MSFT Trading Predictions

1 Day Prediction

Target: August 12, 2025$520

$520.5

$523

$518

Description

The stock shows a slight bearish trend with recent lower highs and a Doji candlestick pattern indicating indecision. RSI is near 50, suggesting a potential pullback. Volume is decreasing, indicating weakening momentum.

Analysis

Over the past 3 months, MSFT has shown a bullish trend with significant upward movement, reaching a peak of 533.50. However, recent price action indicates a potential reversal with lower highs and increased volatility. Key support is around 510, while resistance is at 550. The RSI is neutral, and MACD shows a bearish crossover.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: August 19, 2025$518

$519

$522

$515

Description

The stock is expected to consolidate around current levels, with potential for a slight decline. The Bollinger Bands are tightening, indicating reduced volatility. A bearish engulfing pattern suggests caution.

Analysis

MSFT has experienced a strong rally but is now facing resistance. The recent price action shows signs of exhaustion, with the RSI approaching overbought levels. Volume has been inconsistent, and the ATR indicates increasing volatility, suggesting potential for both upward and downward movements.

Confidence Level

Potential Risks

Unforeseen market events or earnings surprises could lead to significant price movements contrary to the prediction.

1 Month Prediction

Target: September 12, 2025$525

$520

$530

$510

Description

Expect a gradual recovery as the stock finds support at 510. The Fibonacci retracement levels suggest a bounce back towards 525. The MACD is showing signs of bullish divergence.

Analysis

The stock has shown resilience despite recent volatility. Key support at 510 has held, and the overall trend remains bullish. The RSI is stabilizing, and the MACD indicates potential upward momentum. However, caution is warranted as external factors could influence performance.

Confidence Level

Potential Risks

Economic indicators or changes in market sentiment could impact the stock's recovery trajectory.

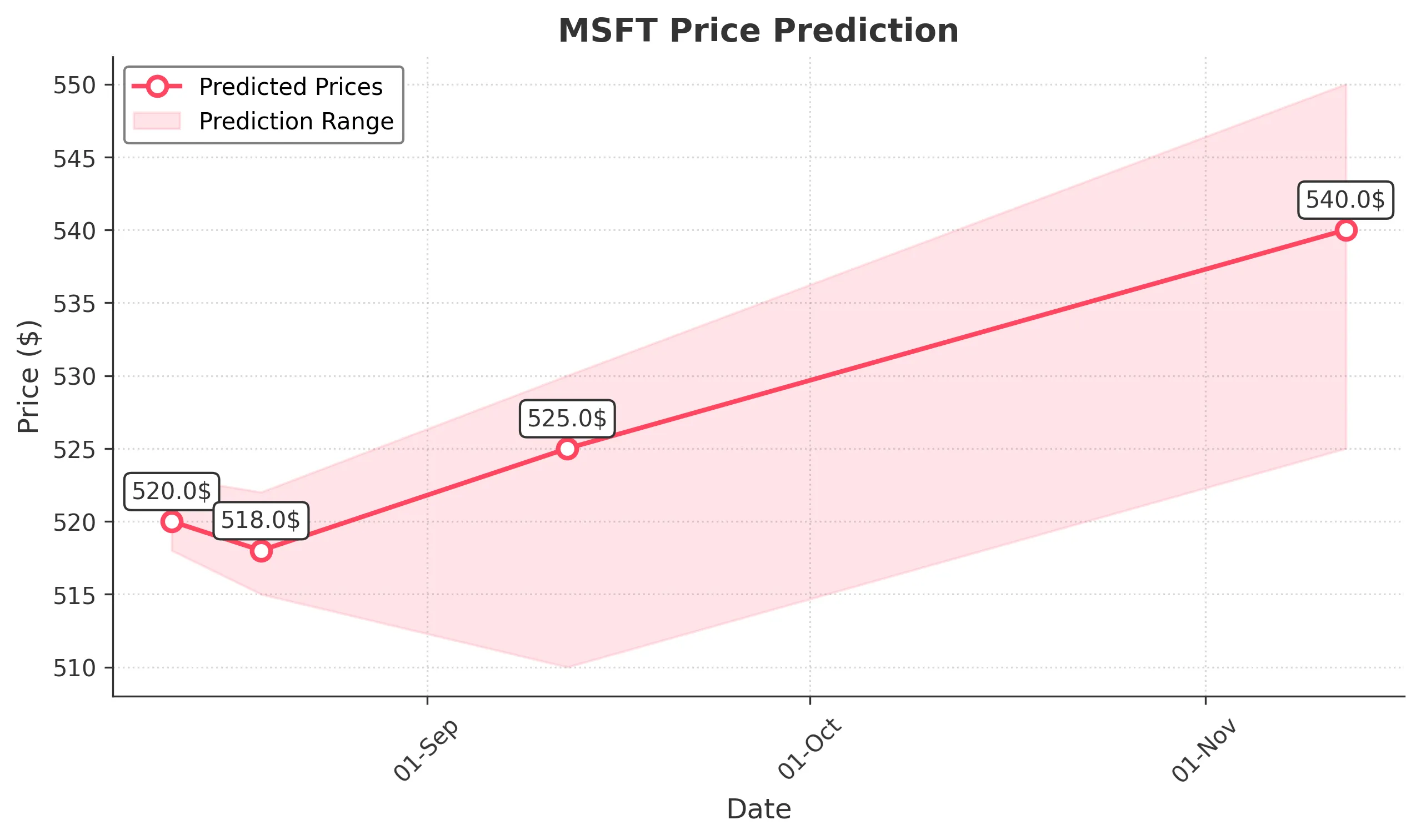

3 Months Prediction

Target: November 12, 2025$540

$530

$550

$525

Description

Long-term outlook remains positive with potential for growth as the market stabilizes. The stock may test resistance at 550, supported by strong fundamentals and positive market sentiment.

Analysis

MSFT has shown a strong upward trend over the past three months, with significant support at 510 and resistance at 550. The overall market sentiment is cautiously optimistic, but external economic factors could introduce volatility. The stock's fundamentals remain strong, supporting a bullish outlook.

Confidence Level

Potential Risks

Market volatility and economic conditions could lead to unexpected downturns, affecting the stock's performance.