GOOG Trading Predictions

1 Day Prediction

Target: July 19, 2025$186.5

$186

$188

$185

Description

The stock shows bullish momentum with a recent close above the 20-day moving average. RSI is near 60, indicating strength. However, a potential Doji pattern suggests indecision, warranting caution.

Analysis

GOOG has shown a bullish trend over the past three months, with significant support at $180 and resistance at $190. Recent volume spikes indicate strong buying interest, but the market's overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 26, 2025$188

$186.5

$190

$184

Description

The stock is expected to continue its upward trajectory, supported by a bullish MACD crossover. However, the RSI nearing overbought levels suggests a potential pullback could occur.

Analysis

GOOG has maintained a bullish trend, with key support at $180. The recent price action indicates strong buying pressure, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential market corrections and earnings reports could introduce volatility.

1 Month Prediction

Target: August 19, 2025$190

$188

$195

$182

Description

The stock is likely to reach $190, driven by positive market sentiment and strong earnings expectations. However, resistance at $195 may limit upside potential in the short term.

Analysis

GOOG's performance has been strong, with a bullish trend supported by solid volume. Key resistance at $195 may pose challenges, while support remains at $180. Market sentiment is cautiously optimistic.

Confidence Level

Potential Risks

Macroeconomic factors and potential earnings misses could lead to downward pressure.

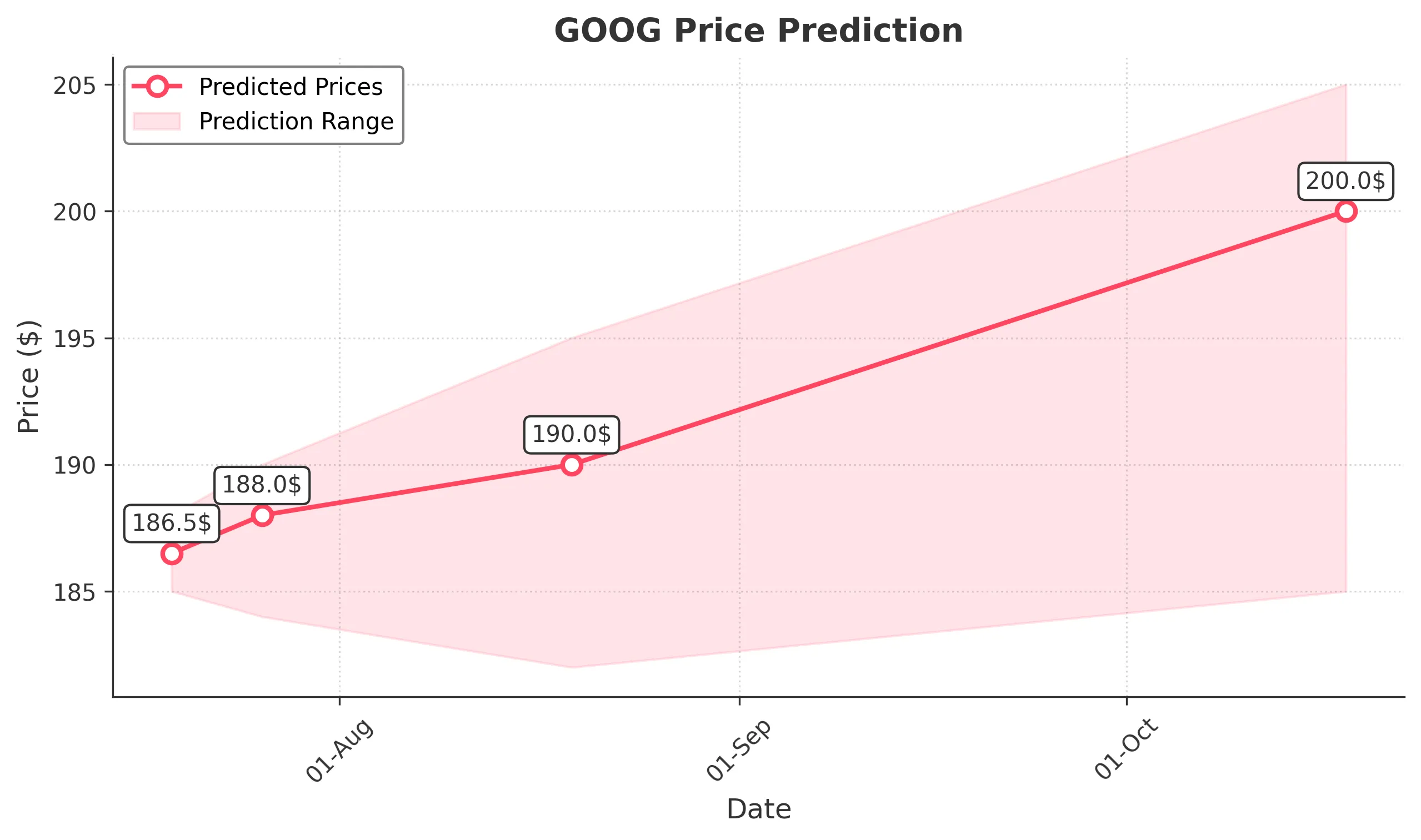

3 Months Prediction

Target: October 18, 2025$200

$195

$205

$185

Description

Long-term bullish sentiment is expected to drive the stock towards $200, supported by strong fundamentals and market trends. However, external economic factors could introduce volatility.

Analysis

GOOG has shown resilience with a bullish trend, but potential resistance at $205 could limit gains. The stock's performance is influenced by broader market conditions and investor sentiment, which remains mixed.

Confidence Level

Potential Risks

Unforeseen macroeconomic events and competitive pressures could impact growth.