META Trading Predictions

1 Day Prediction

Target: April 4, 2025$540

$538

$550

$530

Description

The stock shows bearish momentum with a recent downtrend. The RSI indicates oversold conditions, but a potential bounce could occur. MACD is negative, suggesting continued weakness. Volume spikes on down days indicate selling pressure.

Analysis

Over the past 3 months, META has experienced significant volatility, with a bearish trend recently. Key support is around 570, while resistance is at 600. The MACD and RSI suggest bearish momentum, and volume analysis shows increased selling pressure.

Confidence Level

Potential Risks

Market sentiment is volatile, and any unexpected news could lead to further declines or a reversal.

1 Week Prediction

Target: April 11, 2025$550

$540

$560

$525

Description

The stock may see a slight recovery as it approaches key support levels. However, bearish indicators persist. The Bollinger Bands suggest potential for a bounce, but overall sentiment remains cautious.

Analysis

META's performance has been bearish, with significant resistance at 600. The recent price action shows a struggle to maintain higher levels. The ATR indicates high volatility, and the market sentiment remains cautious due to external economic pressures.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery efforts.

1 Month Prediction

Target: May 3, 2025$570

$550

$580

$510

Description

A potential recovery could occur as the stock approaches historical support levels. However, bearish trends in technical indicators suggest caution. The market's reaction to earnings reports will be crucial.

Analysis

The stock has been in a bearish trend, with significant support around 510. The RSI indicates potential for a bounce, but the MACD remains negative. Volume analysis shows increased selling pressure, and external factors could influence future performance.

Confidence Level

Potential Risks

Earnings reports and macroeconomic conditions could significantly impact stock performance.

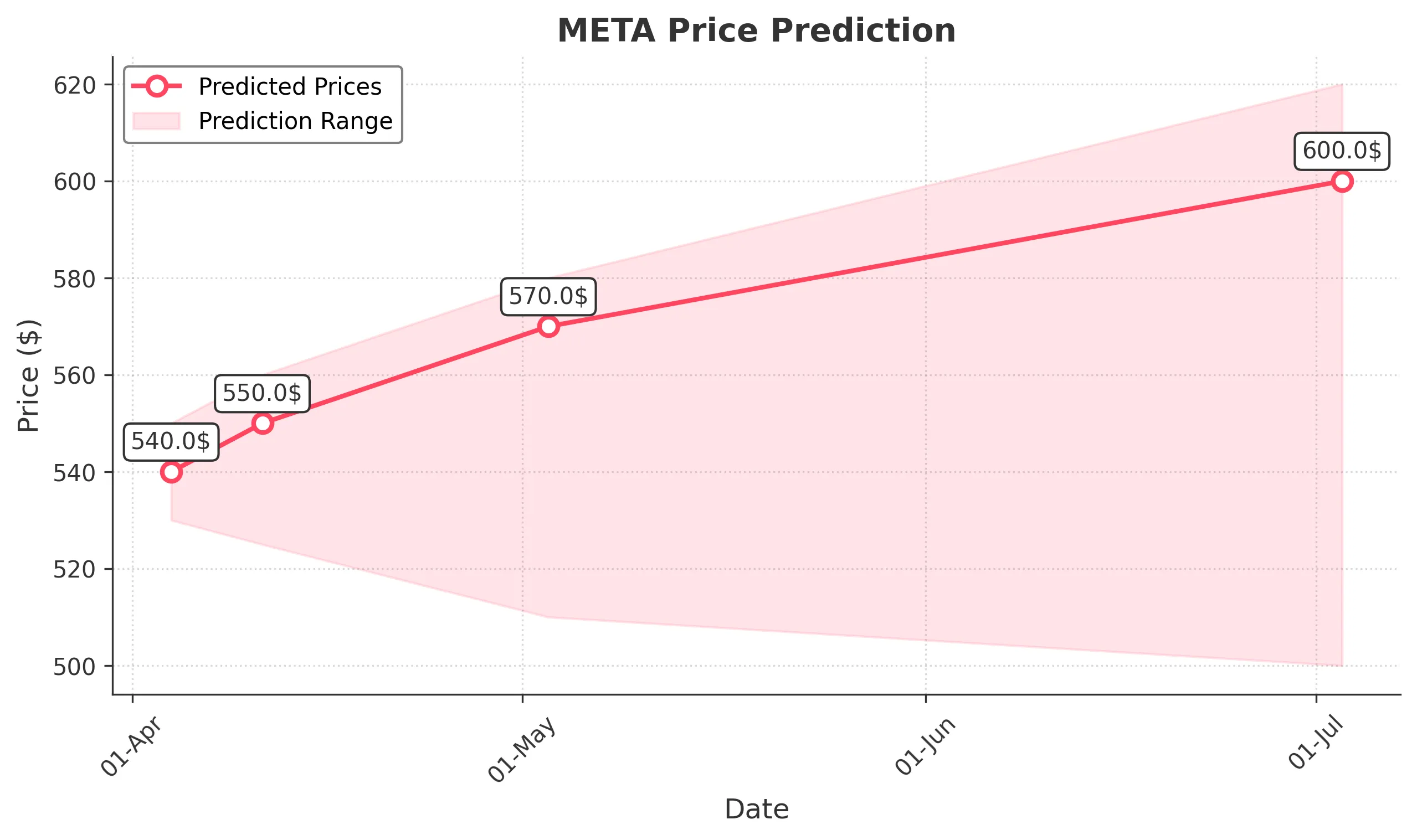

3 Months Prediction

Target: July 3, 2025$600

$580

$620

$500

Description

If the stock can stabilize and break through resistance levels, a gradual recovery is possible. However, bearish sentiment and macroeconomic factors could hinder progress. Watch for key earnings and market reactions.

Analysis

META's performance has been volatile, with a bearish trend dominating. Key resistance is at 600, while support is around 500. The market sentiment is cautious, and external economic factors could significantly impact future performance.

Confidence Level

Potential Risks

Unforeseen market events and economic conditions could lead to further declines.