META Trading Predictions

1 Day Prediction

Target: June 6, 2025$690

$688

$695

$685

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong buying volume suggests continued interest. Expect a close around 690.

Analysis

META has shown a bullish trend over the past three months, with significant support at 670. Recent volume spikes indicate strong buying interest. The MACD is positive, but RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could impact the price.

1 Week Prediction

Target: June 13, 2025$680

$685

$690

$670

Description

A slight pullback is expected as the stock approaches resistance levels. The MACD may show signs of divergence, and profit-taking could lead to a lower close. Anticipate a close around 680.

Analysis

The stock has been in a bullish phase, but recent candlestick patterns suggest potential exhaustion. Key resistance at 690 may trigger selling. Volume remains strong, but watch for signs of reversal.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news, affecting the prediction.

1 Month Prediction

Target: July 5, 2025$650

$660

$670

$640

Description

Expect a continued downtrend as profit-taking and bearish sentiment may dominate. The stock could test support around 640, with a close around 650 as selling pressure increases.

Analysis

The stock has shown volatility with recent highs, but bearish signals are emerging. The ATR indicates increasing volatility, and the RSI suggests overbought conditions. Watch for support at 640.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could alter market dynamics significantly.

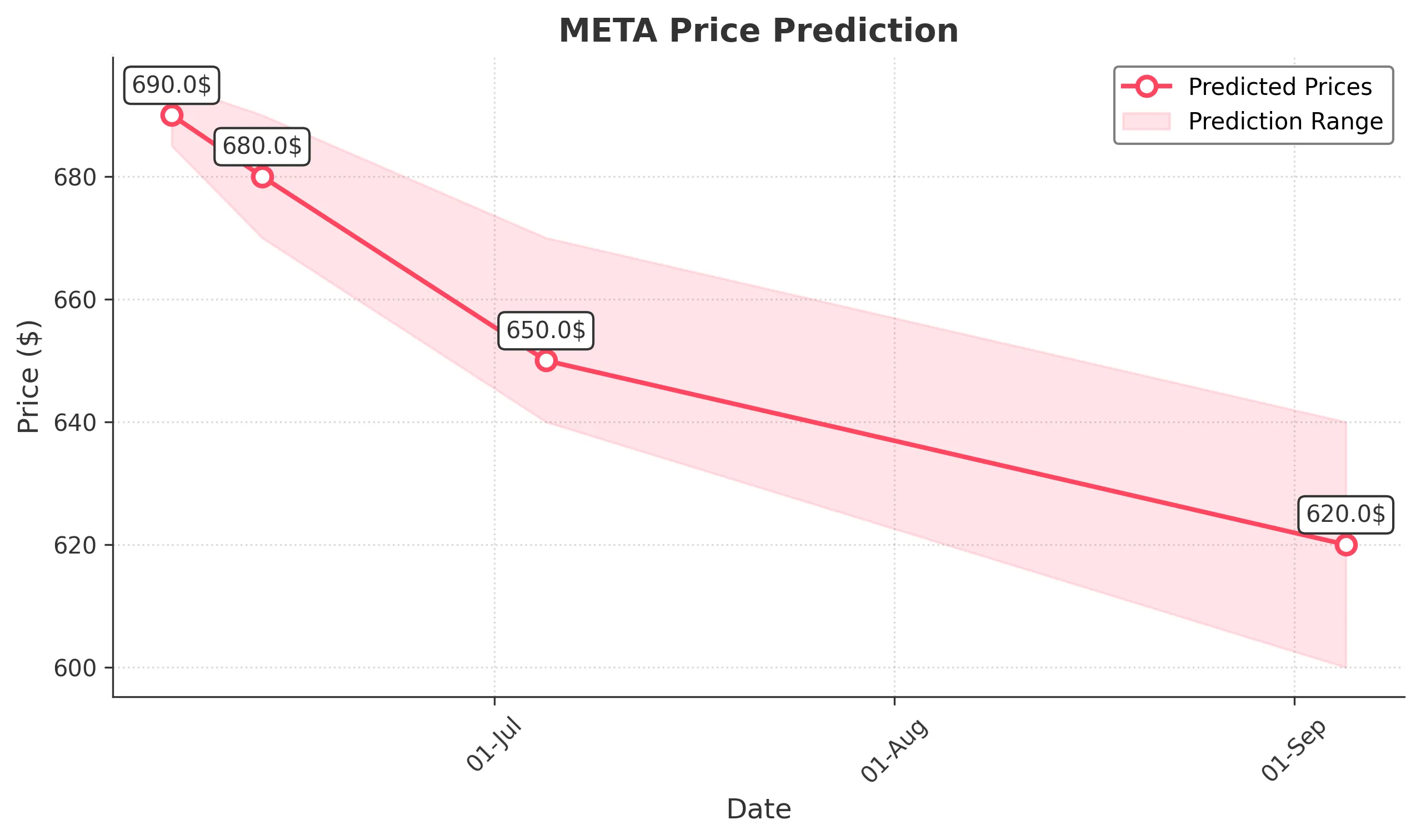

3 Months Prediction

Target: September 5, 2025$620

$630

$640

$600

Description

A bearish outlook is anticipated as the stock may face headwinds from broader market trends. Expect a close around 620, with potential for further declines if support levels fail.

Analysis

Over the past three months, META has experienced significant fluctuations. The overall trend appears bearish, with key support levels being tested. Volume patterns indicate potential selling pressure, and macroeconomic factors may weigh heavily on performance.

Confidence Level

Potential Risks

Market conditions and external factors could lead to unexpected price movements.