GOOG Trading Predictions

1 Day Prediction

Target: July 15, 2025$182.5

$182

$184

$180

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 180.00 suggests limited downside risk.

Analysis

GOOG has shown a bullish trend over the past three months, with significant support at 180.00. The recent candlestick patterns indicate strength, but the RSI nearing overbought levels raises caution for short-term corrections.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could impact the price.

1 Week Prediction

Target: July 22, 2025$183

$182.5

$185

$179

Description

The stock is expected to maintain its upward trajectory, supported by recent bullish candlestick patterns. However, the MACD shows signs of potential divergence, indicating a possible slowdown in momentum.

Analysis

GOOG's performance has been strong, with key resistance at 185.00. The volume has been consistent, but the MACD divergence suggests caution. The overall trend remains bullish, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment and external economic factors could lead to unexpected volatility.

1 Month Prediction

Target: August 14, 2025$185.5

$183

$188

$177

Description

The stock is likely to continue its upward trend, supported by strong fundamentals. However, the Bollinger Bands indicate potential for increased volatility, suggesting caution for investors.

Analysis

GOOG has shown a solid bullish trend, with resistance at 188.00. The volume remains healthy, but the potential for volatility is present. Investors should monitor macroeconomic indicators closely as they may influence price movements.

Confidence Level

Potential Risks

Economic data releases and earnings reports could impact stock performance.

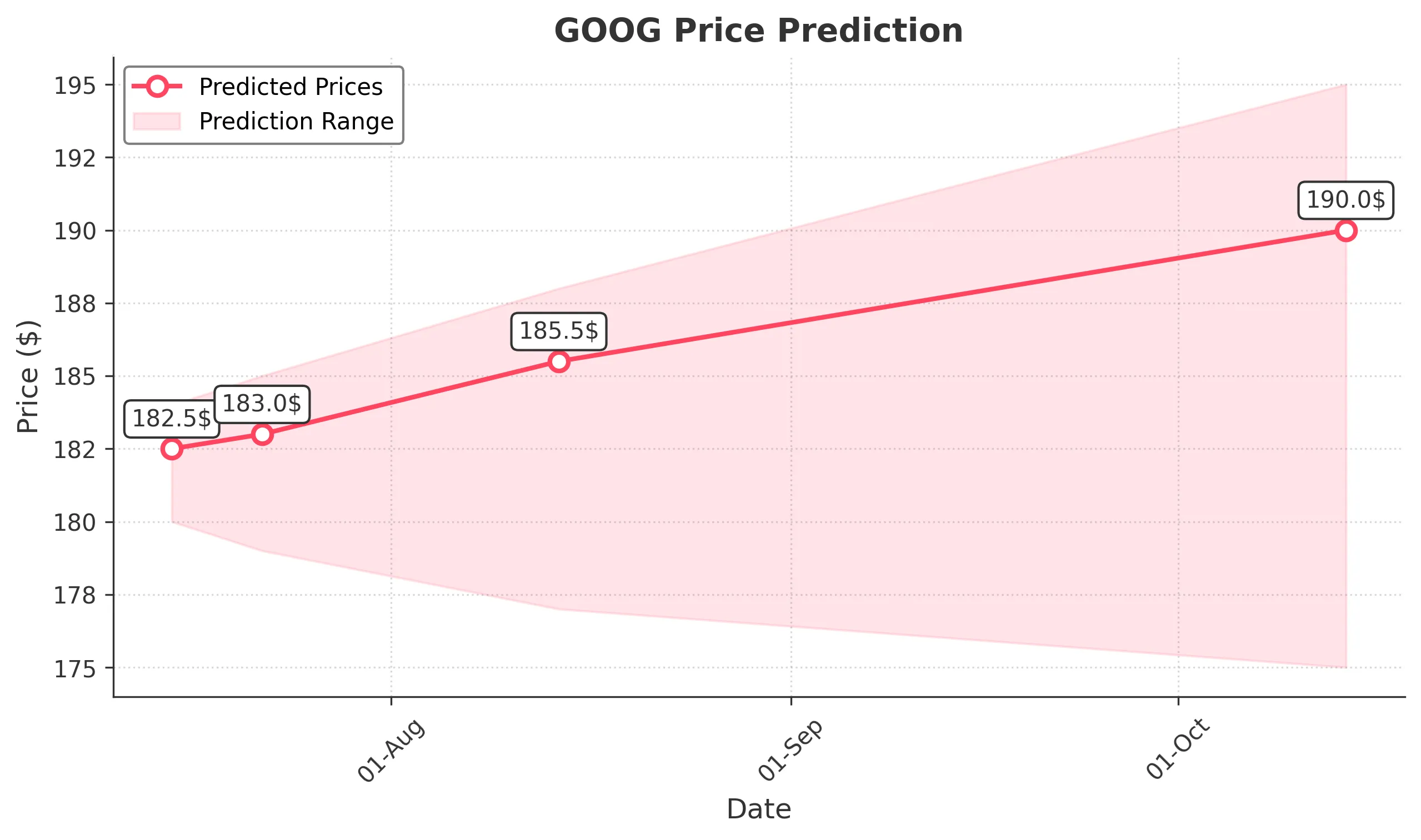

3 Months Prediction

Target: October 14, 2025$190

$185

$195

$175

Description

Long-term outlook remains positive, with strong support at 175.00. However, potential market corrections and economic uncertainties could lead to fluctuations in price.

Analysis

GOOG's long-term performance appears bullish, with key support at 175.00. However, the market's reaction to economic data and earnings reports could introduce volatility. A balanced view is necessary as both upward and downward risks exist.

Confidence Level

Potential Risks

Unforeseen macroeconomic events and market sentiment shifts could affect predictions.