META Trading Predictions

1 Day Prediction

Target: June 24, 2025$680

$681.9

$685

$675

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 680.

Analysis

Over the past 3 months, META has shown a bullish trend with significant price increases, but recent price action indicates a potential reversal. Key support at 675 and resistance at 700. Volume patterns suggest decreasing interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: July 1, 2025$675

$680

$680

$670

Description

Expect a continued downward trend as the stock faces resistance at 685. The MACD shows bearish divergence, and the ATR indicates increasing volatility. A close around 675 is likely.

Analysis

The stock has been volatile, with significant fluctuations. Recent candlestick patterns suggest indecision. Support at 670 is critical; a break below could lead to further declines.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price changes.

1 Month Prediction

Target: July 31, 2025$650

$670

$660

$640

Description

The bearish trend is expected to continue, with potential for further declines as market sentiment weakens. Fibonacci retracement levels suggest 650 as a target. Watch for volume spikes indicating reversals.

Analysis

The stock has shown a bearish trend with lower highs and lows. Key support at 650 is critical. Technical indicators suggest a potential continuation of the downtrend, but external factors could influence price.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, impacting predictions.

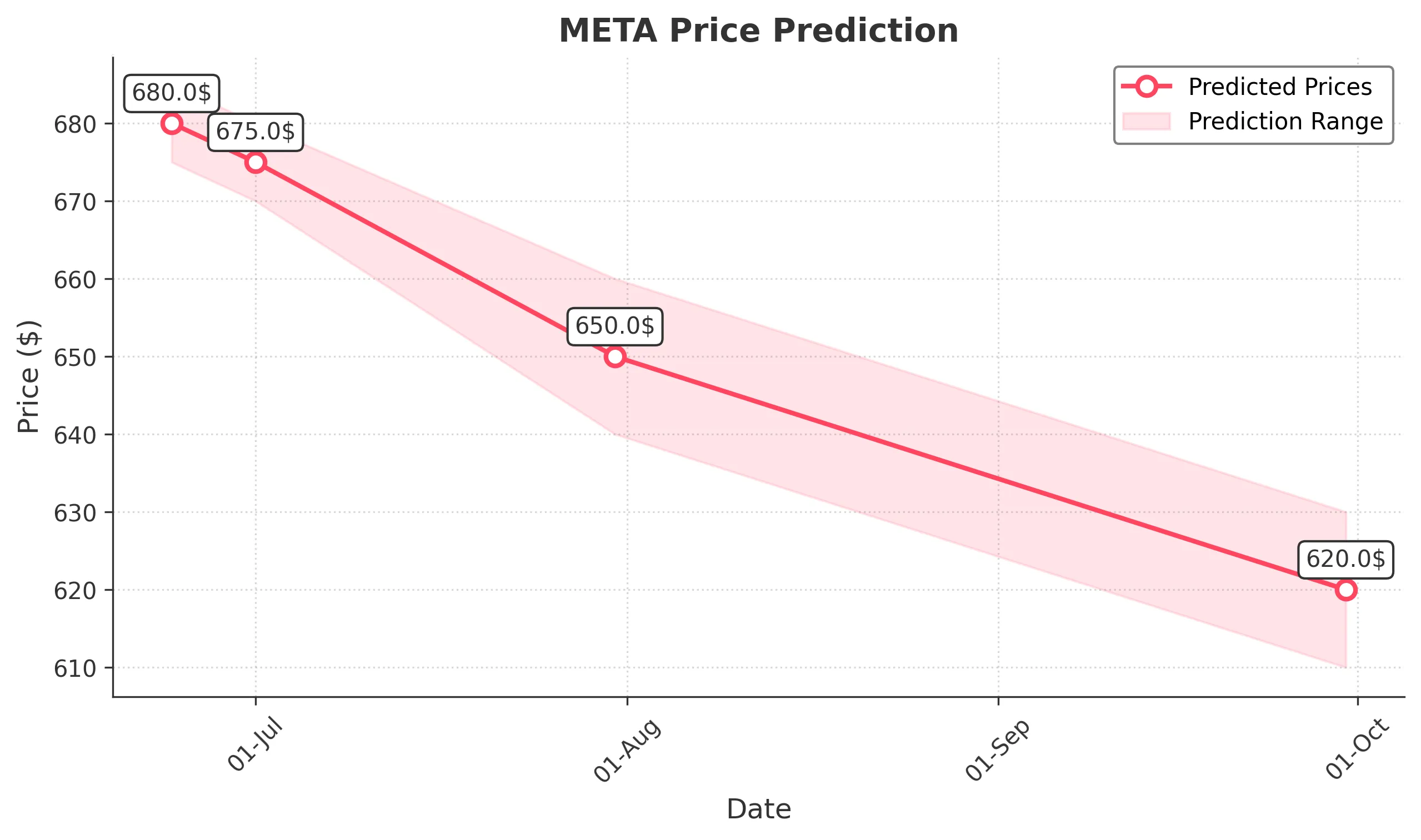

3 Months Prediction

Target: September 30, 2025$620

$625

$630

$610

Description

Long-term bearish outlook as the stock struggles to maintain upward momentum. The overall market sentiment is cautious, and technical indicators suggest further declines. Expect a close around 620.

Analysis

The stock has faced significant resistance and is showing signs of a prolonged downtrend. Key support levels are being tested, and macroeconomic factors could further influence performance. A cautious approach is advised.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential market shifts.