META Trading Predictions

1 Day Prediction

Target: July 25, 2025$715

$715.5

$720

$710

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 715.00.

Analysis

Over the past 3 months, META has shown a bullish trend with significant highs. However, recent price action indicates a potential reversal with lower highs and increased selling pressure. Key support at 700.00.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 1, 2025$710

$712

$715

$705

Description

The bearish trend may continue into next week as the stock struggles to maintain upward momentum. MACD shows a bearish crossover, and volume patterns suggest a lack of buying interest.

Analysis

The stock has been in a consolidation phase with resistance around 720.00. Recent candlestick patterns indicate indecision, and the overall market sentiment is cautious.

Confidence Level

Potential Risks

Unexpected market news or earnings reports could lead to volatility.

1 Month Prediction

Target: August 24, 2025$700

$705

$710

$690

Description

Expect further declines as the stock approaches key support levels. The RSI is trending downwards, indicating potential weakness. A close around 700.00 is likely as selling pressure increases.

Analysis

META has experienced a strong rally but is now facing resistance. The stock's performance is influenced by broader market trends and investor sentiment, which appear cautious.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and macroeconomic factors may influence the stock's performance.

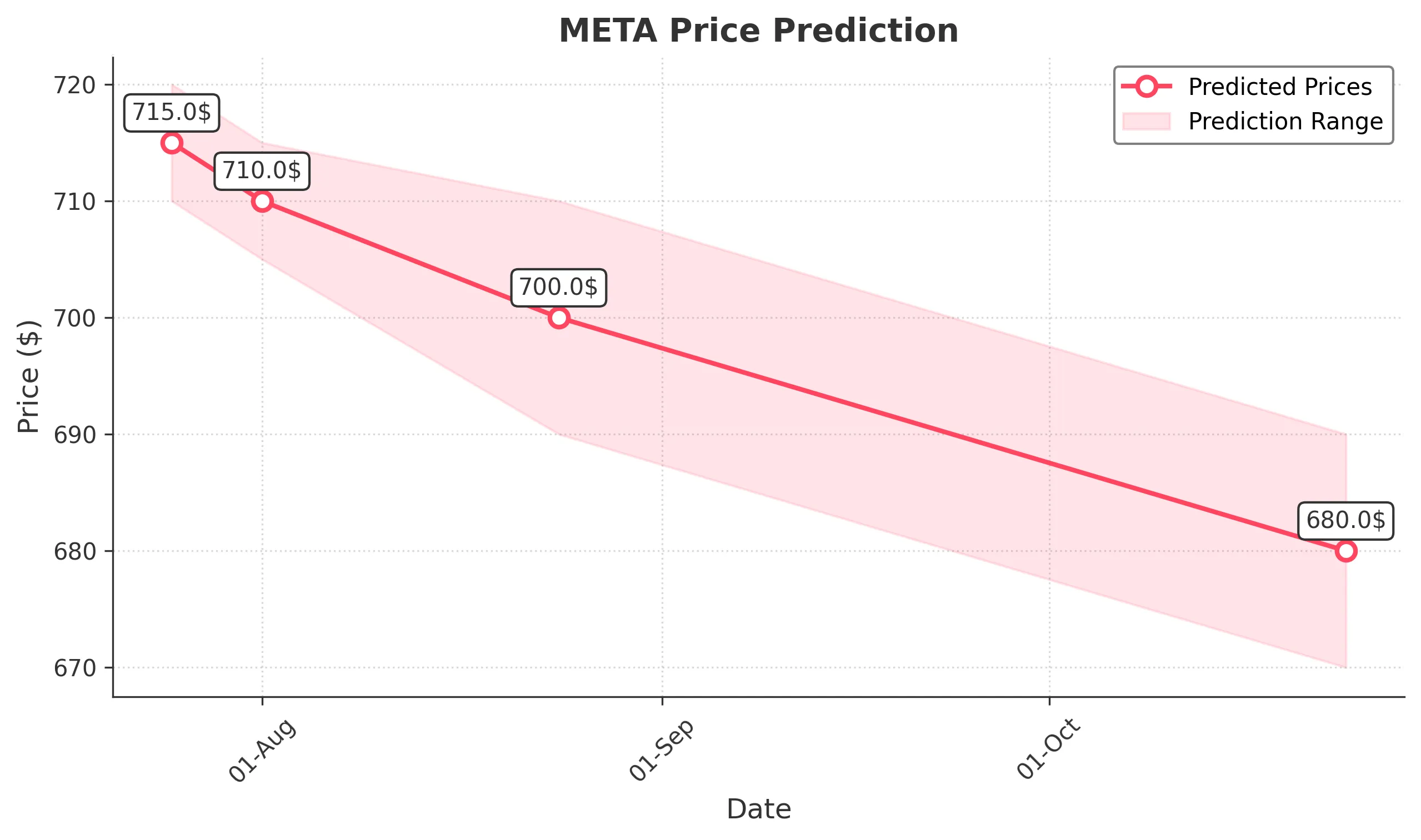

3 Months Prediction

Target: October 24, 2025$680

$685

$690

$670

Description

Long-term bearish sentiment may prevail as the stock approaches critical support levels. The overall trend suggests a potential decline, with macroeconomic factors playing a significant role.

Analysis

The stock has shown signs of weakness with lower highs and increased selling pressure. Key support at 670.00 is critical, and a break below this level could lead to further declines.

Confidence Level

Potential Risks

Unforeseen market events or changes in investor sentiment could lead to volatility.