GOLD Trading Predictions

1 Day Prediction

Target: August 14, 2025$3395

$3390

$3405

$3380

Description

The recent bullish trend, supported by a strong close and positive candlestick patterns, suggests a continuation. RSI is neutral, indicating potential for upward movement. However, volatility remains a concern.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant support at 3300 and resistance around 3400. The RSI indicates a neutral position, while MACD shows bullish momentum. Volume spikes on certain days suggest strong interest.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, impacting the predicted price.

1 Week Prediction

Target: August 21, 2025$3405

$3395

$3420

$3385

Description

The upward momentum is likely to continue, supported by recent bullish patterns and a favorable MACD. However, potential resistance at 3420 may limit gains. Watch for volume trends for confirmation.

Analysis

The stock has been trending upward, with key support at 3300. The MACD indicates bullish momentum, while the RSI is approaching overbought territory. Volume analysis shows increased interest, but caution is warranted as resistance levels loom.

Confidence Level

Potential Risks

Resistance levels may trigger profit-taking, leading to potential pullbacks.

1 Month Prediction

Target: September 13, 2025$3420

$3400

$3450

$3350

Description

If the bullish trend persists, we could see a close around 3420. However, the market's volatility and potential economic news could impact this prediction. Watch for any bearish signals.

Analysis

The stock has shown resilience with a bullish trend, but the RSI indicates potential overbought conditions. Key resistance at 3450 may pose challenges. Volume patterns suggest strong interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic indicators or geopolitical events could lead to unexpected volatility.

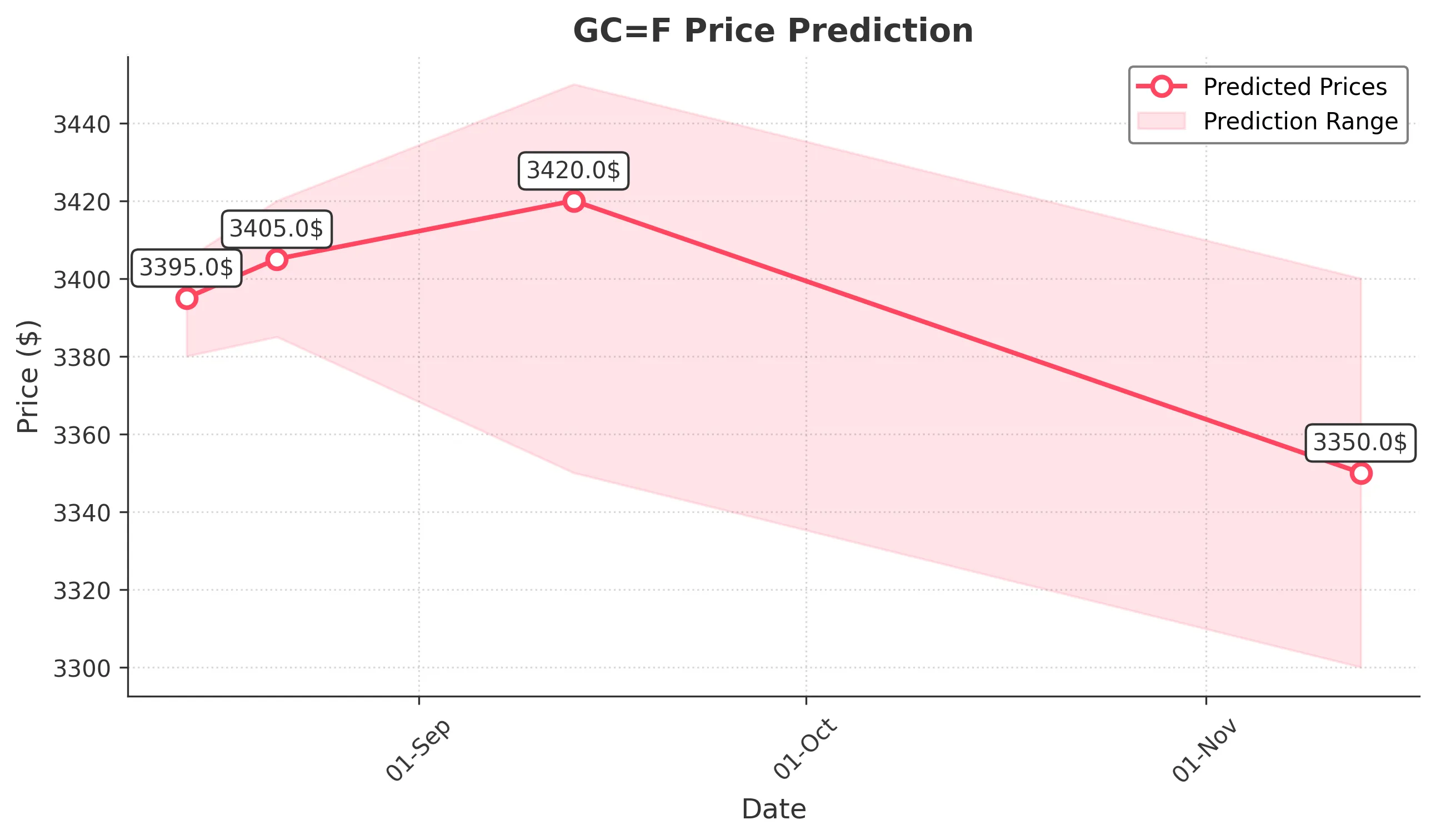

3 Months Prediction

Target: November 13, 2025$3350

$3360

$3400

$3300

Description

A potential correction may occur as the market adjusts to previous highs. The stock could face resistance around 3400, leading to a possible decline. Monitor for bearish patterns.

Analysis

The stock has experienced a bullish run, but signs of exhaustion are emerging. Key support at 3300 is critical. The MACD is flattening, indicating potential loss of momentum. Volume trends suggest caution as the market may be due for a correction.

Confidence Level

Potential Risks

Market corrections are common; external economic factors could exacerbate declines.