HGF Trading Predictions

1 Day Prediction

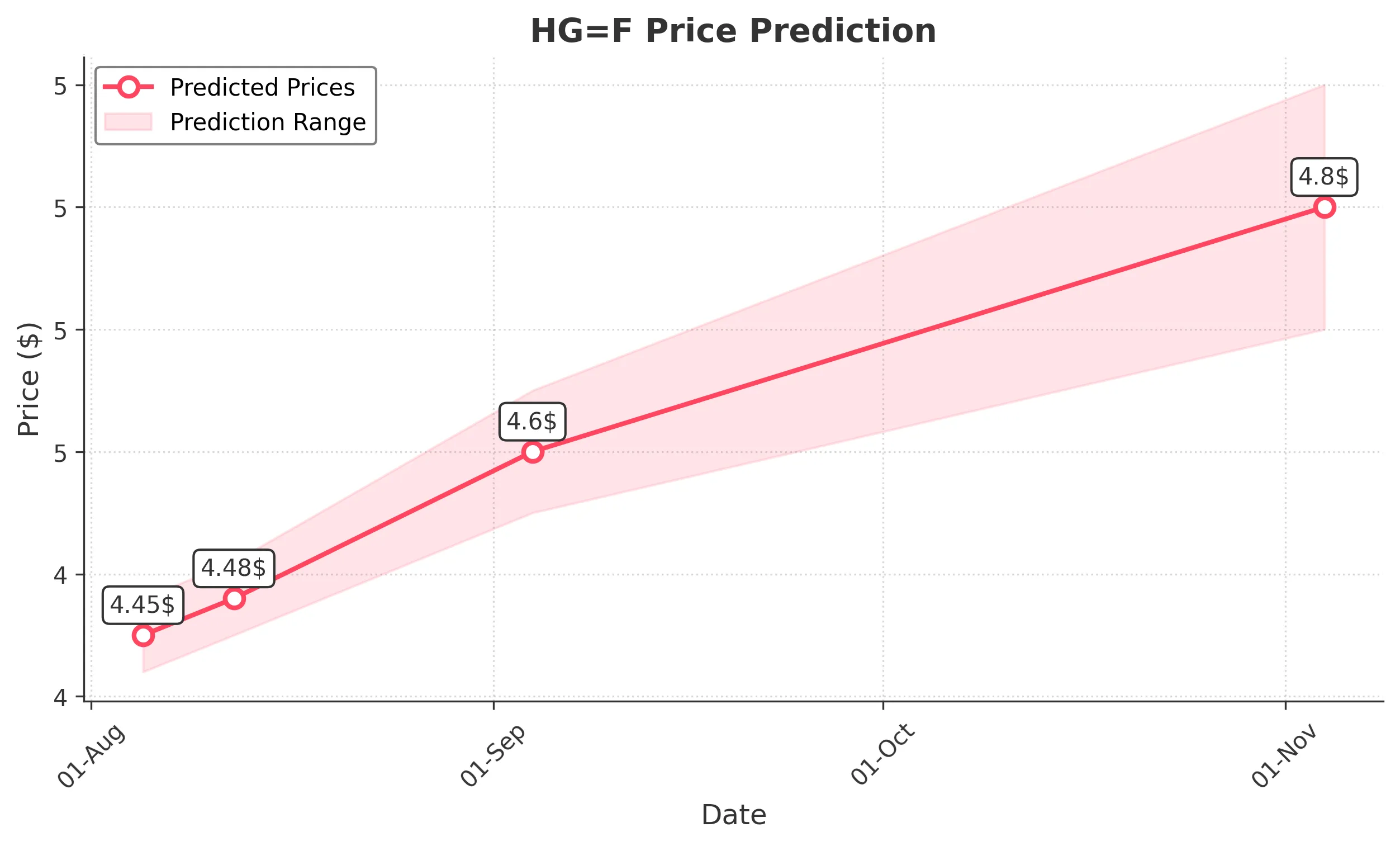

Target: August 5, 2025$4.45

$4.44

$4.48

$4.42

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates overbought conditions, suggesting a pullback. Volume has been increasing, indicating potential selling pressure. Expect a close around 4.4500.

Analysis

Over the past 3 months, HG=F has shown a bullish trend with significant highs around 5.8 but recently faced selling pressure. Key support at 4.4 and resistance at 5.0. RSI indicates potential overbought conditions, while MACD shows bearish divergence.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish reversal is possible.

1 Week Prediction

Target: August 12, 2025$4.48

$4.46

$4.51

$4.45

Description

The stock may stabilize around 4.4800 as it finds support. Recent candlestick patterns suggest indecision, and the market sentiment remains cautious. Expect a slight recovery but limited upside due to resistance levels.

Analysis

The stock has been volatile, with significant fluctuations. Recent highs were not sustained, and the stock is testing support levels. Volume spikes indicate increased trading activity, but overall sentiment is mixed.

Confidence Level

Potential Risks

Potential for further declines if bearish sentiment persists. Economic data releases could also influence market direction.

1 Month Prediction

Target: September 4, 2025$4.6

$4.58

$4.65

$4.55

Description

Expect a gradual recovery towards 4.6000 as the stock finds support. Technical indicators suggest a potential reversal, but resistance remains strong. Market sentiment may improve if macroeconomic conditions stabilize.

Analysis

The stock has shown a bearish trend recently, with significant resistance at 5.0. Key support at 4.4 is critical. Technical indicators are mixed, with some suggesting a potential reversal, but overall market sentiment remains cautious.

Confidence Level

Potential Risks

Uncertainties in the broader market and potential economic downturns could hinder recovery. Watch for news that may impact sentiment.

3 Months Prediction

Target: November 4, 2025$4.8

$4.75

$4.9

$4.7

Description

Longer-term outlook suggests a recovery towards 4.8000 as market conditions stabilize. Technical indicators may turn bullish if the stock breaks above resistance levels. Watch for macroeconomic developments.

Analysis

The stock has experienced significant volatility, with a recent bearish trend. Key resistance at 5.0 and support at 4.4 are critical. Technical indicators show mixed signals, and external economic factors could influence future performance.

Confidence Level

Potential Risks

Economic uncertainties and potential market corrections could impact the prediction. A bearish trend could resume if key support levels fail.