HGF Trading Predictions

1 Day Prediction

Target: July 7, 2025$5.085

$5.071

$5.12

$5.06

Description

The stock shows a slight bullish trend with a recent upward movement. The RSI is near 60, indicating strength, while MACD is positive. However, a potential resistance at 5.12 may limit gains. Volume is expected to be moderate.

Analysis

Over the past 3 months, HG=F has shown a bullish trend, breaking above key resistance levels. The recent price action indicates a strong upward momentum, supported by increasing volume. Key support is at 5.06, while resistance is at 5.12.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 14, 2025$5.12

$5.085

$5.15

$5.08

Description

The stock is expected to continue its upward trajectory, with bullish momentum supported by positive MACD and RSI trends. However, the proximity to resistance at 5.15 may lead to a pullback if not breached.

Analysis

The stock has maintained a bullish trend, with significant volume spikes indicating strong buying interest. Key support is at 5.06, while resistance at 5.15 could pose challenges. Overall, the sentiment remains positive.

Confidence Level

Potential Risks

Potential market corrections or profit-taking could affect the upward trend.

1 Month Prediction

Target: August 7, 2025$5.2

$5.12

$5.25

$5.1

Description

The stock is projected to reach 5.20 as bullish momentum persists. The RSI indicates overbought conditions, suggesting caution. A breakout above 5.15 could lead to further gains, but a pullback is possible.

Analysis

The stock has shown consistent upward movement, with key support at 5.06 and resistance at 5.15. The bullish sentiment is supported by strong volume, but caution is warranted due to potential overbought signals.

Confidence Level

Potential Risks

Overbought conditions may lead to a correction, and external factors could influence market sentiment.

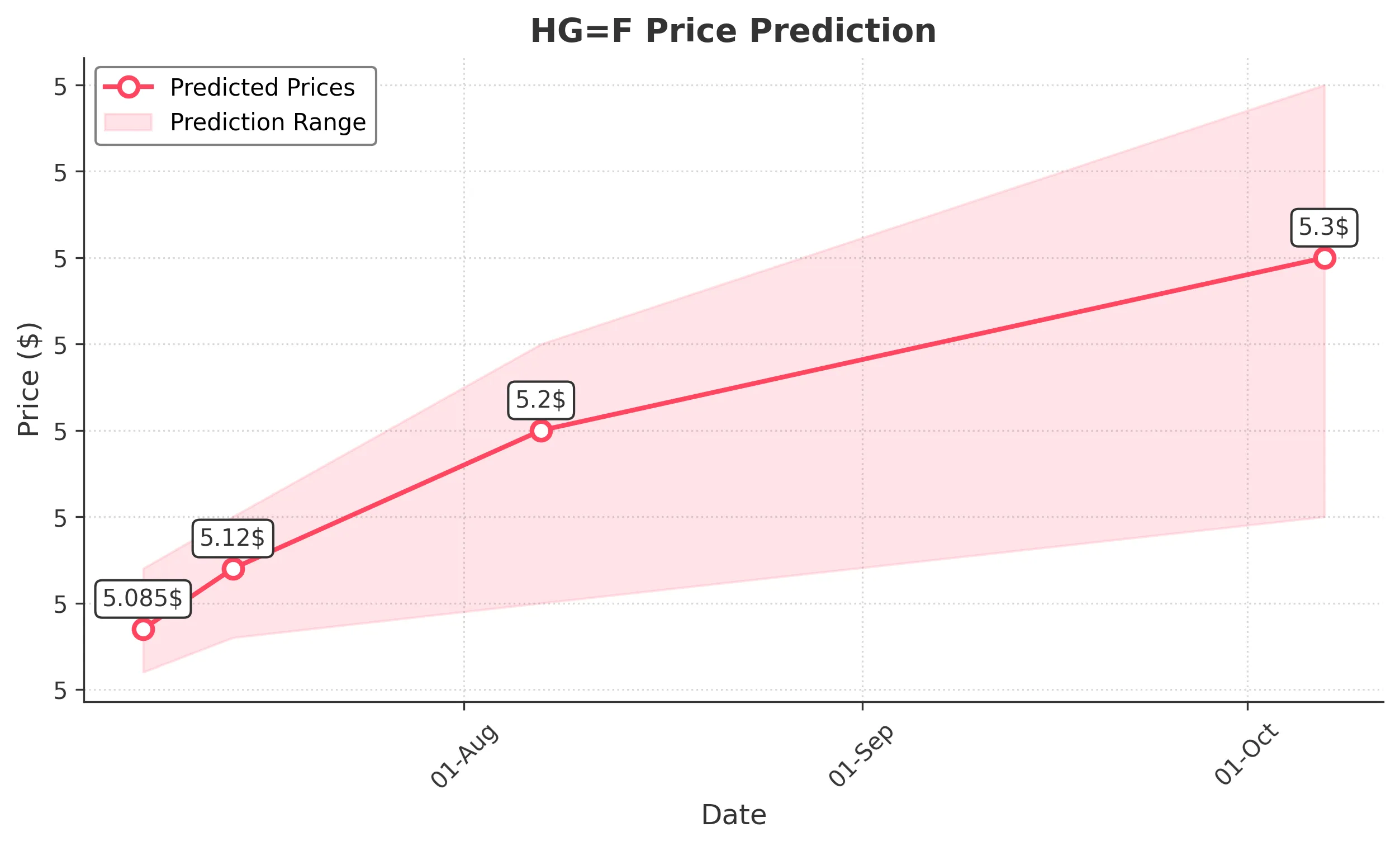

3 Months Prediction

Target: October 7, 2025$5.3

$5.2

$5.4

$5.15

Description

The stock is expected to trend upwards towards 5.30, driven by strong fundamentals and market sentiment. However, potential resistance at 5.40 may limit gains. Watch for volume trends to confirm the bullish outlook.

Analysis

The stock has shown a strong bullish trend, with significant support at 5.06 and resistance at 5.40. While the outlook remains positive, external economic factors and market sentiment could introduce volatility.

Confidence Level

Potential Risks

Market conditions and economic factors could lead to volatility, impacting the prediction.