MSFT Trading Predictions

1 Day Prediction

Target: July 24, 2025$505

$504

$508

$502

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates overbought conditions, suggesting a potential pullback. Volume has decreased, indicating weakening momentum. Expect a close around 505.0.

Analysis

Over the past 3 months, MSFT has shown a bullish trend with significant upward movement. Key resistance at 514.64 and support around 502.25. Recent candlestick patterns indicate potential reversal signals. Volume has been inconsistent, suggesting caution.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could push prices higher.

1 Week Prediction

Target: July 31, 2025$510

$505

$515

$500

Description

Expect a slight recovery as the stock may bounce off support levels. However, bearish signals from the MACD and RSI suggest limited upside. Anticipate a close around 510.0.

Analysis

MSFT has been in a consolidation phase with key support at 502.25. The recent price action shows indecision, with mixed signals from technical indicators. Volume patterns indicate a lack of strong conviction in either direction.

Confidence Level

Potential Risks

Potential for market corrections or external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: August 31, 2025$520

$510

$530

$500

Description

If the bullish trend resumes, expect a gradual increase towards 520.0. However, watch for resistance at 530.0. Market sentiment may shift based on earnings reports and macroeconomic data.

Analysis

The stock has shown resilience with a bullish trend over the past months. Key resistance at 530.0 and support at 500.0. Technical indicators suggest potential upward momentum, but caution is warranted due to market volatility.

Confidence Level

Potential Risks

Earnings surprises or geopolitical events could significantly alter the stock's trajectory.

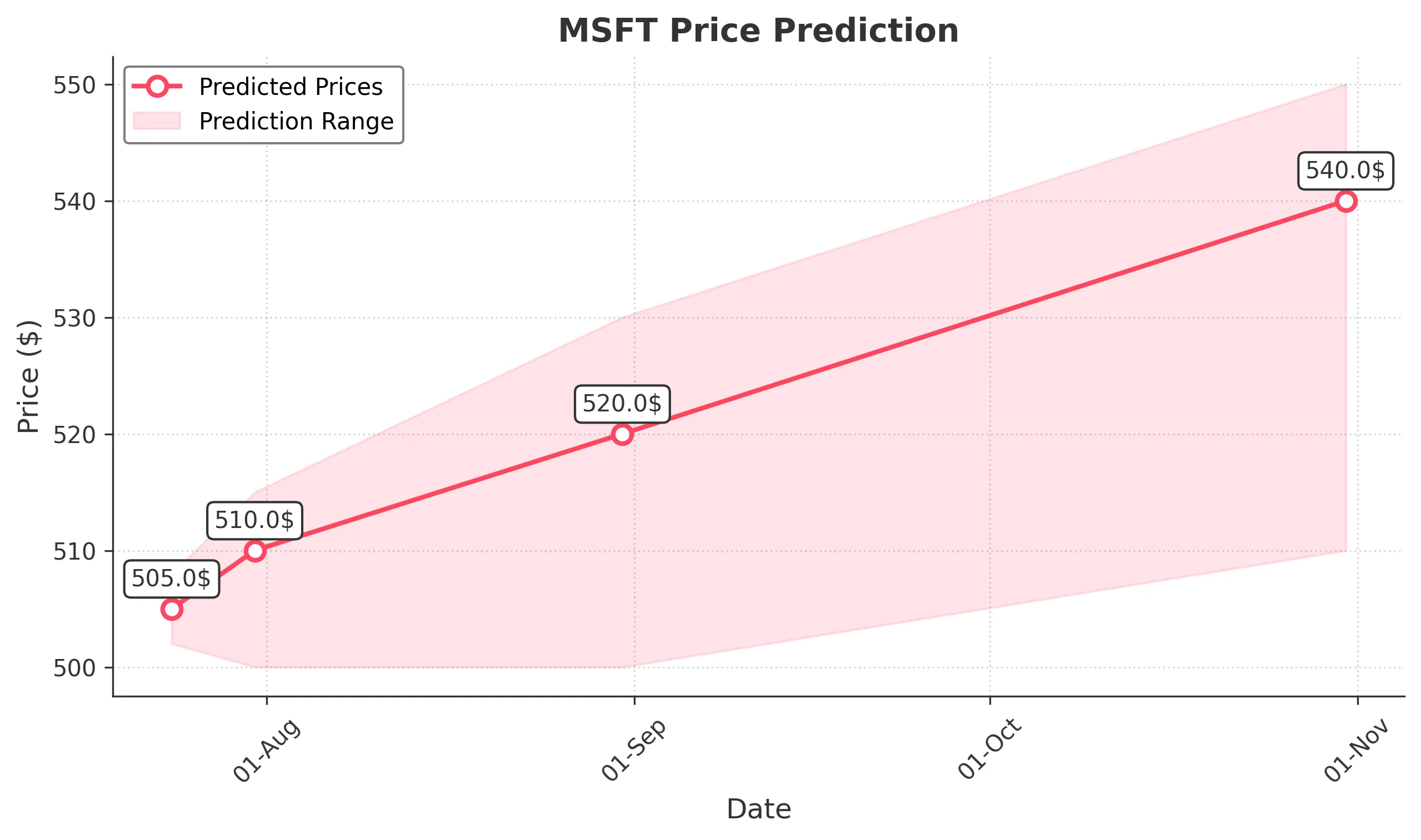

3 Months Prediction

Target: October 31, 2025$540

$520

$550

$510

Description

If the current bullish trend continues, expect a close around 540.0. However, macroeconomic factors and earnings results could lead to volatility. Watch for resistance at 550.0.

Analysis

MSFT has maintained a strong upward trajectory, but recent price action shows signs of potential exhaustion. Key support at 510.0 and resistance at 550.0. Technical indicators suggest a cautious approach as market sentiment may shift.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to potential market corrections and economic shifts.