HGF Trading Predictions

1 Day Prediction

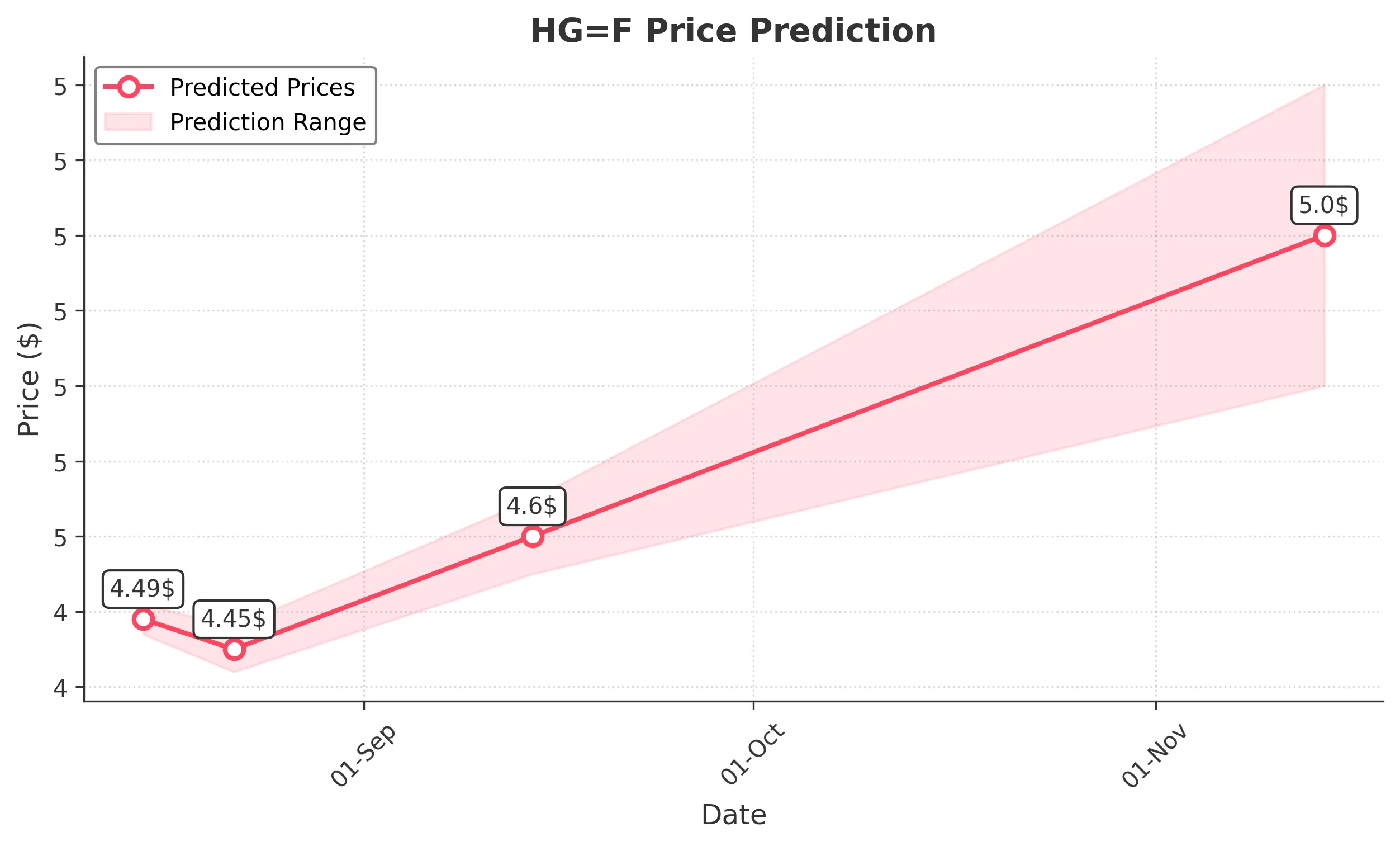

Target: August 15, 2025$4.49

$4.485

$4.51

$4.47

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates overbought conditions, suggesting a potential pullback. Volume is decreasing, indicating weakening momentum. Expect a close around 4.4900.

Analysis

Over the past 3 months, HG=F has shown a bullish trend with significant highs around 5.8 but has recently faced resistance. Key support is at 4.35. The RSI is nearing overbought levels, and MACD shows a bearish crossover, indicating potential downward pressure.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: August 22, 2025$4.45

$4.44

$4.48

$4.42

Description

The stock is expected to continue its bearish trend with potential support at 4.40. The MACD remains negative, and the RSI indicates a correction. Anticipate a close around 4.4500 as selling pressure persists.

Analysis

The stock has been in a corrective phase after reaching highs. The recent candlestick patterns show indecision, and volume has been lower than average, indicating a lack of strong buying interest. Key resistance remains at 5.0.

Confidence Level

Potential Risks

Unforeseen market events or news could lead to volatility.

1 Month Prediction

Target: September 14, 2025$4.6

$4.58

$4.65

$4.55

Description

A potential recovery is anticipated as the stock may find support at 4.50. The RSI could stabilize, and if bullish sentiment returns, expect a close around 4.6000. Watch for volume spikes indicating renewed interest.

Analysis

The stock has shown volatility with significant price swings. The Bollinger Bands indicate potential for a rebound, while Fibonacci retracement levels suggest support at 4.50. Overall, the market sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, affecting the prediction.

3 Months Prediction

Target: November 14, 2025$5

$4.95

$5.2

$4.8

Description

Long-term outlook suggests a recovery towards 5.00 as market conditions stabilize. If bullish momentum builds, expect a close around 5.0000. Watch for macroeconomic factors that could influence demand.

Analysis

The stock has experienced a significant pullback but may find support at 4.80. The long-term trend remains bullish, with potential for recovery if market conditions improve. Key resistance is at 5.20, and volume patterns suggest accumulation.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could impact the market significantly.