META Trading Predictions

1 Day Prediction

Target: July 29, 2025$720

$718

$725

$715

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is around 55, suggesting room for upward movement. However, MACD is flattening, indicating potential resistance ahead.

Analysis

Over the past 3 months, META has shown a bullish trend with significant upward momentum, reaching a peak of 738.09. Key support is at 700, while resistance is around 725. Volume has been consistent, but recent spikes indicate potential profit-taking.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if the price fails to break above recent highs.

1 Week Prediction

Target: August 5, 2025$725

$720

$730

$710

Description

The stock is expected to consolidate around current levels. The Bollinger Bands are tightening, indicating reduced volatility. A potential breakout could occur if the price holds above 720, but bearish divergence in RSI raises concerns.

Analysis

META has been in a bullish phase, but recent price action shows signs of consolidation. The stock has tested resistance levels multiple times, and while the overall trend remains positive, caution is warranted due to potential overbought conditions.

Confidence Level

Potential Risks

If the market sentiment shifts negatively, a pullback could occur, especially if volume decreases. Watch for external economic news that may influence investor behavior.

1 Month Prediction

Target: August 28, 2025$740

$730

$750

$705

Description

Expect a gradual increase as the stock approaches key Fibonacci retracement levels. The MACD is bullish, and the RSI is stabilizing, suggesting a continuation of the upward trend. However, watch for potential resistance at 750.

Analysis

The stock has shown strong performance, with a clear upward trajectory. Key support is at 700, while resistance at 750 could pose challenges. Volume trends indicate healthy buying interest, but external factors may influence future performance.

Confidence Level

Potential Risks

Economic indicators and earnings reports could introduce volatility. A failure to maintain momentum could lead to a correction.

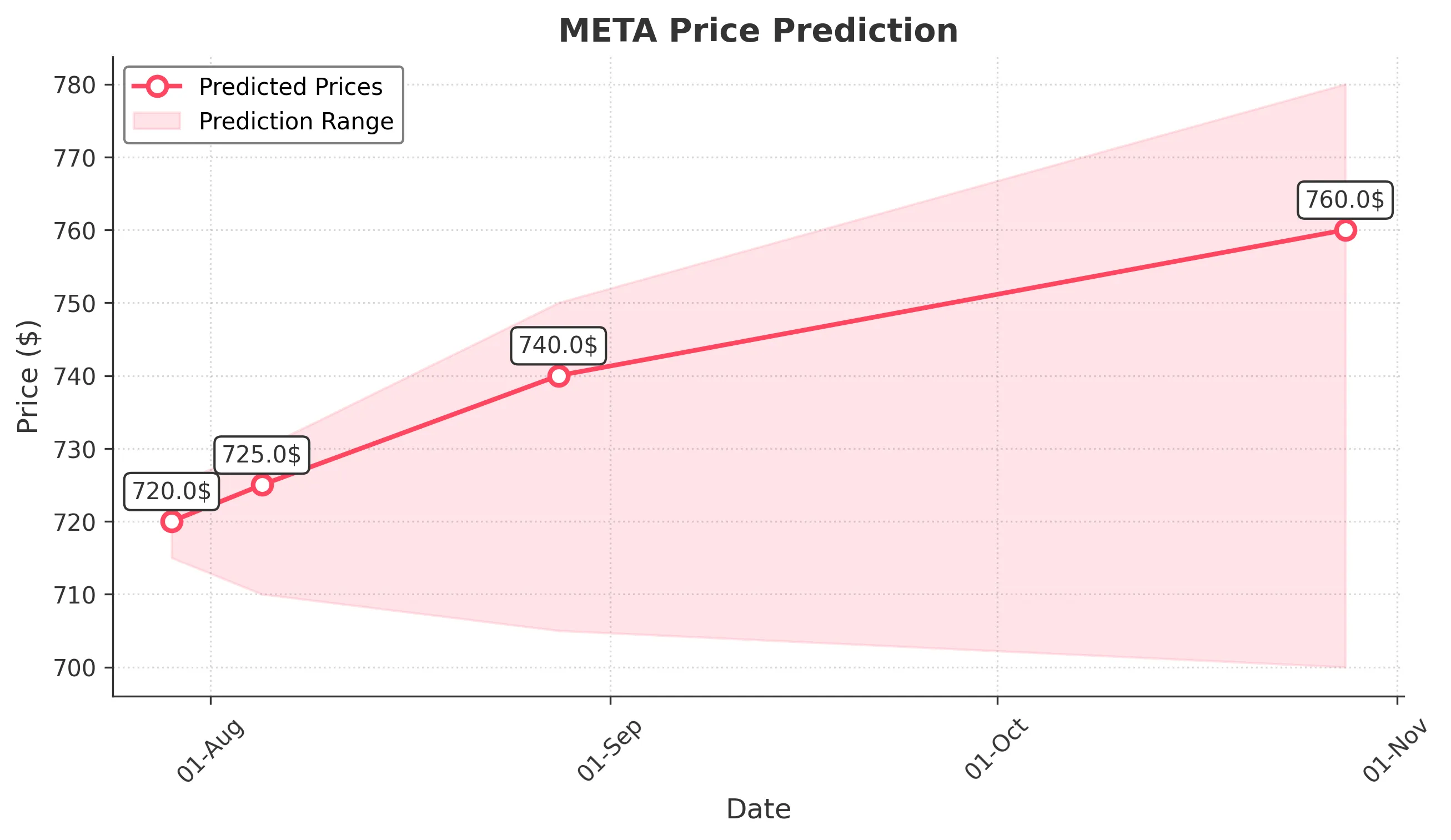

3 Months Prediction

Target: October 28, 2025$760

$750

$780

$700

Description

Long-term bullish sentiment is supported by strong fundamentals and technical indicators. The stock is likely to test higher resistance levels, but potential market corrections could lead to volatility.

Analysis

META has maintained a bullish trend over the past three months, with significant price appreciation. Key support is at 700, while resistance levels are being tested. The overall market sentiment remains positive, but external economic conditions could introduce risks.

Confidence Level

Potential Risks

Macroeconomic factors, including interest rates and inflation, could impact stock performance. A significant market downturn could reverse the bullish trend.