion and potential resistance suggest a possible correction. Key support levels around 3200 will be critical to watch.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could significantly impact the prediction.