GOOG Trading Predictions

1 Day Prediction

Target: July 8, 2025$179.5

$179

$181

$178

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a neutral momentum. A potential breakout above 180 could lead to further gains, but caution is advised due to recent volatility.

Analysis

GOOG has shown a mix of bullish and bearish signals over the past three months. Key support is around 175, while resistance is near 180. The MACD is showing a bullish crossover, but the ATR indicates increased volatility. Volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market sentiment could shift quickly, and external news may impact trading. A reversal is possible if the price fails to hold above 180.

1 Week Prediction

Target: July 15, 2025$181

$179.5

$183

$177.5

Description

With a bullish trend supported by a recent upward movement, the stock is likely to test resistance at 183. The MACD remains positive, and the RSI is approaching overbought territory, indicating potential for a pullback.

Analysis

The stock has been in a bullish phase, with significant support at 175. The recent price action shows a potential upward trend, but the RSI nearing overbought levels raises concerns about sustainability. Volume patterns suggest cautious optimism.

Confidence Level

Potential Risks

The market's reaction to macroeconomic news could lead to volatility. A failure to break above 183 may trigger profit-taking.

1 Month Prediction

Target: August 7, 2025$185

$181

$188

$178

Description

The stock is expected to continue its upward trajectory, driven by positive market sentiment and strong earnings reports. The Fibonacci retracement levels suggest a target around 185, but overbought conditions may lead to corrections.

Analysis

GOOG has shown resilience with a bullish trend, supported by strong volume on up days. Key resistance at 188 may pose challenges, while support at 175 remains critical. The MACD and RSI indicate bullish momentum, but caution is warranted.

Confidence Level

Potential Risks

Unexpected market events or earnings misses could derail the bullish outlook. Watch for signs of exhaustion in the rally.

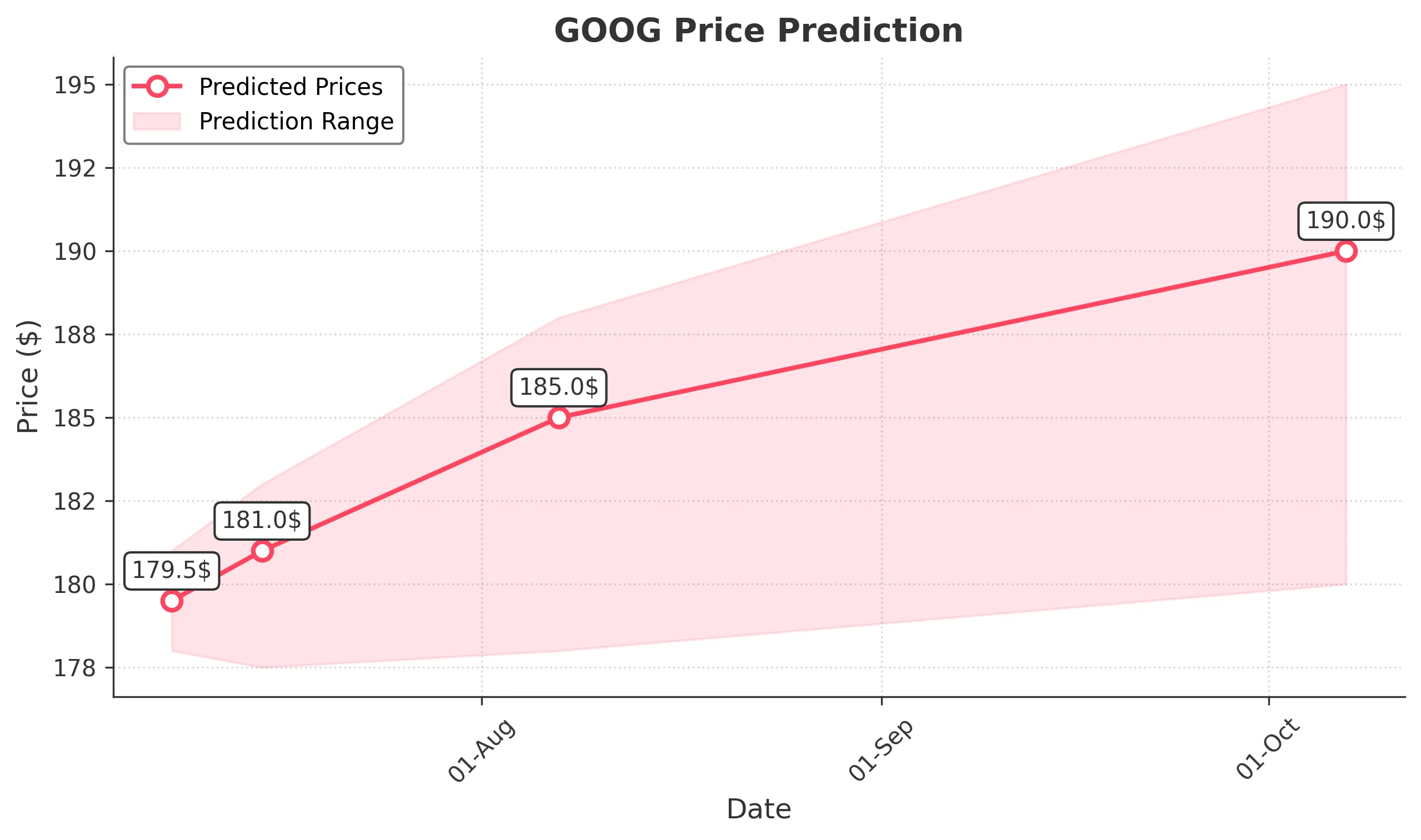

3 Months Prediction

Target: October 7, 2025$190

$185

$195

$180

Description

Long-term indicators suggest a continued bullish trend, with potential for new highs. However, the market may face headwinds from economic data releases and geopolitical tensions, which could introduce volatility.

Analysis

Over the past three months, GOOG has experienced a bullish trend with significant support at 175. The stock's performance is influenced by macroeconomic factors, and while technical indicators suggest upward momentum, external risks remain. A balanced view is essential.

Confidence Level

Potential Risks

Economic downturns or regulatory changes could impact growth. The stock's performance may be influenced by broader market trends.