MSFT Trading Predictions

1 Day Prediction

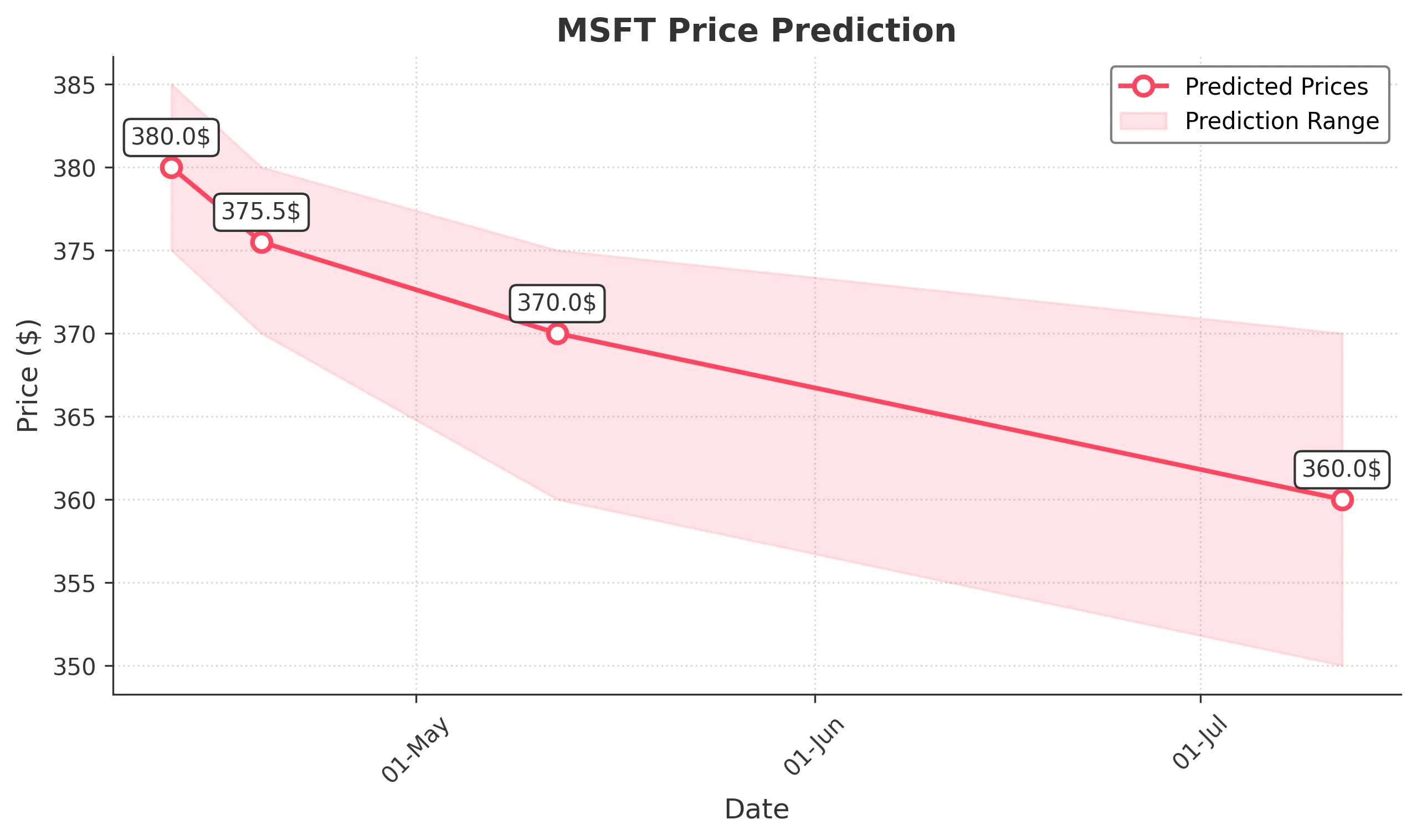

Target: April 12, 2025$380

$378

$385

$375

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, but MACD is bearish. Expect a minor recovery, but volatility remains high due to recent volume spikes.

Analysis

Over the past 3 months, MSFT has shown a bearish trend with significant support around $375. Recent volume spikes indicate increased selling pressure. Technical indicators suggest potential for a short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment is uncertain, and any negative news could lead to further declines.

1 Week Prediction

Target: April 19, 2025$375.5

$378

$380

$370

Description

The stock is expected to stabilize around current levels. Support at $375 is strong, but bearish momentum persists. Watch for potential reversal patterns in the coming days.

Analysis

MSFT has faced downward pressure with significant resistance at $385. The ATR indicates high volatility, and recent candlestick patterns suggest indecision. A cautious approach is warranted as external factors may influence price movements.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could impact recovery.

1 Month Prediction

Target: May 12, 2025$370

$373

$375

$360

Description

Expect continued bearish pressure with potential for further declines. Key support at $360 may hold, but overall market sentiment is weak.

Analysis

The stock has been in a bearish phase, with significant resistance at $380. Volume analysis shows increased selling. Technical indicators suggest a lack of bullish momentum, and external economic factors may further impact performance.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could exacerbate downward trends.

3 Months Prediction

Target: July 12, 2025$360

$365

$370

$350

Description

Long-term outlook remains bearish with potential for further declines. Key support at $350 is critical. Watch for any signs of reversal.

Analysis

MSFT has shown a consistent bearish trend over the past months. Key support levels are being tested, and technical indicators suggest a lack of bullish momentum. External economic factors and market sentiment will play a crucial role in future performance.

Confidence Level

Potential Risks

Market volatility and economic conditions could lead to unexpected price movements.