MSFT Trading Predictions

1 Day Prediction

Target: May 1, 2025$386.5

$387

$389

$384

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, resistance at 390 may limit upside. Volume is expected to be moderate as traders react to earnings reports.

Analysis

MSFT has been in a bearish trend over the past month, with significant support around 380. Technical indicators like MACD are showing bearish momentum. Volume spikes on down days indicate selling pressure. Market sentiment is cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and earnings announcements could lead to unexpected price movements.

1 Week Prediction

Target: May 8, 2025$384

$386

$388

$380

Description

The bearish trend is expected to continue, with potential support at 380. The MACD remains negative, and RSI suggests further downside. Volume may increase as traders react to broader market trends.

Analysis

Over the past three months, MSFT has shown a bearish trend with key resistance at 390. The stock has been trading below its moving averages, indicating weakness. Volume analysis shows increased selling pressure, and macroeconomic concerns may weigh on performance.

Confidence Level

Potential Risks

Unforeseen news or earnings surprises could impact the stock's performance significantly.

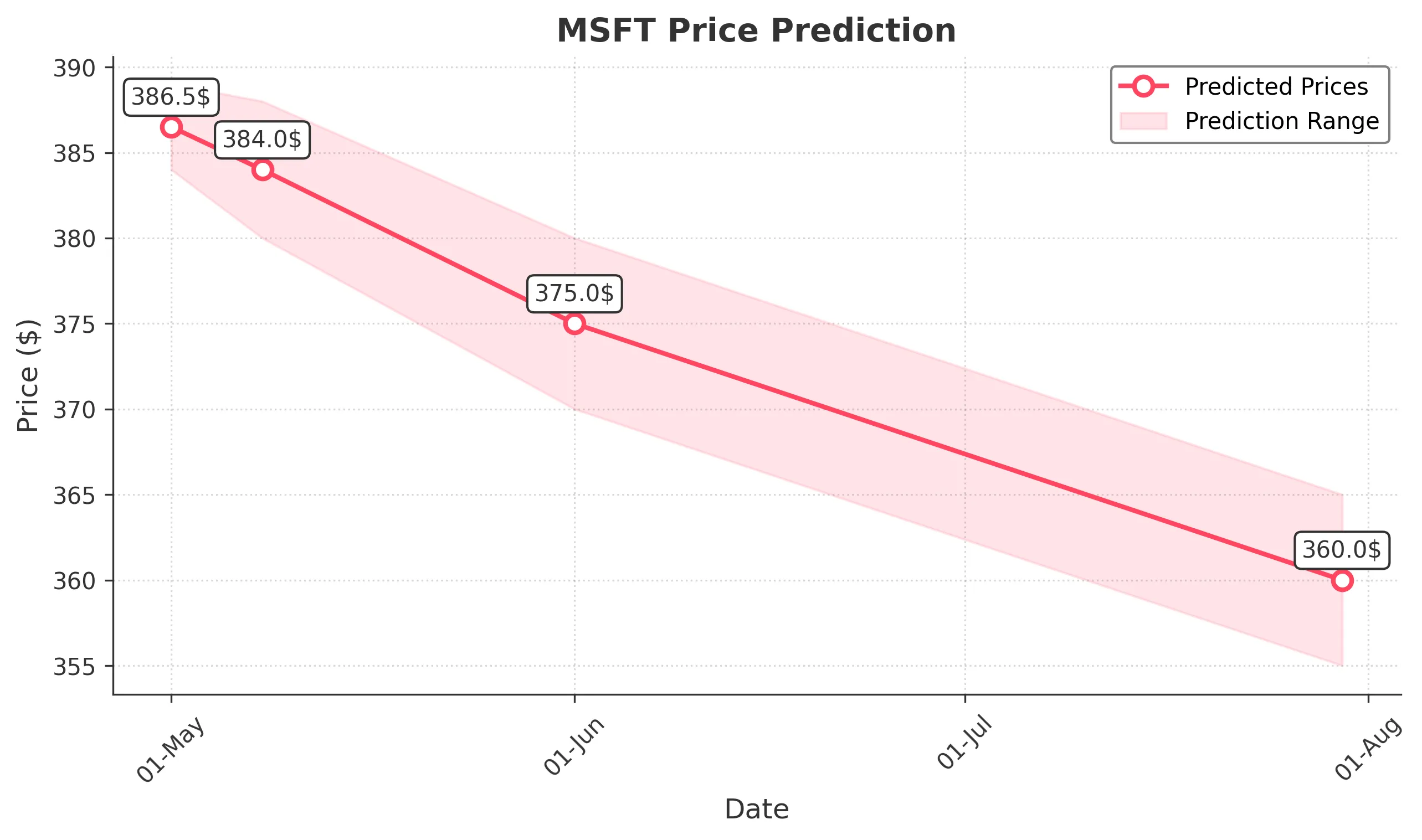

1 Month Prediction

Target: June 1, 2025$375

$378

$380

$370

Description

Continued bearish sentiment is expected, with potential for further declines. The stock may test support at 370. Technical indicators suggest a lack of bullish momentum, and market sentiment remains cautious.

Analysis

MSFT's performance has been characterized by a bearish trend, with significant resistance at 390. The stock is trading below key moving averages, and volume patterns indicate selling pressure. Macroeconomic factors and market sentiment are likely to influence future performance.

Confidence Level

Potential Risks

Market conditions and external economic factors could lead to volatility and unexpected price movements.

3 Months Prediction

Target: July 30, 2025$360

$362

$365

$355

Description

The bearish trend may persist, with potential for further declines as the stock approaches key support levels. Technical indicators suggest continued weakness, and external economic factors could exacerbate selling pressure.

Analysis

MSFT has been in a bearish phase, with significant resistance at 390 and support around 370. The stock's performance has been influenced by macroeconomic factors, and technical indicators suggest a lack of bullish momentum. Volume patterns indicate selling pressure, and market sentiment remains cautious.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market reversals and economic developments.