GOOG Trading Predictions

1 Day Prediction

Target: April 17, 2025$156.5

$156

$158

$155

Description

The stock shows a slight bearish trend with recent lower highs and lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating continued downward pressure. Volume spikes on recent down days suggest selling pressure.

Analysis

GOOG has shown a bearish trend over the past three months, with significant support around $155. Technical indicators like the MACD and RSI suggest potential for a short-term bounce, but overall sentiment remains cautious due to recent volatility and high trading volumes.

Confidence Level

Potential Risks

Market sentiment is volatile, and any unexpected news could impact the stock significantly.

1 Week Prediction

Target: April 24, 2025$158

$157.5

$160

$155.5

Description

A potential recovery is indicated as the stock approaches key support levels. The RSI may recover from oversold conditions, and a bullish divergence could form. However, MACD remains bearish, suggesting caution in the short term.

Analysis

The stock has been in a downtrend, with significant resistance at $160. Recent volume spikes indicate selling pressure, but a potential reversal could occur if support holds. Technical indicators suggest a cautious outlook, with the possibility of a short-term recovery.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery, leading to further declines.

1 Month Prediction

Target: May 16, 2025$162

$161

$165

$158

Description

If the stock can maintain above key support levels, a gradual recovery is possible. The RSI may stabilize, and MACD could show signs of bullish momentum. However, external market conditions remain a risk.

Analysis

GOOG's performance has been bearish, with significant resistance at $165. The stock's ability to hold above $158 will be crucial for any recovery. Technical indicators suggest a cautious outlook, with potential for upward movement if market conditions improve.

Confidence Level

Potential Risks

Market volatility and potential negative news could derail recovery efforts, leading to further declines.

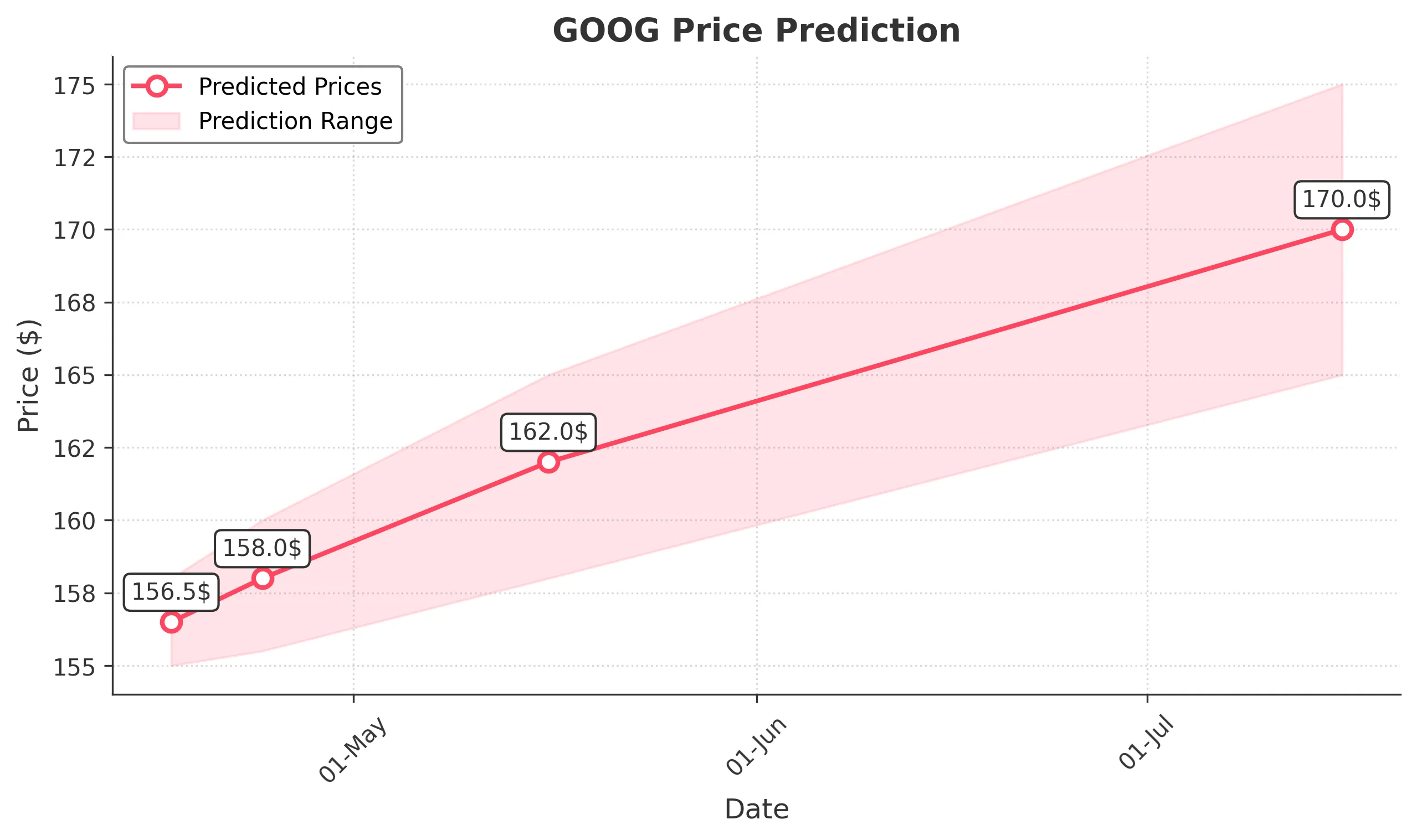

3 Months Prediction

Target: July 16, 2025$170

$171

$175

$165

Description

Assuming stabilization in market conditions, a gradual recovery could lead to higher prices. The stock may find support at $165, and if bullish momentum builds, it could test resistance at $175.

Analysis

Over the past three months, GOOG has faced significant downward pressure, with key support at $165. The potential for recovery exists, but external factors and market sentiment will play a crucial role in determining the stock's future performance.

Confidence Level

Potential Risks

Long-term uncertainties, including macroeconomic factors and market sentiment, could impact the stock's recovery trajectory.