GOOG Trading Predictions

1 Day Prediction

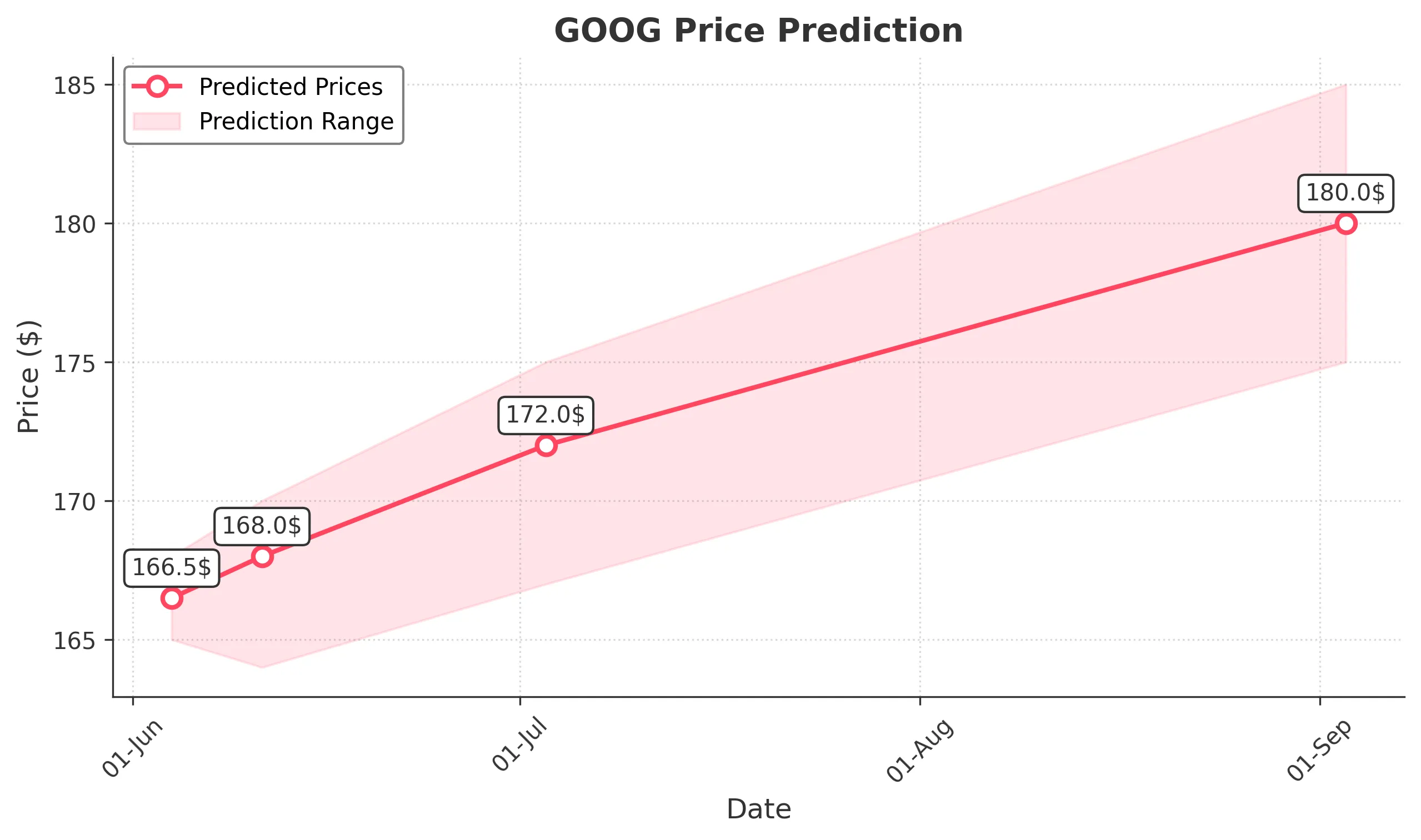

Target: June 4, 2025$166.5

$167

$168

$165

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume has been declining, indicating caution.

Analysis

GOOG has shown a bearish trend over the past month, with significant support around $165. Recent candlestick patterns indicate indecision. The MACD is bearish, while RSI suggests oversold conditions, hinting at a possible short-term rebound.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden market shift could lead to unexpected price movements.

1 Week Prediction

Target: June 11, 2025$168

$166.5

$170

$164

Description

Expect a slight recovery as the stock approaches key support levels. The RSI may stabilize, and a bullish divergence could form. However, MACD remains bearish, indicating potential resistance at higher levels.

Analysis

The stock has been trading sideways with a bearish bias. Key support at $165 has held, but resistance at $170 remains strong. Volume spikes on down days suggest selling pressure. The market sentiment is cautious, influenced by broader economic conditions.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility. The bearish MACD trend raises concerns about sustainability.

1 Month Prediction

Target: July 3, 2025$172

$170

$175

$167

Description

A potential recovery is anticipated as the stock approaches the Fibonacci retracement level of 61.8%. Positive market sentiment could drive prices higher, but resistance at $175 may limit gains.

Analysis

GOOG has shown signs of recovery, with key support at $165 and resistance at $175. The RSI is improving, indicating a potential bullish reversal. Volume trends suggest accumulation, but macroeconomic factors could introduce volatility.

Confidence Level

Potential Risks

Economic indicators and earnings reports could impact the stock's trajectory. A failure to break resistance could lead to a pullback.

3 Months Prediction

Target: September 3, 2025$180

$178

$185

$175

Description

Long-term bullish sentiment is expected as the stock breaks above key resistance levels. Positive earnings and market conditions could support this trend, but caution is advised due to potential market corrections.

Analysis

Over the past three months, GOOG has experienced significant volatility, with a bearish trend recently. However, if the stock can maintain above $175, a bullish reversal could occur. Key resistance levels will be critical in determining future price action.

Confidence Level

Potential Risks

Market corrections or negative news could derail the bullish trend. The potential for profit-taking at higher levels may also create volatility.