GOOG Trading Predictions

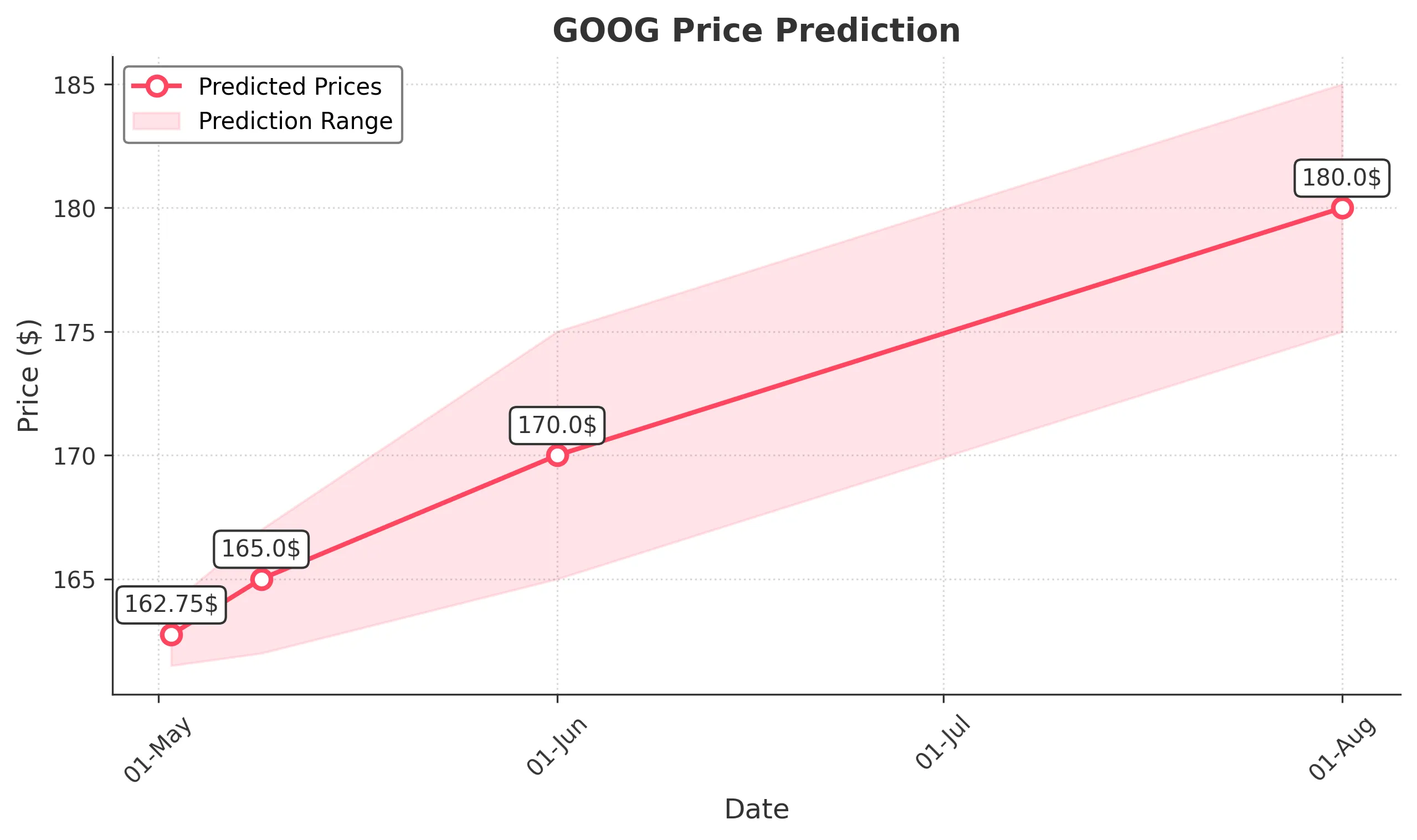

1 Day Prediction

Target: May 2, 2025$162.75

$162.5

$164

$161.5

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a potential upward move. However, MACD is flat, indicating a lack of momentum. Volume is expected to be moderate.

Analysis

GOOG has shown volatility with a recent bearish trend, hitting a low of 147.74. Key support is around 150, while resistance is at 170. The RSI indicates neutral momentum, and volume spikes suggest potential reversals. Overall, the outlook is cautiously optimistic.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: May 9, 2025$165

$163.5

$167

$162

Description

A bullish reversal pattern is forming, supported by a rising MACD. The stock may test resistance at 170. The RSI is improving, indicating increasing buying pressure. Volume is expected to rise as traders react to market sentiment.

Analysis

The stock has been in a bearish phase but shows signs of recovery. Key support at 150 remains intact, while resistance at 170 is crucial. The recent increase in volume suggests renewed interest, and technical indicators hint at a possible bullish reversal.

Confidence Level

Potential Risks

Potential market corrections or negative news could impact the upward momentum.

1 Month Prediction

Target: June 1, 2025$170

$168

$175

$165

Description

The stock is expected to continue its upward trajectory, supported by bullish momentum from the MACD and a favorable RSI. A breakout above 170 could lead to further gains. Volume is likely to increase as the market reacts positively.

Analysis

GOOG has shown resilience despite recent lows. The stock is approaching a critical resistance level at 170. Technical indicators suggest a potential bullish trend, but external factors such as economic data releases could introduce volatility.

Confidence Level

Potential Risks

Market volatility and external economic factors could hinder the predicted growth.

3 Months Prediction

Target: August 1, 2025$180

$178

$185

$175

Description

Long-term indicators suggest a bullish trend as the stock breaks above key resistance levels. The RSI is expected to remain strong, and MACD should confirm the upward momentum. Volume is projected to increase as investor sentiment improves.

Analysis

Over the past three months, GOOG has experienced significant volatility, with a bearish trend recently. However, the potential for recovery exists as it approaches key resistance levels. The overall market sentiment and economic conditions will play a crucial role in determining future performance.

Confidence Level

Potential Risks

Long-term predictions are subject to market fluctuations and macroeconomic changes that could alter the trajectory.