MSFT Trading Predictions

1 Day Prediction

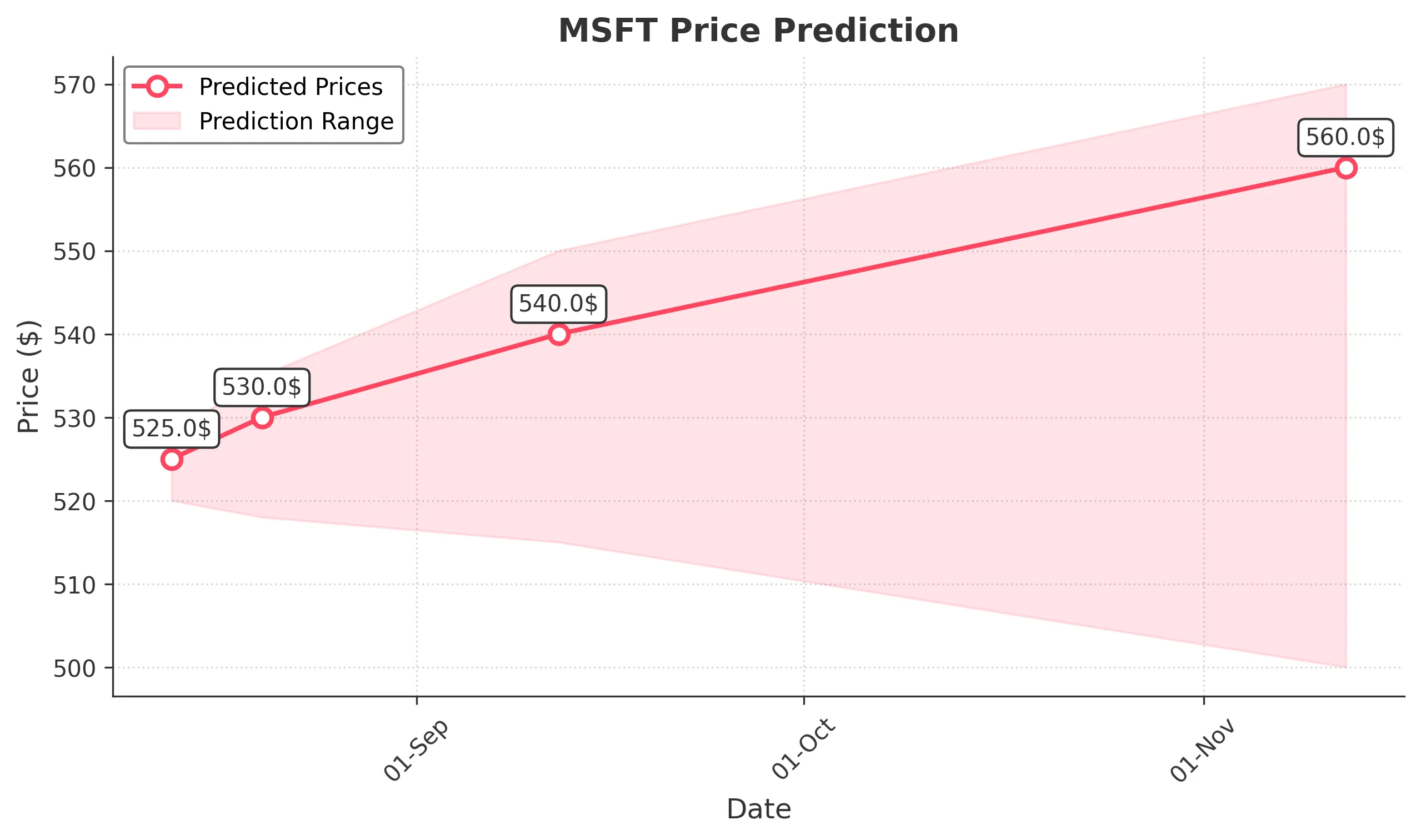

Target: August 13, 2025$525

$524

$528

$520

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing bullish. Expect a minor pullback but overall stability.

Analysis

Over the past 3 months, MSFT has shown a bullish trend with significant support at $520 and resistance around $550. Recent volume spikes suggest strong interest, but volatility remains a concern.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the price.

1 Week Prediction

Target: August 20, 2025$530

$525

$535

$518

Description

The stock is expected to rise as bullish momentum builds. The MACD indicates a potential upward trend, and the RSI is approaching overbought territory, suggesting caution.

Analysis

MSFT has maintained a bullish trend with key support at $520. The recent price action shows strong buying interest, but the RSI nearing overbought levels indicates a possible pullback.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend, impacting the forecast.

1 Month Prediction

Target: September 12, 2025$540

$530

$550

$515

Description

Continued bullish sentiment is expected, supported by strong earnings reports. However, the RSI indicates potential overbought conditions, suggesting a correction could occur.

Analysis

The stock has shown consistent upward movement with significant resistance at $550. Volume trends indicate strong investor interest, but caution is warranted as the market may react to external factors.

Confidence Level

Potential Risks

Economic indicators or geopolitical events could negatively impact market sentiment.

3 Months Prediction

Target: November 12, 2025$560

$550

$570

$500

Description

Long-term bullish outlook as the company continues to innovate and expand. However, potential market corrections and economic shifts could lead to volatility.

Analysis

MSFT has shown a strong bullish trend with key support at $500 and resistance at $570. The overall market sentiment remains positive, but external factors could introduce volatility.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings misses could lead to significant price adjustments.