GOOG Trading Predictions

1 Day Prediction

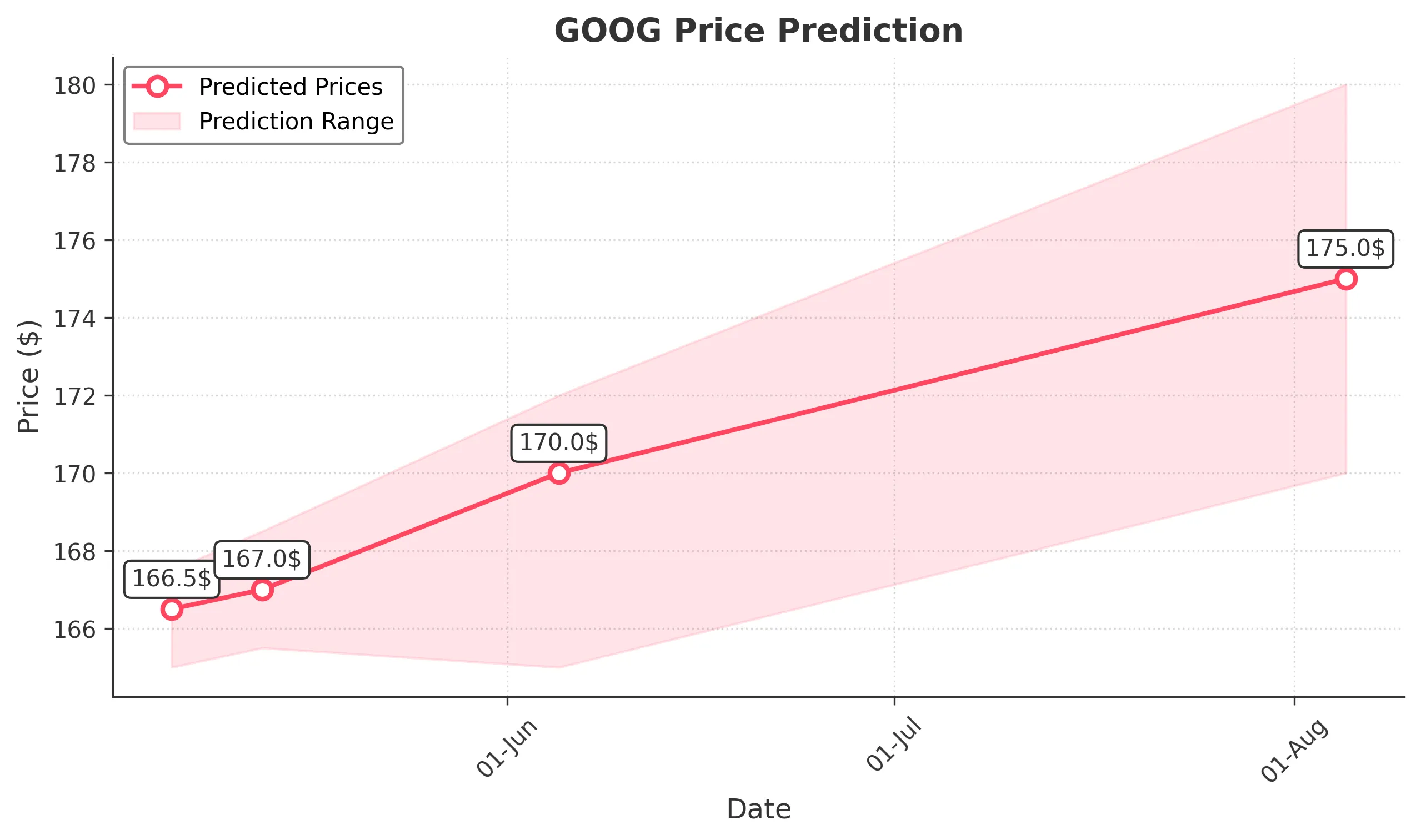

Target: May 6, 2025$166.5

$166

$167.5

$165

Description

The stock shows a slight bullish trend with a recent upward movement. The RSI is near 50, indicating neutrality, while MACD shows a potential bullish crossover. However, volatility remains high, suggesting caution.

Analysis

GOOG has shown a bearish trend over the past three months, with significant support around $160. Recent volume spikes indicate increased interest, but the overall trend remains uncertain. Technical indicators suggest potential for short-term recovery.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: May 13, 2025$167

$166.5

$168.5

$165.5

Description

The stock may continue its upward trajectory as it approaches resistance at $168. The MACD is showing bullish momentum, but the RSI indicates overbought conditions, which could lead to a pullback.

Analysis

GOOG's performance has been volatile, with recent price fluctuations indicating uncertainty. Key resistance levels are being tested, and while bullish signals are present, the risk of a downturn remains.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the upward trend, impacting the prediction.

1 Month Prediction

Target: June 5, 2025$170

$168

$172

$165

Description

A gradual recovery is expected as the stock approaches key Fibonacci retracement levels. The overall market sentiment is cautiously optimistic, but external factors could influence volatility.

Analysis

GOOG has experienced a bearish trend, but recent price action suggests a potential reversal. Key support levels are holding, and technical indicators show mixed signals, indicating a cautious approach is warranted.

Confidence Level

Potential Risks

Economic indicators and earnings reports could significantly impact stock performance, leading to unexpected volatility.

3 Months Prediction

Target: August 5, 2025$175

$172

$180

$170

Description

If the current bullish momentum continues, the stock could reach higher levels. However, macroeconomic factors and market sentiment will play a crucial role in determining the actual outcome.

Analysis

GOOG's performance has been characterized by volatility and uncertainty. While there are signs of recovery, the stock remains susceptible to broader market trends and economic conditions, necessitating a balanced outlook.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential market corrections and external economic factors.