GOOG Trading Predictions

1 Day Prediction

Target: June 19, 2025$177.5

$177

$179

$176

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains a concern.

Analysis

GOOG has shown a mix of bullish and bearish trends over the past three months, with significant support around $175 and resistance near $180. The recent increase in volume indicates heightened interest, but the stock has also faced volatility, particularly after recent highs.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: June 26, 2025$179

$177.5

$182

$175.5

Description

The stock is expected to continue its upward trajectory, supported by a bullish MACD crossover and a rising 50-day moving average. However, the RSI is approaching overbought territory, indicating potential pullbacks.

Analysis

Over the last three months, GOOG has experienced a bullish trend with key support at $175 and resistance at $180. The stock's recent performance has been characterized by increased volume and positive sentiment, although caution is warranted due to potential overbought conditions.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend, impacting the predicted price.

1 Month Prediction

Target: July 26, 2025$185

$179

$190

$178

Description

The stock is projected to rise as bullish momentum builds, supported by strong earnings reports and positive market sentiment. The Fibonacci retracement levels suggest a target around $185, but caution is advised as the RSI may indicate overbought conditions.

Analysis

GOOG has shown a strong bullish trend with significant support at $175 and resistance at $190. The stock's performance has been bolstered by positive earnings and market sentiment, but the potential for pullbacks exists if the market reacts negatively to external factors.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings misses could lead to volatility and affect the stock's upward trajectory.

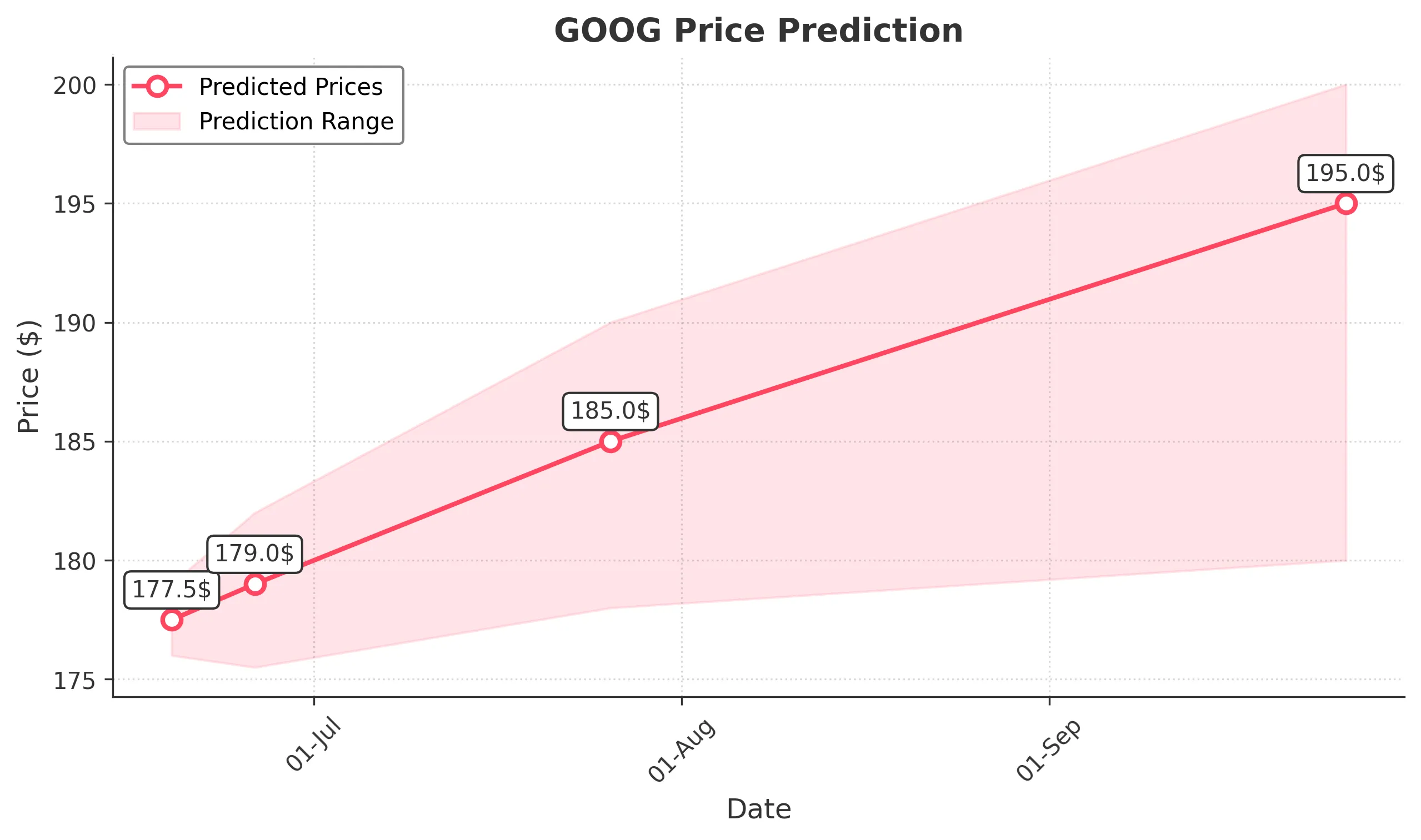

3 Months Prediction

Target: September 26, 2025$195

$185

$200

$180

Description

The stock is expected to continue its upward trend, driven by strong fundamentals and market demand. The MACD remains bullish, and the stock is likely to test the $200 resistance level. However, external economic factors could introduce volatility.

Analysis

GOOG has maintained a bullish trend over the past three months, with key support at $175 and resistance at $200. The stock's performance has been characterized by strong volume and positive sentiment, but external factors could introduce risks that may affect future price movements.

Confidence Level

Potential Risks

Economic downturns or regulatory changes could impact the stock's performance, leading to potential corrections.