META Trading Predictions

1 Day Prediction

Target: July 2, 2025$735

$735

$740

$730

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 730 suggests limited downside risk.

Analysis

META has shown a bullish trend over the past three months, with significant support at 730 and resistance around 740. The recent volume spikes indicate strong buying interest, but the RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could impact the price.

1 Week Prediction

Target: July 9, 2025$740

$735

$750

$725

Description

The upward momentum is expected to continue, supported by recent bullish candlestick patterns. However, the MACD shows signs of potential divergence, indicating a possible slowdown in momentum.

Analysis

Over the past three months, META has experienced a strong bullish trend, with key resistance at 750. The MACD is positive, but divergence signals caution. Volume patterns suggest sustained interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news, affecting the stock's performance.

1 Month Prediction

Target: August 1, 2025$750

$740

$760

$720

Description

The stock is likely to test the 750 resistance level, with potential for a breakout. However, the RSI indicates overbought conditions, suggesting a possible pullback before any significant upward movement.

Analysis

META's performance has been bullish, with significant resistance at 750. The RSI is high, indicating potential overbought conditions. Volume trends remain strong, but external economic factors could introduce uncertainty in the coming month.

Confidence Level

Potential Risks

Market corrections and profit-taking could lead to volatility, impacting the price.

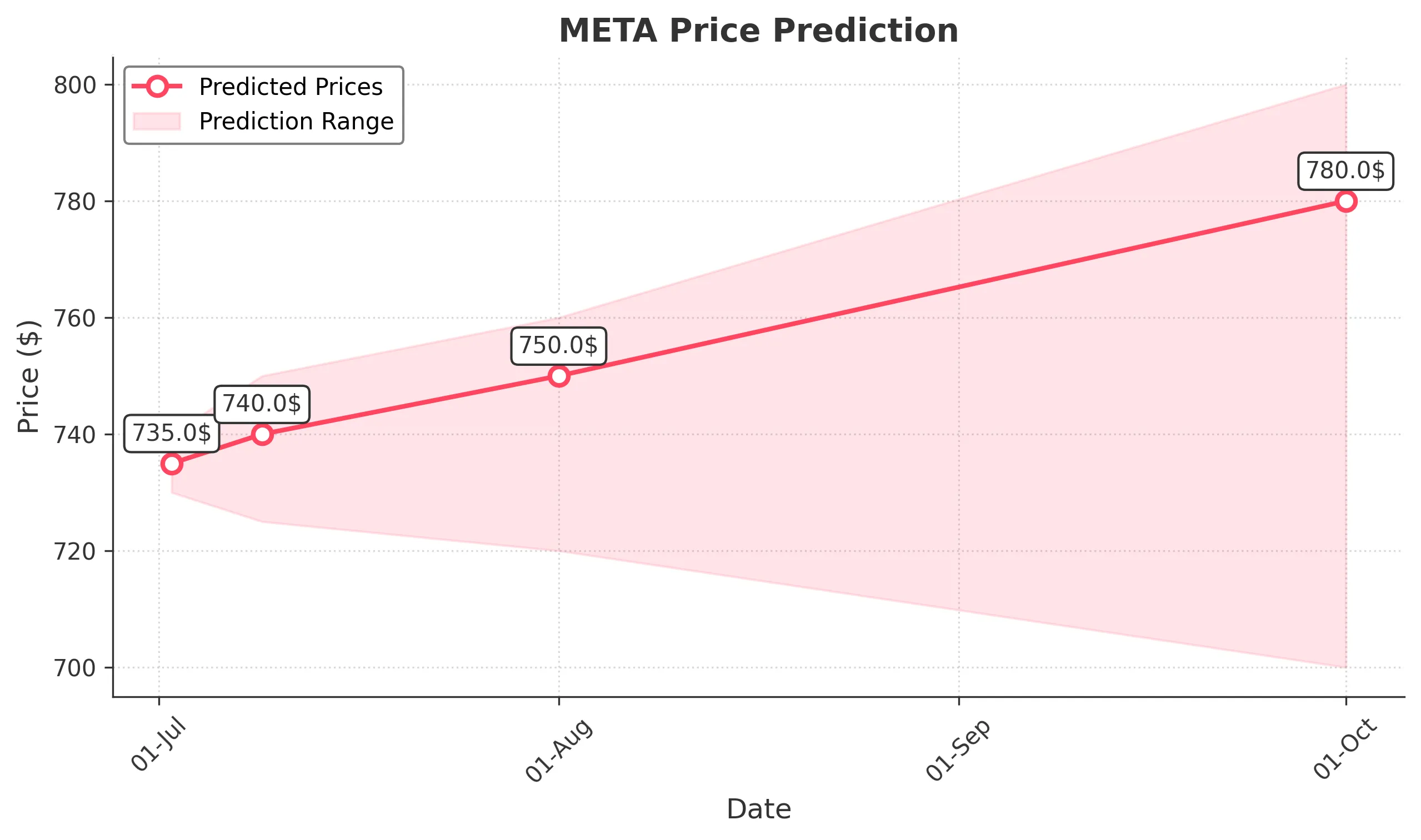

3 Months Prediction

Target: October 1, 2025$780

$750

$800

$700

Description

If the bullish trend continues, META could reach 780, supported by strong fundamentals. However, macroeconomic factors and potential market corrections pose risks to this forecast.

Analysis

META has shown a strong upward trend, but the potential for market corrections exists. Key support levels are at 700, while resistance is at 800. The overall market sentiment and macroeconomic conditions will play a crucial role in the stock's performance over the next three months.

Confidence Level

Potential Risks

Unforeseen economic events and market sentiment shifts could significantly impact the stock's trajectory.