GOOG Trading Predictions

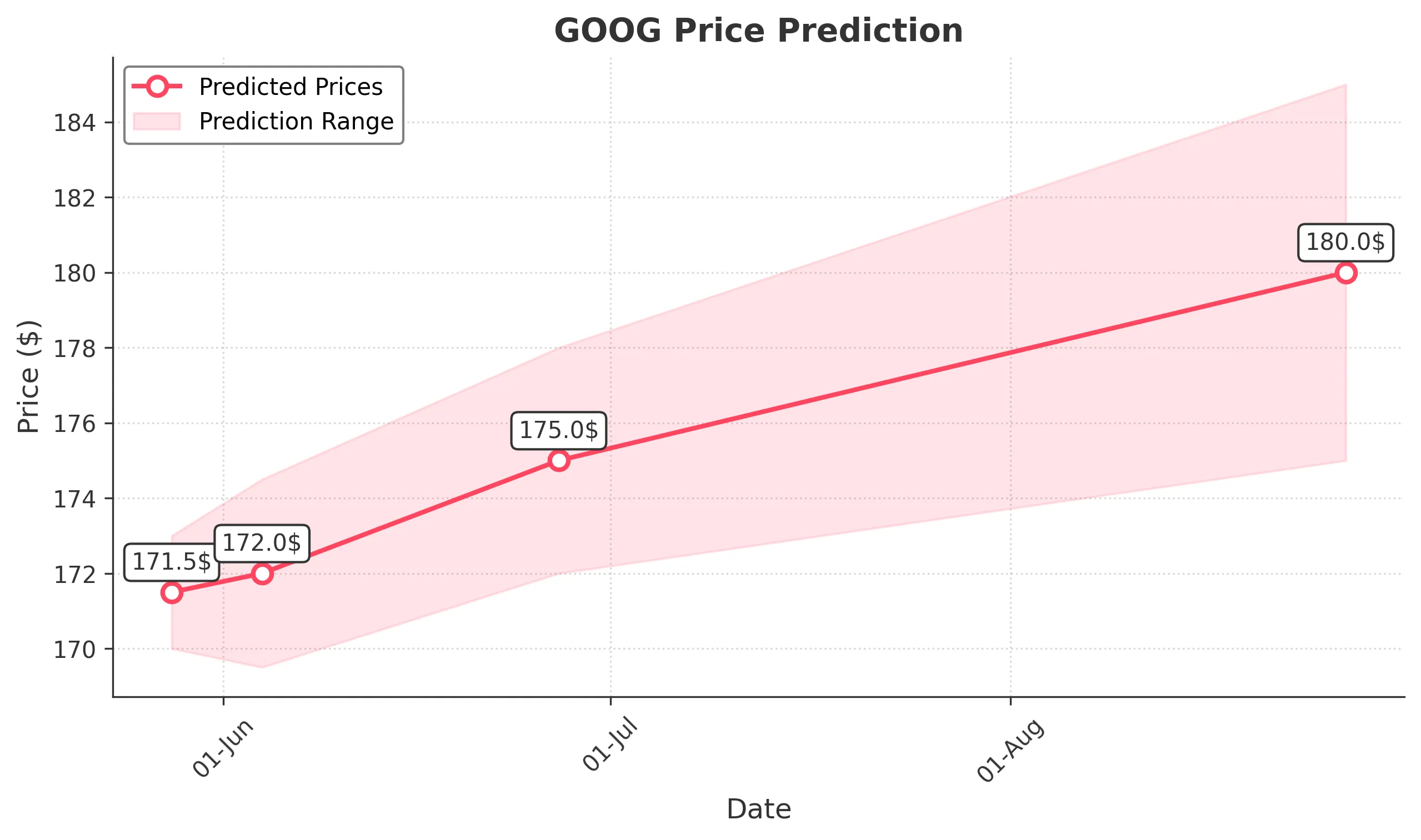

1 Day Prediction

Target: May 28, 2025$171.5

$171

$173

$170

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. Volume remains stable, supporting the prediction.

Analysis

GOOG has shown a mix of bullish and bearish trends over the past three months, with significant support around $170 and resistance near $175. Recent volume spikes indicate increased interest, but the stock has also faced downward pressure, particularly in early May.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: June 4, 2025$172

$171.5

$174.5

$169.5

Description

The stock is expected to maintain a bullish trend as it approaches resistance levels. The MACD shows potential for upward movement, while the RSI indicates a slight bullish divergence. Volume is expected to increase as traders react to market sentiment.

Analysis

Over the last three months, GOOG has fluctuated between $156 and $176, with key support at $170. The stock's recent performance shows a recovery from lows, but uncertainty remains due to macroeconomic factors and market sentiment.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend.

1 Month Prediction

Target: June 27, 2025$175

$173

$178

$172

Description

A bullish outlook is supported by a potential breakout above resistance levels. The MACD is bullish, and the RSI is approaching overbought territory, indicating strong momentum. Volume is expected to remain high as traders react to earnings reports.

Analysis

GOOG has shown resilience with a recent upward trend, bouncing back from lower levels. Key resistance at $176 has been tested, and if broken, could lead to further gains. However, external economic factors may introduce volatility.

Confidence Level

Potential Risks

Earnings surprises or broader market corrections could impact the price.

3 Months Prediction

Target: August 27, 2025$180

$178

$185

$175

Description

The long-term outlook remains bullish as the stock is expected to break through key resistance levels. Positive earnings and market sentiment could drive prices higher. The MACD and RSI indicate strong upward momentum, supported by increasing volume.

Analysis

GOOG's performance over the past three months has shown a recovery from lows, with significant support at $170. The stock is currently in a bullish phase, but external factors such as economic data and market sentiment could influence future performance.

Confidence Level

Potential Risks

Market corrections or negative news could lead to unexpected downturns.