GOOG Trading Predictions

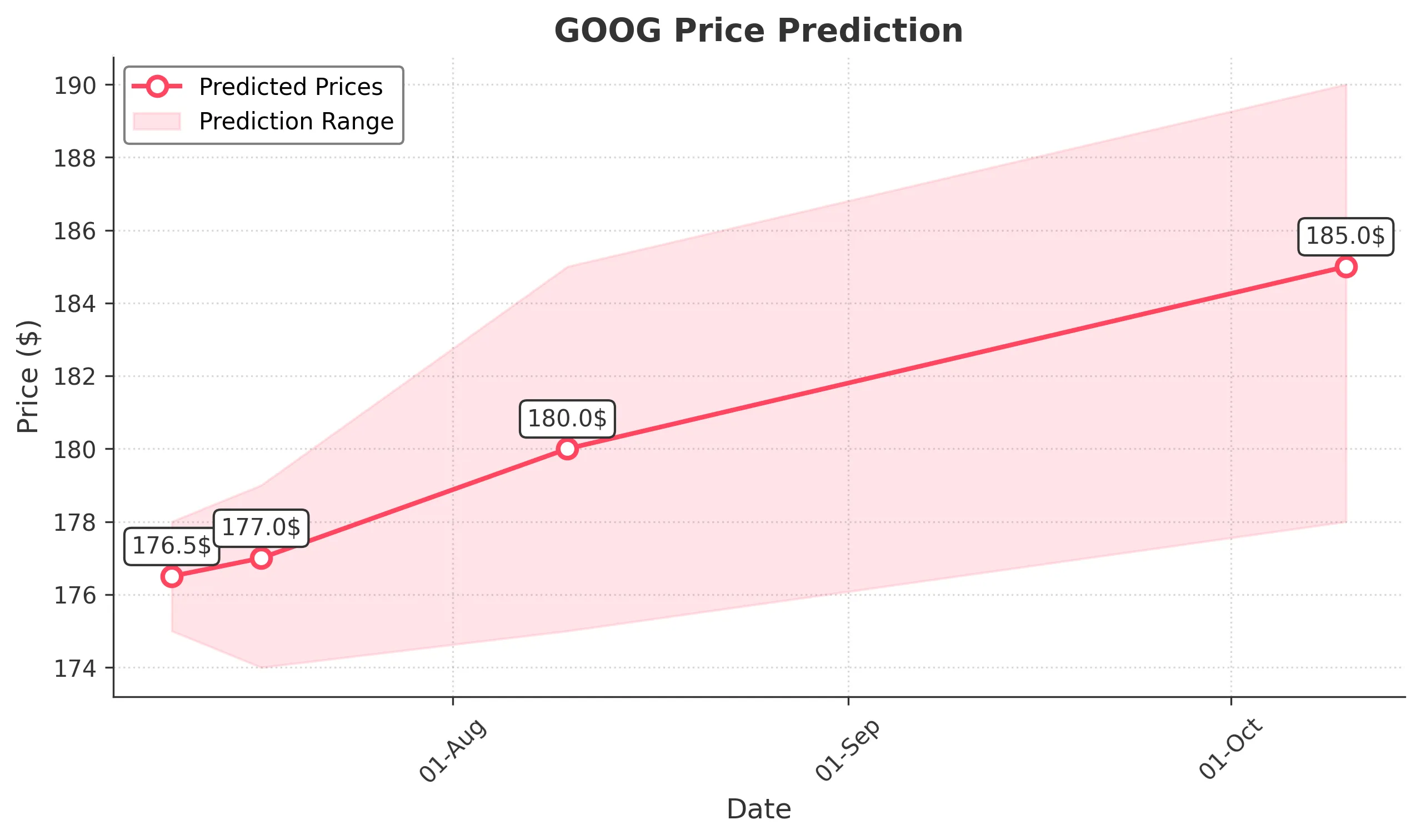

1 Day Prediction

Target: July 10, 2025$176.5

$176

$178

$175

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating caution. Volume remains moderate, reflecting indecision in the market.

Analysis

Over the past 3 months, GOOG has shown a bearish trend with significant support around $175. Recent candlestick patterns indicate indecision, and the MACD is trending downwards. Volume spikes on down days suggest selling pressure. Overall, the market sentiment is cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A reversal pattern could emerge if bullish sentiment returns.

1 Week Prediction

Target: July 17, 2025$177

$176.5

$179

$174

Description

The stock may stabilize around current levels, with potential for a slight recovery. The RSI is approaching neutral, indicating a possible reversal. However, MACD remains bearish, suggesting caution. Volume may increase as traders react to market news.

Analysis

GOOG has been in a bearish phase, with resistance at $180. Recent trading patterns show a struggle to maintain upward momentum. The ATR indicates increasing volatility, and the market sentiment is mixed, reflecting uncertainty among investors.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility. The bearish trend may continue if selling pressure persists.

1 Month Prediction

Target: August 10, 2025$180

$178

$185

$175

Description

A potential recovery could occur as the stock approaches key support levels. The RSI may improve, indicating a bullish divergence. However, MACD remains a concern. Volume may increase as traders react to earnings or market sentiment shifts.

Analysis

The stock has shown bearish tendencies, with significant support at $175. The market is currently indecisive, and technical indicators suggest potential for a rebound. However, external factors could heavily influence price movements.

Confidence Level

Potential Risks

The prediction is subject to market volatility and external factors. A failure to break resistance could lead to further declines.

3 Months Prediction

Target: October 10, 2025$185

$180

$190

$178

Description

If the stock can break through resistance levels, a bullish trend may develop. The RSI could indicate strength, and MACD may turn positive. Volume is expected to increase as market sentiment improves, especially if macroeconomic conditions stabilize.

Analysis

GOOG's performance has been mixed, with a bearish trend recently. Key resistance levels are critical for future movements. The market sentiment is cautious, and external economic factors could significantly impact the stock's trajectory.

Confidence Level

Potential Risks

Market conditions are unpredictable, and any negative news could reverse the trend. The potential for a bearish continuation remains if resistance is not broken.