META Trading Predictions

1 Day Prediction

Target: August 14, 2025$790.5

$788

$795

$785

Description

The stock shows bullish momentum with a recent close above the 50-day moving average. RSI is near 70, indicating overbought conditions, but MACD remains positive. Expect slight profit-taking, but overall bullish sentiment persists.

Analysis

META has shown a strong upward trend over the past three months, with significant support at $760 and resistance around $800. Recent volume spikes indicate strong buying interest. However, the overbought RSI suggests caution.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI levels and profit-taking pressure.

1 Week Prediction

Target: August 21, 2025$795

$790

$805

$780

Description

Continued bullish momentum is expected as the stock remains above key moving averages. The MACD indicates a strong trend, but RSI is still high, suggesting potential volatility. Watch for resistance at $800.

Analysis

The stock has maintained a bullish trend, with strong support at $760. Recent candlestick patterns show bullish engulfing formations, indicating continued buying pressure. However, external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment could shift quickly, especially if macroeconomic news impacts tech stocks.

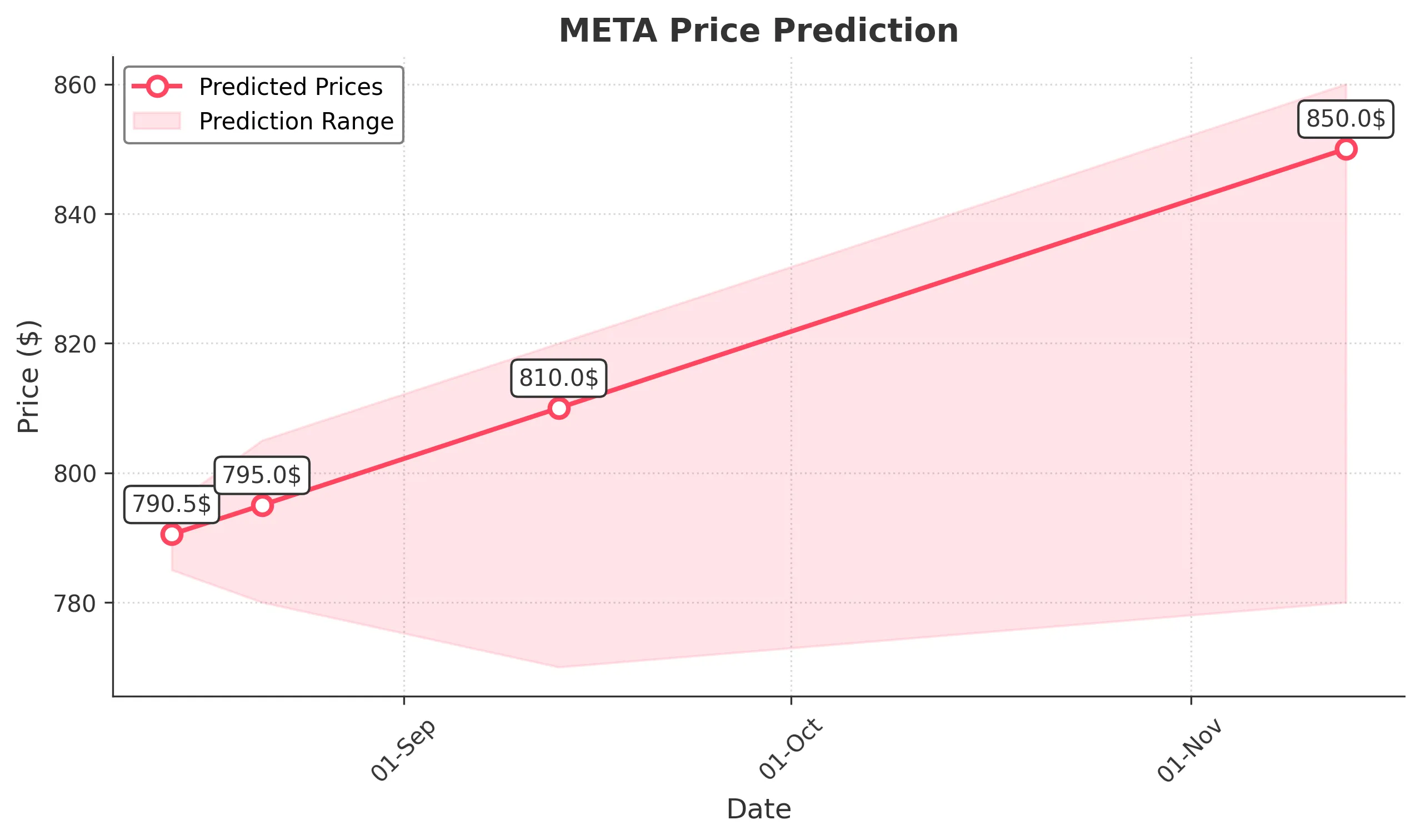

1 Month Prediction

Target: September 13, 2025$810

$795

$820

$770

Description

The stock is expected to continue its upward trajectory, supported by strong fundamentals and positive market sentiment. However, the high RSI indicates potential corrections. Watch for resistance at $820.

Analysis

META has shown resilience with a bullish trend, but the high RSI suggests overbought conditions. Key support at $760 remains intact, while resistance at $820 could pose challenges. Volume patterns indicate strong interest.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could impact the stock's performance.

3 Months Prediction

Target: November 13, 2025$850

$820

$860

$780

Description

Long-term bullish outlook as the stock is expected to break through resistance levels. Continued strong earnings and market sentiment support this prediction, but watch for potential corrections.

Analysis

Over the past three months, META has shown a strong bullish trend, with significant support at $760 and resistance at $820. The stock's performance is influenced by macroeconomic factors, and while bullish, caution is advised due to potential volatility.

Confidence Level

Potential Risks

Market volatility and economic conditions could lead to unexpected downturns.