META Trading Predictions

1 Day Prediction

Target: July 31, 2025$705

$703

$712

$698

Description

The stock shows a slight bullish trend with a potential close around 705. The RSI indicates neutrality, while MACD suggests a possible upward momentum. However, recent volatility and market sentiment could lead to fluctuations.

Analysis

Over the past 3 months, META has shown a bullish trend with significant resistance around 720. The recent price action indicates a potential pullback, with support at 700. Volume has been decreasing, suggesting a lack of strong buying interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: August 7, 2025$710

$705

$720

$695

Description

Predicted close at 710 reflects a cautious bullish outlook. The MACD is showing a potential crossover, while the RSI is nearing overbought territory. Watch for resistance at 720, which may limit upside potential.

Analysis

The stock has been trading sideways with a slight upward bias. Key resistance at 720 and support at 700 are critical levels. The ATR indicates increasing volatility, which could lead to sharp price movements.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts or if negative news emerges.

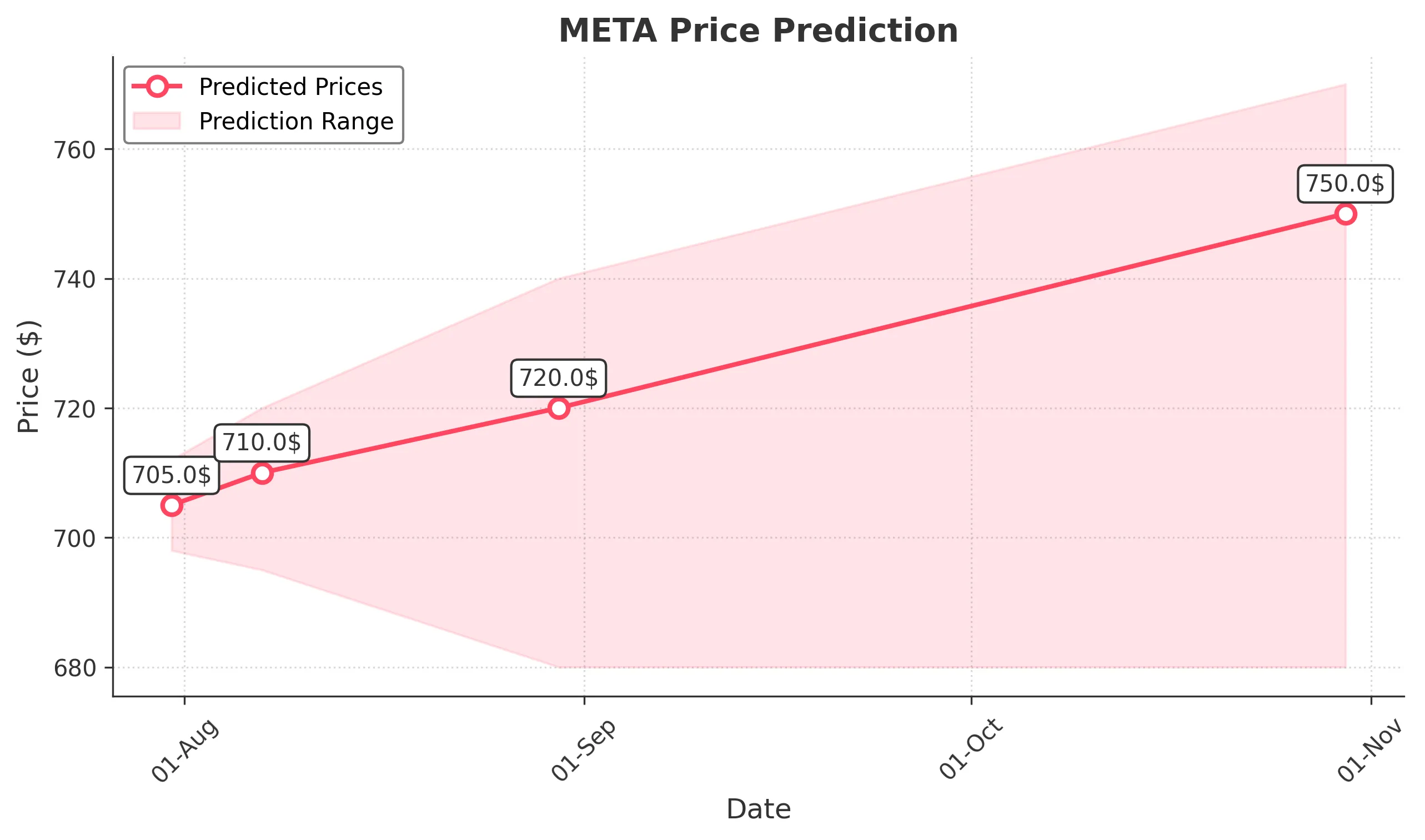

1 Month Prediction

Target: August 30, 2025$720

$710

$740

$680

Description

The forecasted close of 720 suggests a bullish trend continuation. The Fibonacci retracement levels indicate strong support at 700, while the MACD remains positive. However, watch for potential bearish divergence in RSI.

Analysis

META has shown resilience with a bullish trend. Key support at 700 and resistance at 740 are pivotal. Volume patterns indicate healthy buying interest, but external economic factors could influence future performance.

Confidence Level

Potential Risks

Economic indicators and earnings reports could introduce volatility.

3 Months Prediction

Target: October 30, 2025$750

$740

$770

$680

Description

The long-term outlook suggests a bullish trend with a close around 750. The MACD indicates sustained upward momentum, while the RSI is approaching overbought levels. Market sentiment remains positive, but caution is advised.

Analysis

META's performance has been strong, with a bullish trend supported by increasing volume. Resistance at 770 and support at 680 are critical. The overall market sentiment is positive, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market corrections and macroeconomic factors could lead to unexpected price movements.