META Trading Predictions

1 Day Prediction

Target: April 16, 2025$532

$530

$540

$525

Description

The stock shows signs of consolidation around the 530 level, with recent bearish momentum. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating caution. Volume remains low, reflecting uncertainty.

Analysis

Over the past 3 months, META has experienced significant volatility, with a bearish trend recently. Key support is around 530, while resistance is near 550. Technical indicators show mixed signals, with RSI indicating oversold conditions but MACD remaining bearish. Volume spikes during sell-offs suggest strong selling pressure.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly. A reversal is possible if bearish sentiment continues.

1 Week Prediction

Target: April 23, 2025$540

$532

$550

$520

Description

A potential recovery is anticipated as the stock approaches key support levels. The RSI may recover from oversold conditions, and a bullish divergence could form. However, MACD remains bearish, indicating caution.

Analysis

The stock has been in a bearish trend, with significant price drops. Support at 530 is critical, while resistance is at 550. Technical indicators show potential for a bounce, but overall sentiment remains cautious. Volume patterns indicate selling pressure, and external factors could influence future performance.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery. Watch for any significant news that may impact market sentiment.

1 Month Prediction

Target: May 15, 2025$560

$540

$570

$510

Description

If the stock can stabilize above 530, a gradual recovery towards 560 is possible. The RSI may improve, and MACD could show signs of bullish momentum. However, external factors remain a risk.

Analysis

META has faced significant downward pressure, with key support at 530. The stock's performance has been volatile, with mixed signals from technical indicators. Volume analysis shows selling pressure, but a potential recovery could occur if support holds. External factors will play a crucial role in future performance.

Confidence Level

Potential Risks

Market conditions and potential negative news could derail recovery efforts. Watch for earnings reports or macroeconomic data that may impact sentiment.

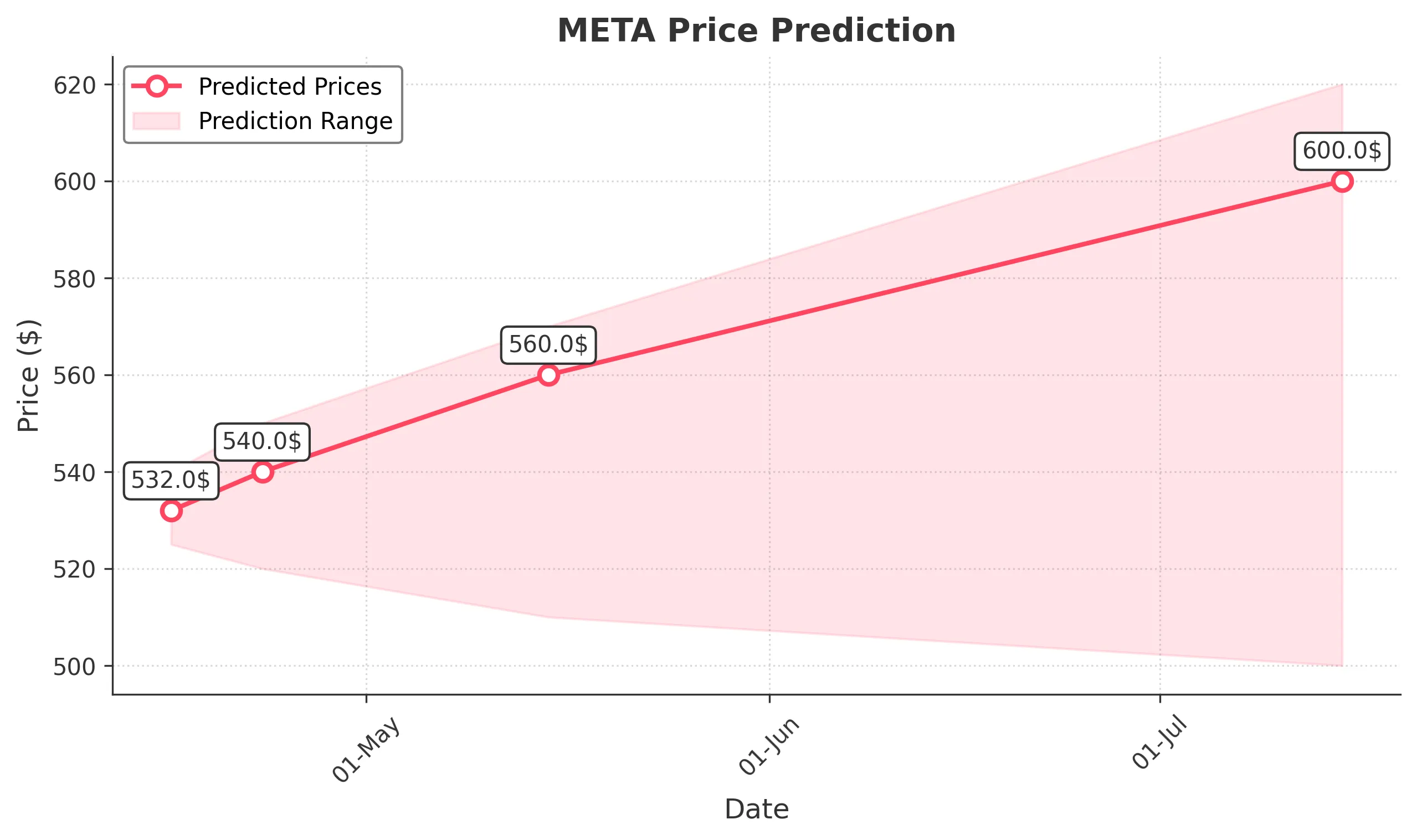

3 Months Prediction

Target: July 15, 2025$600

$570

$620

$500

Description

Assuming stabilization and recovery, the stock could reach 600. Positive market sentiment and improved fundamentals may support this. However, macroeconomic risks remain.

Analysis

The stock has been in a bearish trend, with significant volatility. Key support at 530 and resistance at 600 are critical levels. Technical indicators show potential for recovery, but overall sentiment remains cautious. Volume patterns indicate selling pressure, and external factors could influence future performance.

Confidence Level

Potential Risks

Unforeseen market events or negative news could significantly impact the stock's trajectory. The potential for further declines exists if bearish sentiment persists.