META Trading Predictions

1 Day Prediction

Target: July 12, 2025$712.5

$711

$715

$710

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 712.50.

Analysis

Over the past 3 months, META has shown a bullish trend with significant upward movement, peaking at 738.09. However, recent price action indicates a potential reversal with lower highs and increased volatility. Key support at 700.00 and resistance at 740.00.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: July 19, 2025$705

$710

$710

$700

Description

Expect continued bearish pressure as the stock approaches key support levels. MACD shows a bearish crossover, and RSI is trending downwards. Anticipate a close around 705.00 as selling pressure may increase.

Analysis

The stock has been in a corrective phase after reaching highs of 738.09. Recent trading has shown lower volume and bearish candlestick patterns, indicating a possible trend reversal. Key support at 700.00 is critical.

Confidence Level

Potential Risks

Potential for unexpected market news or earnings could lead to volatility, impacting the accuracy of this prediction.

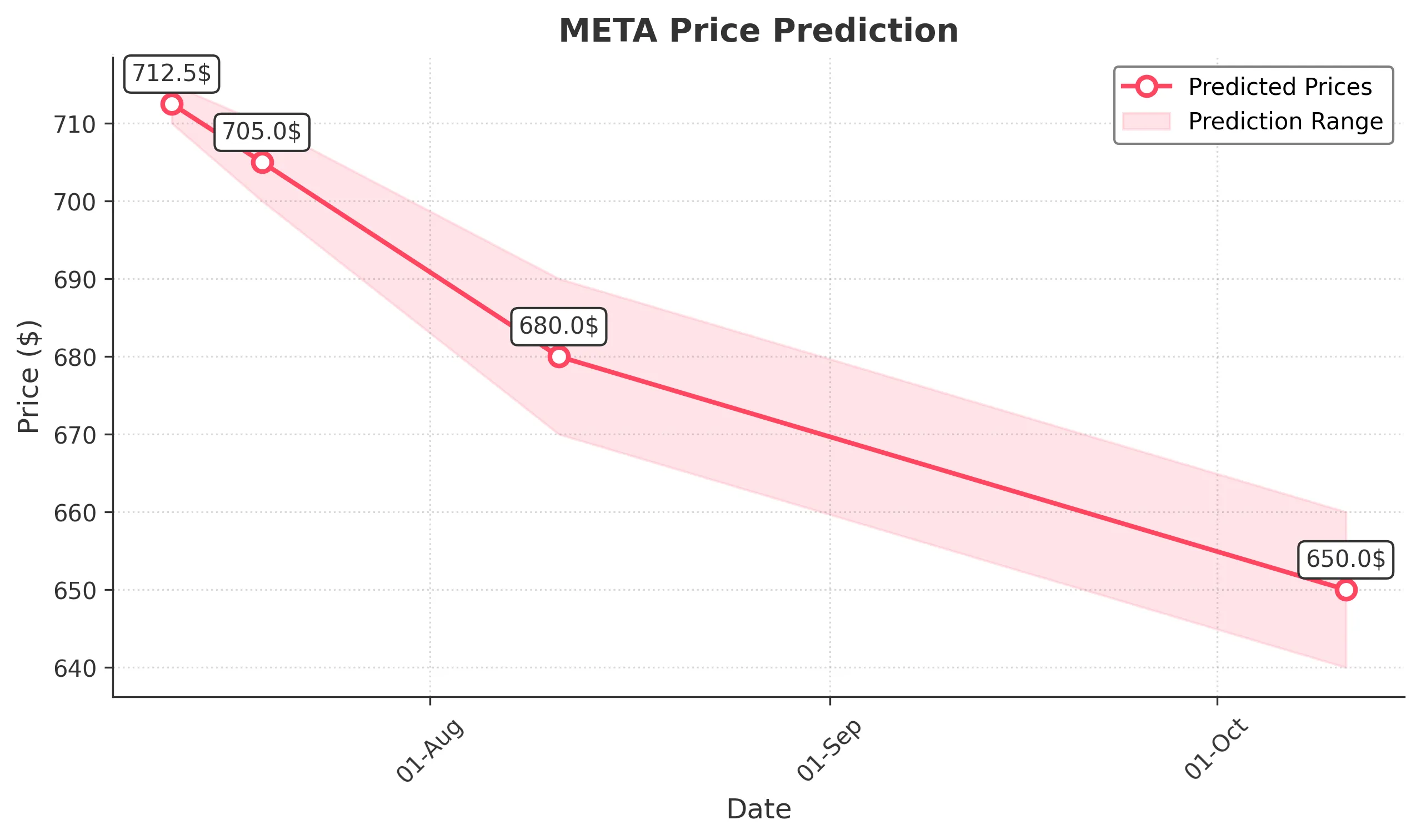

1 Month Prediction

Target: August 11, 2025$680

$685

$690

$670

Description

The bearish trend is expected to continue as the stock approaches significant support levels. The Bollinger Bands indicate potential for further downside. Anticipate a close around 680.00 as market sentiment remains cautious.

Analysis

META has shown a strong bullish trend but is now facing resistance and potential reversal signals. The stock is testing key support levels, and if broken, could lead to further declines. Watch for volume spikes that may indicate a change in trend.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements, affecting the prediction.

3 Months Prediction

Target: October 11, 2025$650

$655

$660

$640

Description

Long-term bearish outlook as the stock may continue to decline towards key support levels. Technical indicators suggest weakening momentum. Expect a close around 650.00 as market sentiment remains bearish.

Analysis

The overall trend has shifted from bullish to bearish, with significant resistance levels being tested. The stock's performance over the next three months will depend heavily on market conditions and external factors, including economic data releases.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could significantly alter the stock's trajectory.