META Trading Predictions

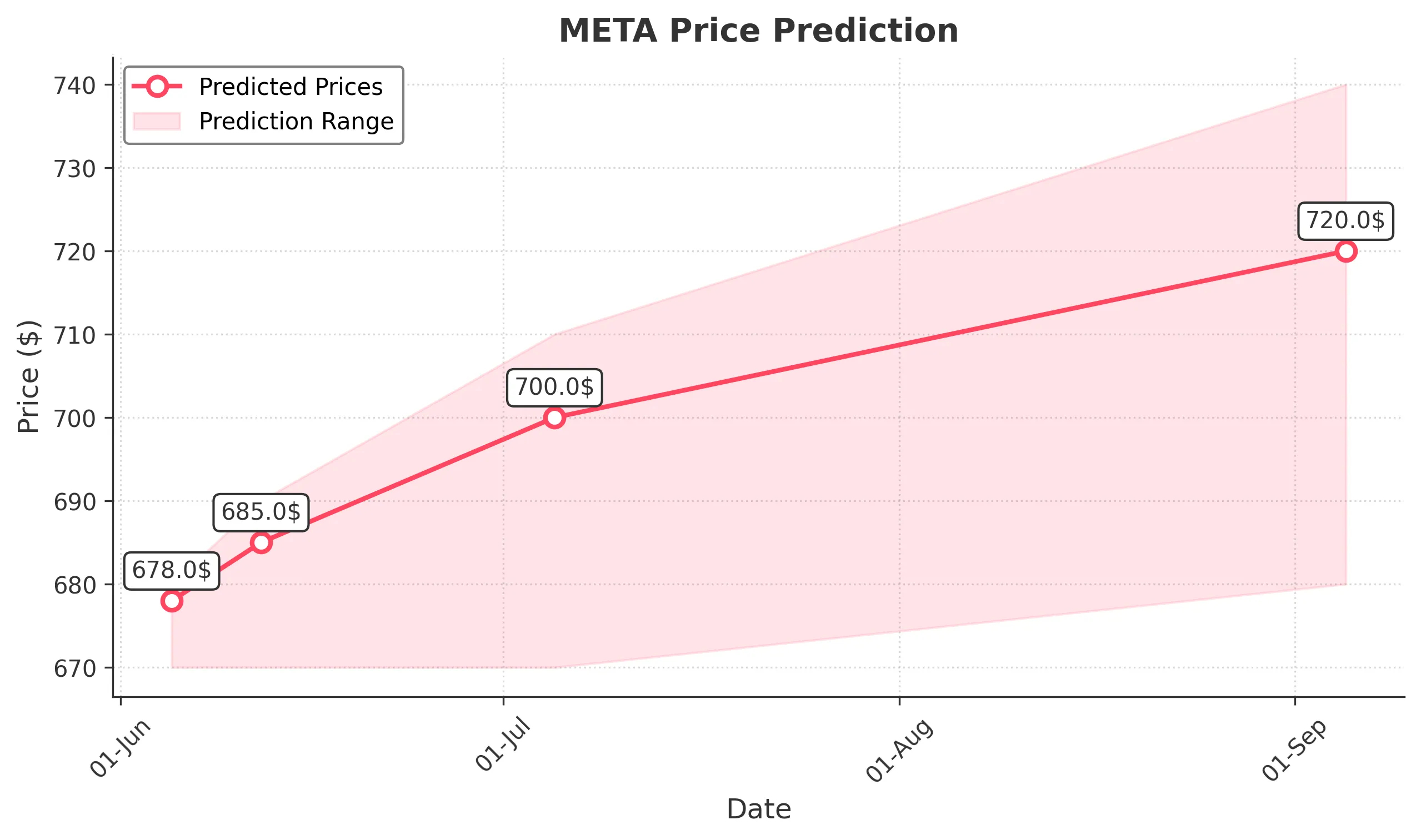

1 Day Prediction

Target: June 5, 2025$678

$676

$680

$670

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, MACD is positive, suggesting continued upward movement. Volume is stable, supporting the price action.

Analysis

META has shown a bullish trend over the past three months, with significant support at $640 and resistance around $680. The recent price action indicates strong buying interest, but the RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential market corrections or external news could impact the price.

1 Week Prediction

Target: June 12, 2025$685

$678

$690

$670

Description

The bullish trend is expected to continue, supported by positive MACD and stable volume. However, the RSI indicates overbought conditions, which may lead to a short-term pullback before further gains.

Analysis

The stock has been trending upward, with key support at $670. The recent price action shows strong buying interest, but the overbought RSI suggests a potential correction could occur before further gains.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: July 5, 2025$700

$685

$710

$670

Description

The overall bullish sentiment is expected to drive prices higher, with strong support at $670. The MACD remains positive, and volume trends indicate sustained interest. However, watch for potential corrections as the RSI approaches overbought territory.

Analysis

META has shown a strong upward trend, with significant resistance at $710. The stock's performance is supported by positive technical indicators, but the potential for a pullback exists due to overbought conditions.

Confidence Level

Potential Risks

Economic data releases and market sentiment shifts could impact the forecast.

3 Months Prediction

Target: September 5, 2025$720

$700

$740

$680

Description

Long-term bullish trends are expected to continue, with strong support at $680. The MACD remains bullish, and volume trends indicate sustained interest. However, potential market corrections could occur, impacting the upward trajectory.

Analysis

The stock has shown a consistent upward trend, with key support at $680. While the technical indicators suggest continued bullish momentum, external economic factors and market sentiment could lead to volatility in the coming months.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to macroeconomic factors and market volatility.