MSFT Trading Predictions

1 Day Prediction

Target: June 19, 2025$477.5

$476.5

$480

$475

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing bullish. Expect a minor pullback but overall stability in the price.

Analysis

Over the past 3 months, MSFT has shown a bullish trend with significant support at $475. Recent volume spikes indicate strong buying interest. However, the stock has faced resistance around $480, suggesting potential consolidation.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: June 26, 2025$480

$478

$485

$475

Description

With the MACD showing bullish momentum and RSI nearing overbought territory, expect a push towards $480. However, resistance at $485 may limit gains. Watch for volume trends for confirmation.

Analysis

MSFT has maintained a bullish trend with strong support at $475. The recent price action suggests a continuation towards $480, but overbought conditions may lead to a pullback. Volume remains healthy, indicating investor interest.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend.

1 Month Prediction

Target: July 19, 2025$490

$482

$495

$475

Description

Expect a bullish trend to continue as the stock approaches $490, driven by strong earnings and positive market sentiment. Watch for potential resistance at $495, which could trigger profit-taking.

Analysis

The stock has shown a strong upward trajectory with key support at $475. Technical indicators suggest continued bullish momentum, but external economic factors could impact performance. Resistance at $495 is a critical level to monitor.

Confidence Level

Potential Risks

Economic indicators and earnings reports could introduce volatility.

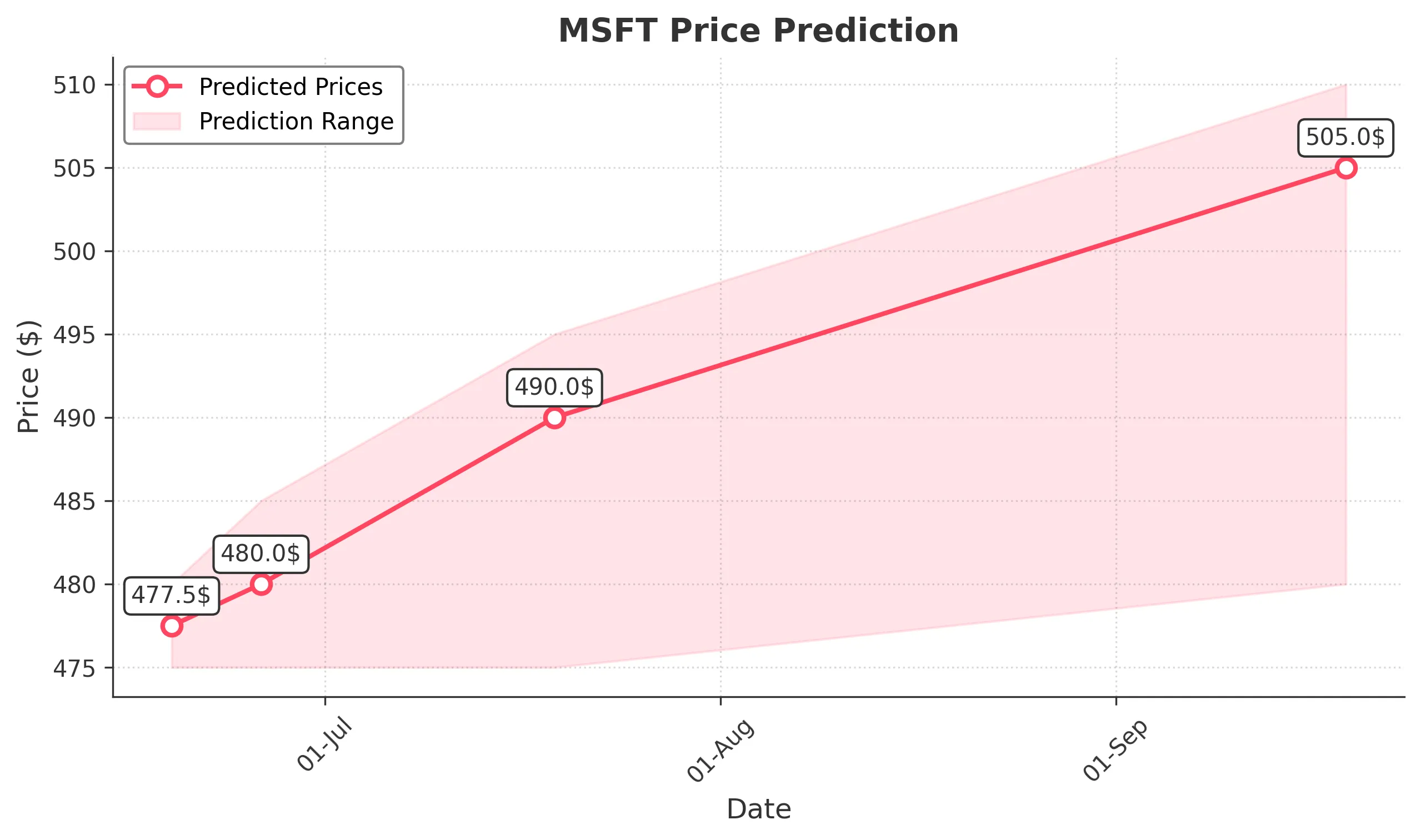

3 Months Prediction

Target: September 19, 2025$505

$490

$510

$480

Description

Long-term bullish sentiment supported by strong fundamentals and market trends. Anticipate a gradual rise towards $505, with potential volatility around earnings announcements.

Analysis

MSFT has shown resilience with a bullish trend over the past three months. Key support at $480 and resistance at $510 will be crucial. The stock's performance will depend on broader market conditions and economic indicators.

Confidence Level

Potential Risks

Market corrections and geopolitical events could affect the stock's trajectory.