META Trading Predictions

1 Day Prediction

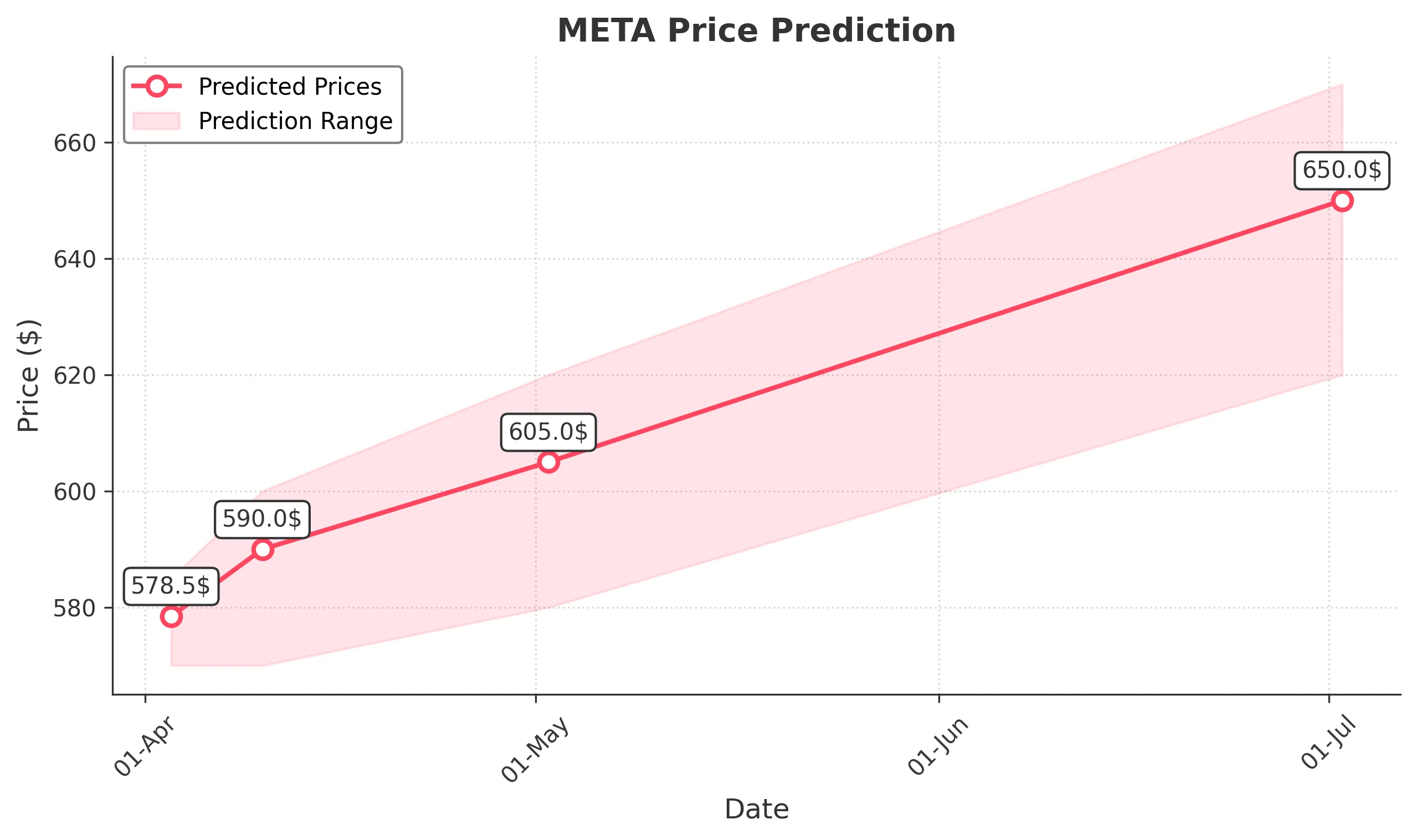

Target: April 3, 2025$578.5

$577

$585

$570

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume is declining, indicating caution. Expect a close around 578.50.

Analysis

Over the past 3 months, META has shown a bearish trend with significant resistance around 600. Recent price action indicates a struggle to maintain higher levels. Technical indicators like MACD and RSI suggest potential for a short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A reversal pattern could emerge if bullish sentiment returns.

1 Week Prediction

Target: April 10, 2025$590

$580

$600

$570

Description

Expect a slight recovery as the stock may find support around 570. The RSI is improving, indicating potential upward momentum. However, MACD remains bearish, suggesting limited upside. Anticipate a close around 590.00.

Analysis

The stock has faced downward pressure, with key support at 570. Recent candlestick patterns show indecision, and while there are signs of recovery, the overall trend remains bearish. Volume analysis indicates lower participation, which could limit upward movement.

Confidence Level

Potential Risks

Uncertainty in market conditions and potential negative news could hinder recovery. Watch for volume spikes that may indicate a trend change.

1 Month Prediction

Target: May 2, 2025$605

$590

$620

$580

Description

A potential recovery is anticipated as the stock may test resistance around 620. The RSI is expected to stabilize, and MACD may show signs of bullish divergence. Expect a close around 605.00.

Analysis

META has been in a bearish phase, but signs of stabilization are emerging. Key resistance at 620 could be tested if bullish momentum builds. Technical indicators suggest a potential reversal, but caution is warranted due to recent volatility.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may impact the stock's performance. Watch for earnings reports or macroeconomic data.

3 Months Prediction

Target: July 2, 2025$650

$640

$670

$620

Description

Longer-term outlook suggests a recovery towards 650 as market sentiment improves. Technical indicators may turn bullish, with potential for higher highs. Anticipate a close around 650.00.

Analysis

The stock has shown resilience despite recent declines. If the market stabilizes, META could see a return to previous highs. Key support levels are holding, and bullish patterns may emerge, indicating a potential upward trend.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could impact growth. Monitor for any significant news that may alter market sentiment.