GOOG Trading Predictions

1 Day Prediction

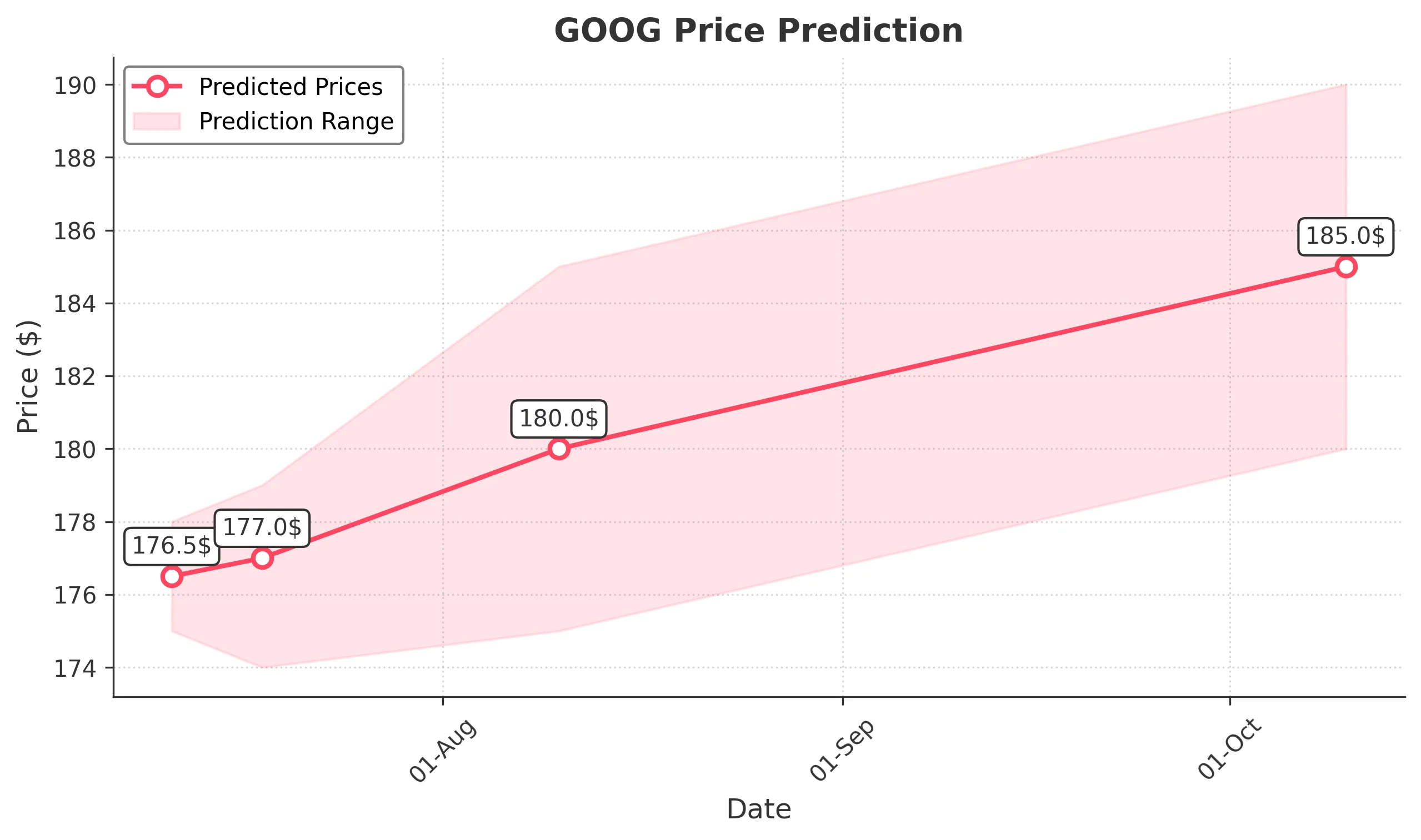

Target: July 11, 2025$176.5

$176.5

$178

$175

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating caution. Volume is expected to be moderate as traders await further direction.

Analysis

Over the past 3 months, GOOG has shown a bearish trend with significant support around $175. Recent candlestick patterns indicate indecision. The MACD is bearish, while RSI suggests oversold conditions. Volume spikes were noted during sell-offs, indicating potential profit-taking.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A reversal pattern could emerge if bullish sentiment returns.

1 Week Prediction

Target: July 18, 2025$177

$176.5

$179

$174

Description

The stock may stabilize around current levels, with potential for a slight recovery. The RSI is approaching neutral, and a bullish divergence could form if prices hold. However, MACD remains bearish, indicating caution.

Analysis

GOOG has been in a bearish phase, with resistance at $180. The recent price action shows a potential for sideways movement. Technical indicators suggest a cautious approach, with volume patterns indicating profit-taking. Market sentiment remains mixed.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. A failure to hold above $175 could trigger further declines.

1 Month Prediction

Target: August 10, 2025$180

$178

$185

$175

Description

A potential recovery could occur if the stock breaks above $180, supported by bullish sentiment. The RSI may improve, indicating a shift in momentum. However, MACD remains a concern, suggesting caution.

Analysis

The stock has shown bearish tendencies, with key support at $175. Technical indicators suggest a potential for recovery if bullish momentum builds. Volume analysis indicates profit-taking, and market sentiment remains cautious amid macroeconomic uncertainties.

Confidence Level

Potential Risks

Market conditions and external factors could lead to unexpected volatility. A failure to break resistance could lead to further declines.

3 Months Prediction

Target: October 10, 2025$185

$182

$190

$180

Description

If the stock can maintain upward momentum, it may reach $185. A bullish reversal pattern could emerge if the stock breaks key resistance levels. However, macroeconomic factors could impact performance.

Analysis

GOOG's performance has been bearish, with significant resistance at $180. Technical indicators suggest potential for recovery, but macroeconomic factors and market sentiment remain uncertain. Volume patterns indicate profit-taking, and caution is advised.

Confidence Level

Potential Risks

Economic conditions and market sentiment could lead to volatility. A failure to sustain upward momentum could result in a bearish reversal.