HGF Trading Predictions

1 Day Prediction

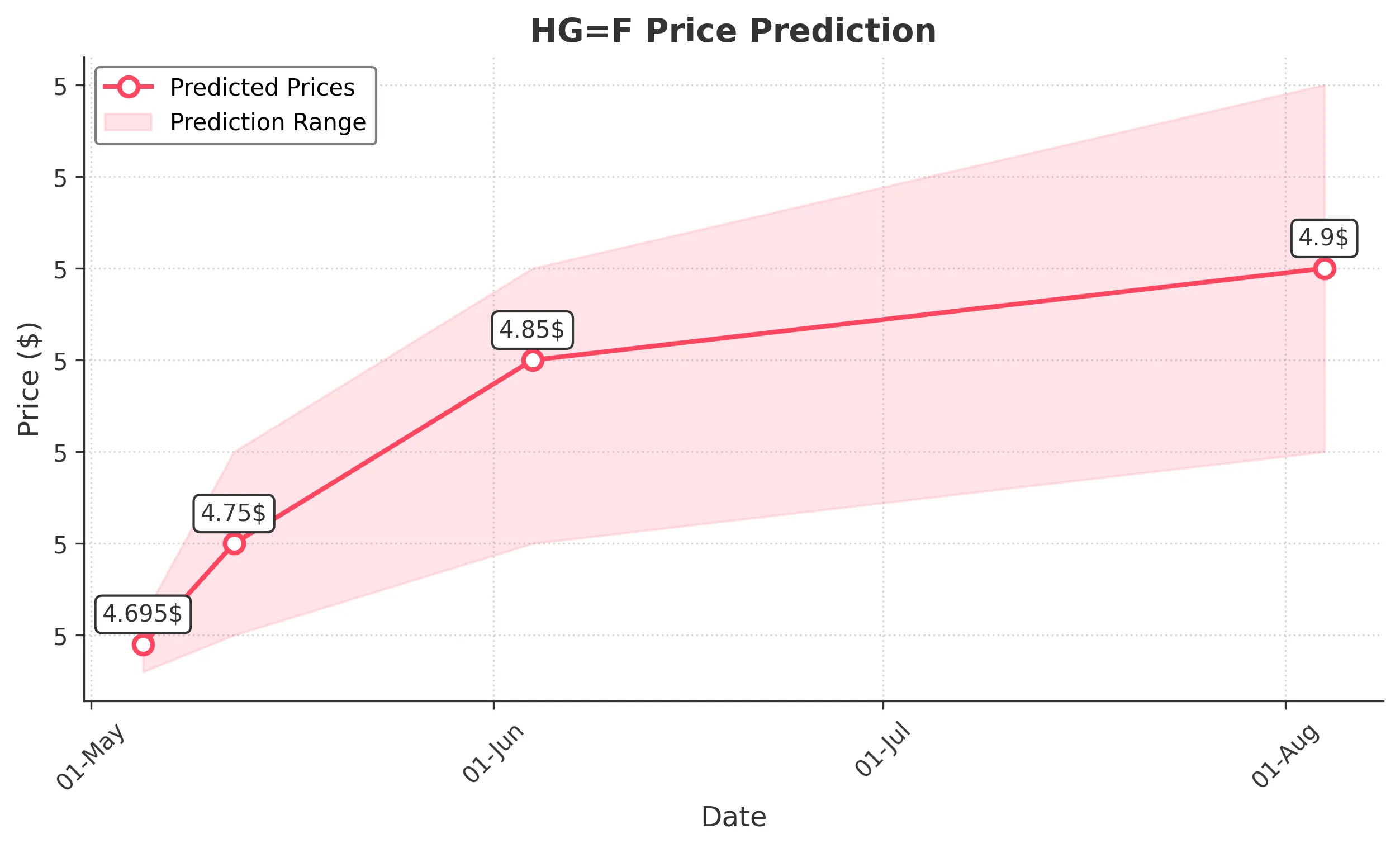

Target: May 5, 2025$4.695

$4.69

$4.71

$4.68

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential for a pullback. However, the MACD is positive, suggesting continued momentum. Expect slight gains tomorrow.

Analysis

Over the past 3 months, HG=F has shown a bullish trend with significant support at 4.5 and resistance around 5.1. The recent price action indicates a strong upward momentum, but the RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential market volatility could impact the prediction, especially if external news arises.

1 Week Prediction

Target: May 12, 2025$4.75

$4.73

$4.8

$4.7

Description

The stock is expected to continue its upward trajectory, supported by bullish candlestick patterns and positive MACD. However, the RSI indicates potential overbought conditions, which may lead to a correction.

Analysis

The stock has been trending upward with increasing volume, indicating strong buying interest. Key resistance at 5.1 remains a challenge, while support at 4.5 is solid. Watch for potential pullbacks as the RSI approaches overbought territory.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could reverse the trend.

1 Month Prediction

Target: June 4, 2025$4.85

$4.8

$4.9

$4.75

Description

The stock is likely to maintain its bullish trend, with strong support levels. The MACD remains positive, and the price is expected to test resistance at 5.1. However, watch for signs of exhaustion as the RSI approaches overbought.

Analysis

The stock has shown resilience with a bullish trend, but the RSI indicates potential overbought conditions. Volume patterns suggest strong interest, but caution is warranted as the price approaches key resistance levels.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could impact the stock's performance, leading to volatility.

3 Months Prediction

Target: August 4, 2025$4.9

$4.85

$5

$4.8

Description

The stock is expected to stabilize around current levels, with potential for slight gains. The overall trend remains bullish, but the RSI suggests caution. Market sentiment and external factors could influence price movements.

Analysis

The stock has shown a strong upward trend, but the potential for a correction exists as the RSI nears overbought levels. Key support at 4.5 and resistance at 5.1 will be critical in determining future price action.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic changes.