META Trading Predictions

1 Day Prediction

Target: July 17, 2025$705

$710

$710

$700

Description

The stock shows signs of a potential pullback after recent highs. RSI indicates overbought conditions, and a bearish candlestick pattern was observed. Expect a slight decline in price with lower volume as traders take profits.

Analysis

META has shown a bullish trend over the past three months, reaching new highs. However, recent price action suggests a potential reversal. Key support at 700.00 and resistance at 740.00. Volume has been decreasing, indicating a possible slowdown.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 24, 2025$695

$700

$705

$690

Description

The bearish momentum may continue as the stock approaches key support levels. MACD shows a bearish crossover, and the ATR indicates increasing volatility. Expect a gradual decline as profit-taking continues.

Analysis

The stock has been in a bullish phase but is now showing signs of weakness. Key support at 690.00 is critical. Technical indicators suggest a potential downward trend, with volume patterns indicating profit-taking behavior.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to sudden price changes.

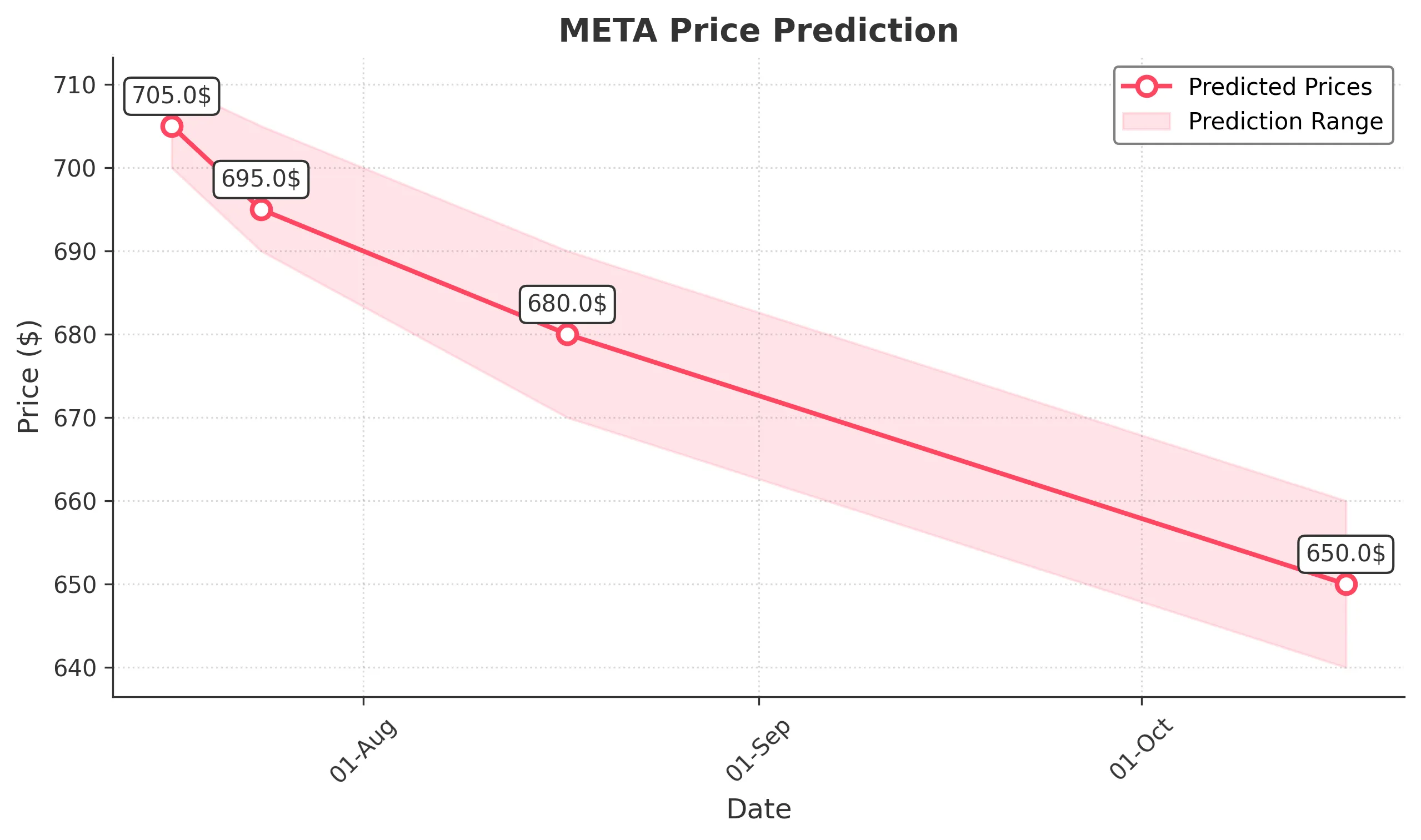

1 Month Prediction

Target: August 17, 2025$680

$685

$690

$670

Description

Continued bearish sentiment may drive the price lower. The stock is likely to test support at 670.00. RSI remains in a bearish divergence, indicating potential further declines.

Analysis

META's performance has been strong, but recent price action suggests a correction. The stock is approaching significant support levels, and technical indicators indicate a bearish outlook. Volume patterns show a decrease, suggesting weakening interest.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive news could reverse the trend.

3 Months Prediction

Target: October 17, 2025$650

$655

$660

$640

Description

If bearish trends persist, the stock may continue to decline towards 650.00. Market sentiment is cautious, and external economic factors could weigh heavily on performance.

Analysis

The stock has shown a strong upward trend but is now facing resistance. Key support at 640.00 is critical. Technical indicators suggest a bearish outlook, and external economic factors could further impact performance.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic changes.