HGF Trading Predictions

1 Day Prediction

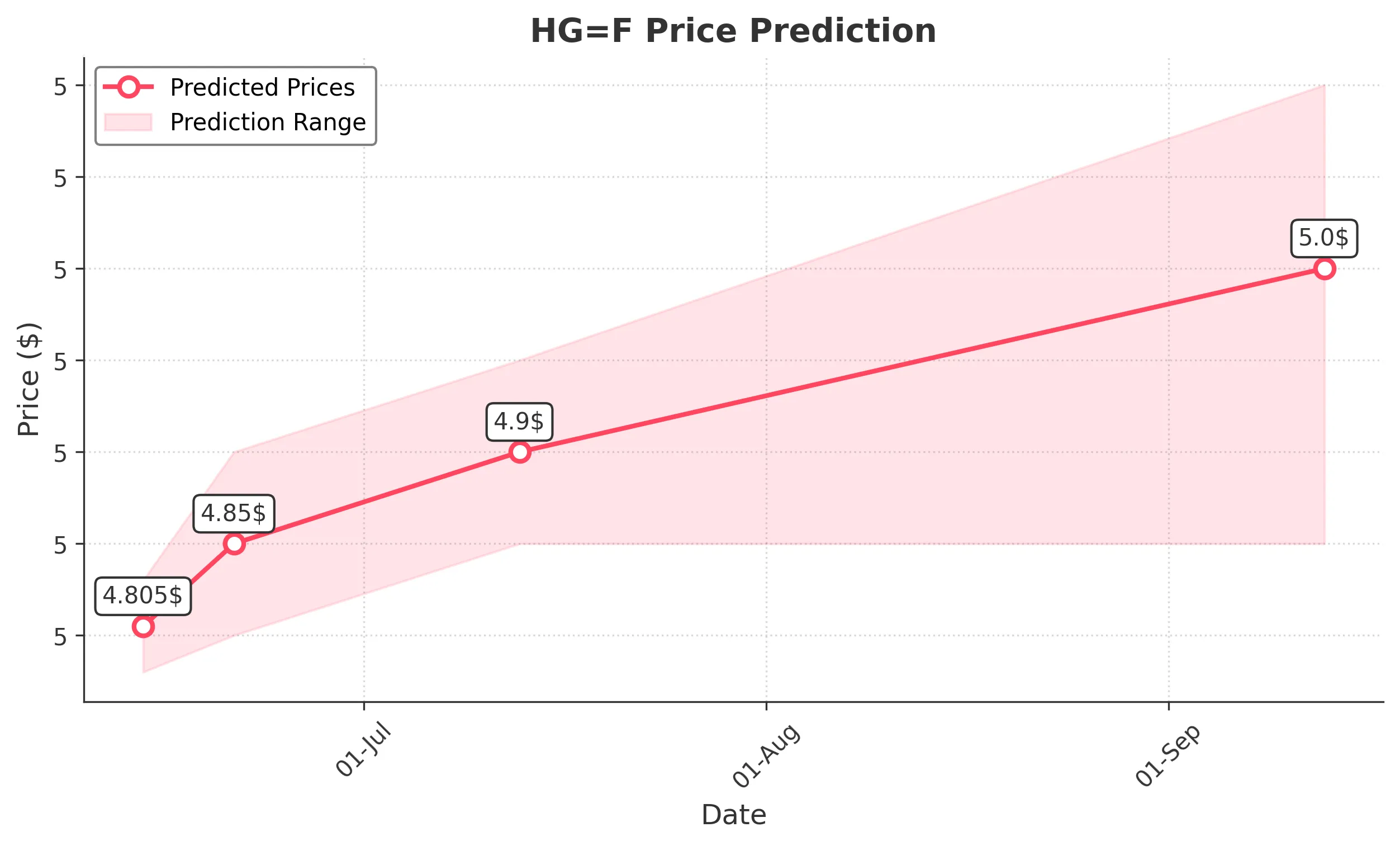

Target: June 14, 2025$4.805

$4.8

$4.83

$4.78

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains a concern.

Analysis

Over the past 3 months, HG=F has shown a bearish trend with significant support around 4.80. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. Volume spikes on certain days suggest increased interest, but the overall trend is still uncertain.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, and a reversal is possible if selling pressure increases.

1 Week Prediction

Target: June 21, 2025$4.85

$4.82

$4.9

$4.8

Description

The stock is expected to continue its upward movement, supported by a bullish MACD crossover and a recent bullish engulfing pattern. However, resistance at 4.90 may limit gains. Volume is expected to increase as traders react to market sentiment.

Analysis

The stock has been fluctuating around the 4.80 level, with recent bullish signals suggesting a possible upward trend. Key resistance at 4.90 needs to be monitored, as it could trigger profit-taking. Overall, the sentiment is cautiously optimistic.

Confidence Level

Potential Risks

Potential market corrections or negative news could impact the stock's performance, leading to a pullback.

1 Month Prediction

Target: July 13, 2025$4.9

$4.87

$4.95

$4.85

Description

The stock is likely to test the resistance at 4.90, with bullish momentum supported by a favorable RSI and MACD. However, the market's overall volatility could lead to fluctuations. A breakout above 4.90 could signal further gains.

Analysis

The stock has shown signs of recovery, with key support at 4.80 and resistance at 4.90. The overall trend appears bullish, but external factors could influence price movements. Volume patterns indicate increased interest, suggesting potential upward momentum.

Confidence Level

Potential Risks

Economic indicators or geopolitical events could introduce volatility, impacting the stock's trajectory.

3 Months Prediction

Target: September 13, 2025$5

$4.95

$5.1

$4.85

Description

The stock is projected to reach 5.00, driven by a bullish trend and potential breakout above resistance levels. However, market volatility and economic conditions could pose risks to this prediction.

Analysis

The stock has been in a recovery phase, with a potential bullish trend forming. Key resistance levels will need to be monitored closely. Volume analysis indicates growing interest, but external economic factors could introduce uncertainty.

Confidence Level

Potential Risks

Unforeseen market events or economic downturns could lead to a significant price correction.