MSFT Trading Predictions

1 Day Prediction

Target: April 9, 2025$371.5

$370

$374

$368

Description

The stock shows a slight bullish trend with a potential bounce from recent lows. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, MSFT has experienced significant volatility, with a bearish trend recently. Key support at $359.84 and resistance at $382.14. Volume spikes indicate potential reversals, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: April 16, 2025$375

$372

$380

$365

Description

Expect a gradual recovery as the stock may find support around $365. The RSI is improving, and MACD shows potential bullish momentum. However, external factors could still lead to fluctuations.

Analysis

The stock has been in a bearish phase, with recent lows indicating a need for a correction. Key resistance at $382.14 and support at $359.84. Volume analysis shows increased activity, suggesting traders are positioning for a rebound.

Confidence Level

Potential Risks

Uncertainty in the broader market and potential earnings surprises could lead to unexpected price movements.

1 Month Prediction

Target: May 8, 2025$385

$375

$390

$370

Description

A bullish trend is anticipated as the stock may recover towards $385. Positive divergence in RSI and MACD supports this outlook, but caution is advised due to potential market corrections.

Analysis

MSFT has shown a bearish trend recently, but signs of recovery are emerging. Key support at $359.84 and resistance at $382.14. Volume patterns indicate increased interest, suggesting a potential upward move if market conditions stabilize.

Confidence Level

Potential Risks

Market volatility and economic indicators could impact the stock's recovery trajectory.

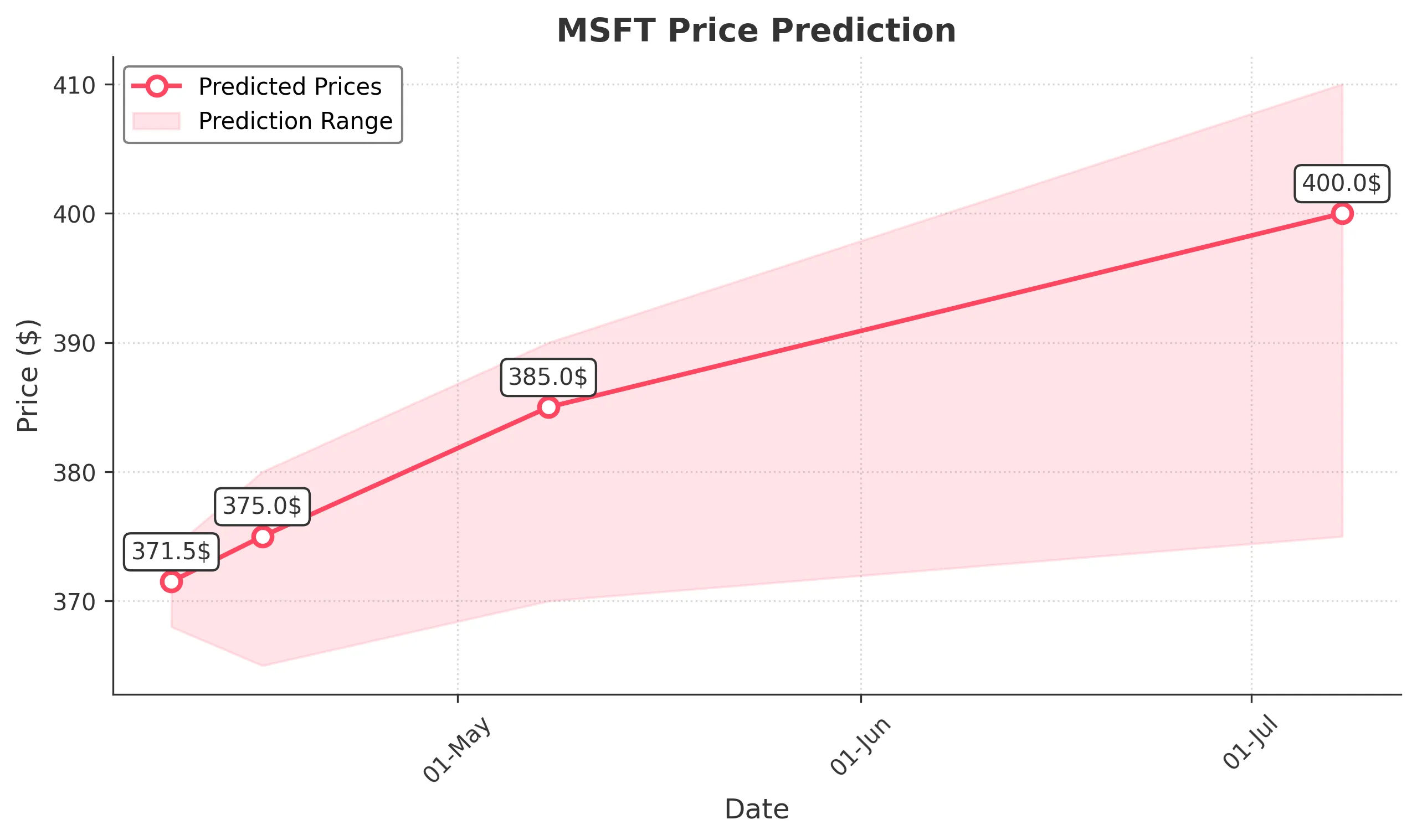

3 Months Prediction

Target: July 8, 2025$400

$385

$410

$375

Description

Long-term outlook suggests a recovery towards $400, supported by improving fundamentals and technical indicators. However, macroeconomic factors could introduce volatility.

Analysis

The stock has faced significant volatility, with a bearish trend recently. Key support at $359.84 and resistance at $382.14. The overall market sentiment is cautious, but if conditions improve, a recovery towards $400 is plausible.

Confidence Level

Potential Risks

Potential economic downturns or changes in market sentiment could hinder growth.