MSFT Trading Predictions

1 Day Prediction

Target: April 18, 2025$370

$371

$372

$368

Description

The stock shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, but MACD is bearish. Expect a slight recovery, but resistance at 372 may limit gains.

Analysis

MSFT has been in a bearish trend over the past three months, with significant support around 370. Recent volume spikes indicate selling pressure. Technical indicators suggest potential for a short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish reversal is possible.

1 Week Prediction

Target: April 25, 2025$375

$370

$378

$368

Description

A potential recovery is anticipated as the stock approaches key support levels. However, resistance at 378 may hinder upward movement. Watch for volume trends to confirm direction.

Analysis

The stock has shown signs of consolidation around 370, with key support levels holding. Technical indicators suggest a possible rebound, but bearish sentiment persists. Volume analysis indicates cautious trading behavior.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility, impacting the accuracy of this prediction.

1 Month Prediction

Target: May 17, 2025$380

$375

$385

$370

Description

Expect gradual recovery as the stock stabilizes. Key resistance at 385 may limit gains, but bullish divergence in RSI suggests potential for upward movement.

Analysis

Over the past month, MSFT has shown signs of stabilization after a bearish trend. Key support at 370 is critical, while resistance at 385 remains a challenge. Technical indicators suggest a cautious bullish outlook.

Confidence Level

Potential Risks

Market sentiment and external factors could lead to unexpected price movements, particularly if earnings reports are disappointing.

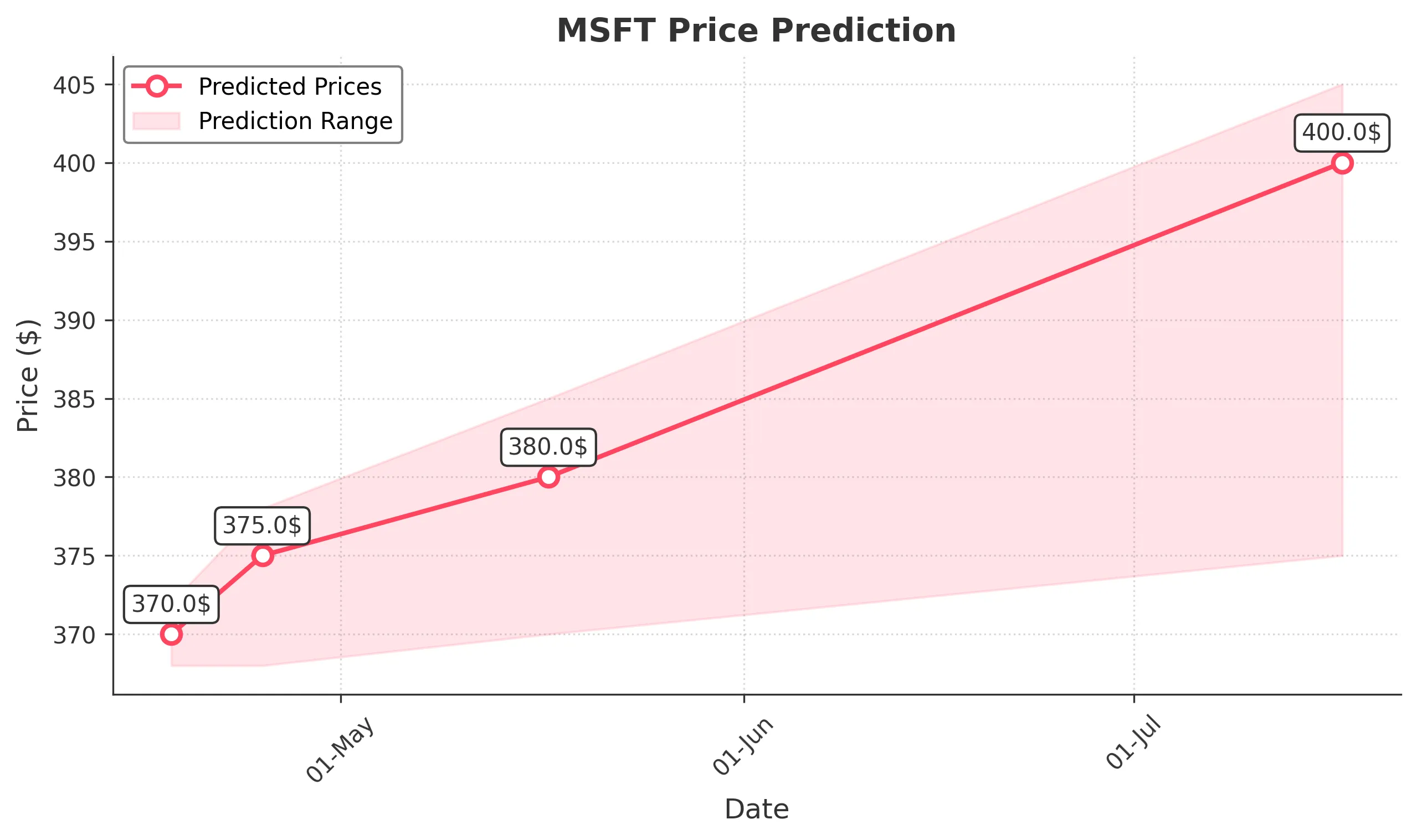

3 Months Prediction

Target: July 17, 2025$400

$385

$405

$375

Description

Long-term recovery is expected as market sentiment improves. Key resistance at 405 may be tested, with potential for bullish momentum if earnings exceed expectations.

Analysis

MSFT's performance over the last three months has been characterized by volatility and bearish trends. However, signs of recovery are emerging, with key support levels holding. Technical indicators suggest a potential bullish reversal if market conditions stabilize.

Confidence Level

Potential Risks

Macroeconomic conditions and competitive pressures could impact performance, leading to potential volatility.