META Trading Predictions

1 Day Prediction

Target: April 12, 2025$540

$535

$550

$530

Description

The stock shows a slight bullish trend with a potential recovery from recent lows. The RSI indicates oversold conditions, suggesting a bounce. However, resistance at 550 may limit upside. Volume is expected to be moderate as traders react to recent volatility.

Analysis

Over the past 3 months, META has experienced significant volatility, with a bearish trend recently. Key support is around 530, while resistance is at 550. The MACD shows a potential bullish crossover, but the overall sentiment is cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market sentiment remains fragile, and any negative news could reverse this short-term recovery.

1 Week Prediction

Target: April 19, 2025$550

$540

$560

$525

Description

A week ahead, the stock may stabilize around 550 as it tests resistance. The Bollinger Bands suggest potential for a breakout, but the recent bearish trend could lead to profit-taking. Volume may increase as traders react to earnings reports.

Analysis

The stock has shown a bearish trend with significant sell-offs. Key support at 525 is critical, while resistance at 560 looms. The ATR indicates high volatility, and recent volume spikes suggest traders are cautious. Market sentiment is mixed, influenced by macroeconomic conditions.

Confidence Level

Potential Risks

Uncertainty in the broader market and potential earnings misses could lead to downward pressure.

1 Month Prediction

Target: May 12, 2025$570

$550

$580

$510

Description

In a month, META may recover to 570, driven by potential positive earnings and market sentiment. However, resistance at 580 could pose challenges. The RSI may indicate a recovery, but caution is warranted due to macroeconomic uncertainties.

Analysis

The stock has been in a bearish phase, with recent attempts to recover. Key support at 510 and resistance at 580 are critical levels. The MACD is showing signs of potential bullish momentum, but overall market sentiment remains cautious due to external factors.

Confidence Level

Potential Risks

Earnings results and macroeconomic data could significantly impact the stock's trajectory, leading to unexpected volatility.

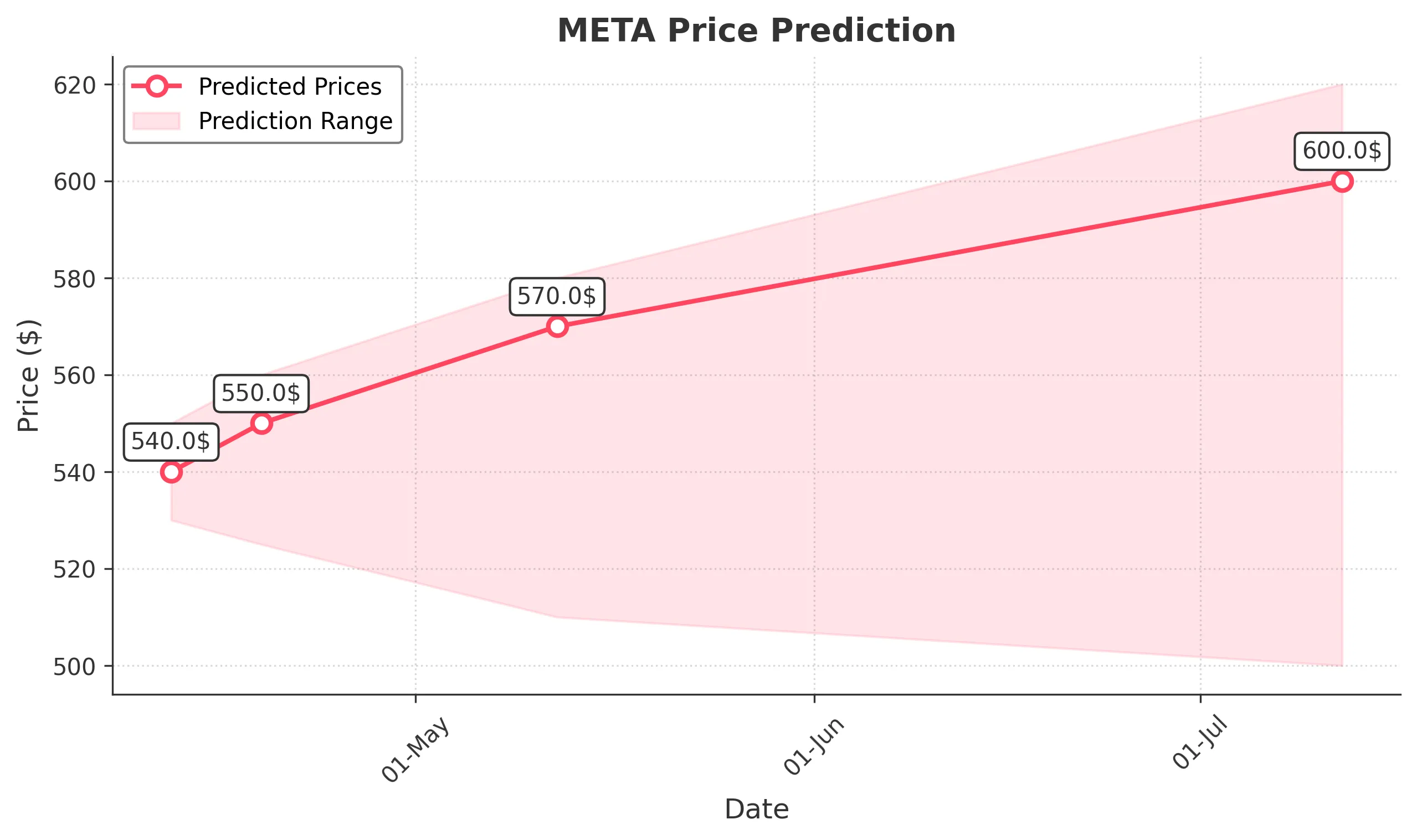

3 Months Prediction

Target: July 12, 2025$600

$570

$620

$500

Description

Three months out, META could reach 600 if market conditions improve and earnings are favorable. However, significant resistance at 620 may limit gains. The overall trend will depend on macroeconomic stability and investor sentiment.

Analysis

The stock has faced significant challenges, with a bearish trend recently. Key support at 500 and resistance at 620 are crucial. The ATR indicates potential for volatility, and market sentiment is mixed, influenced by broader economic conditions.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market corrections and economic shifts that could impact investor confidence.