NFLX Trading Predictions

1 Day Prediction

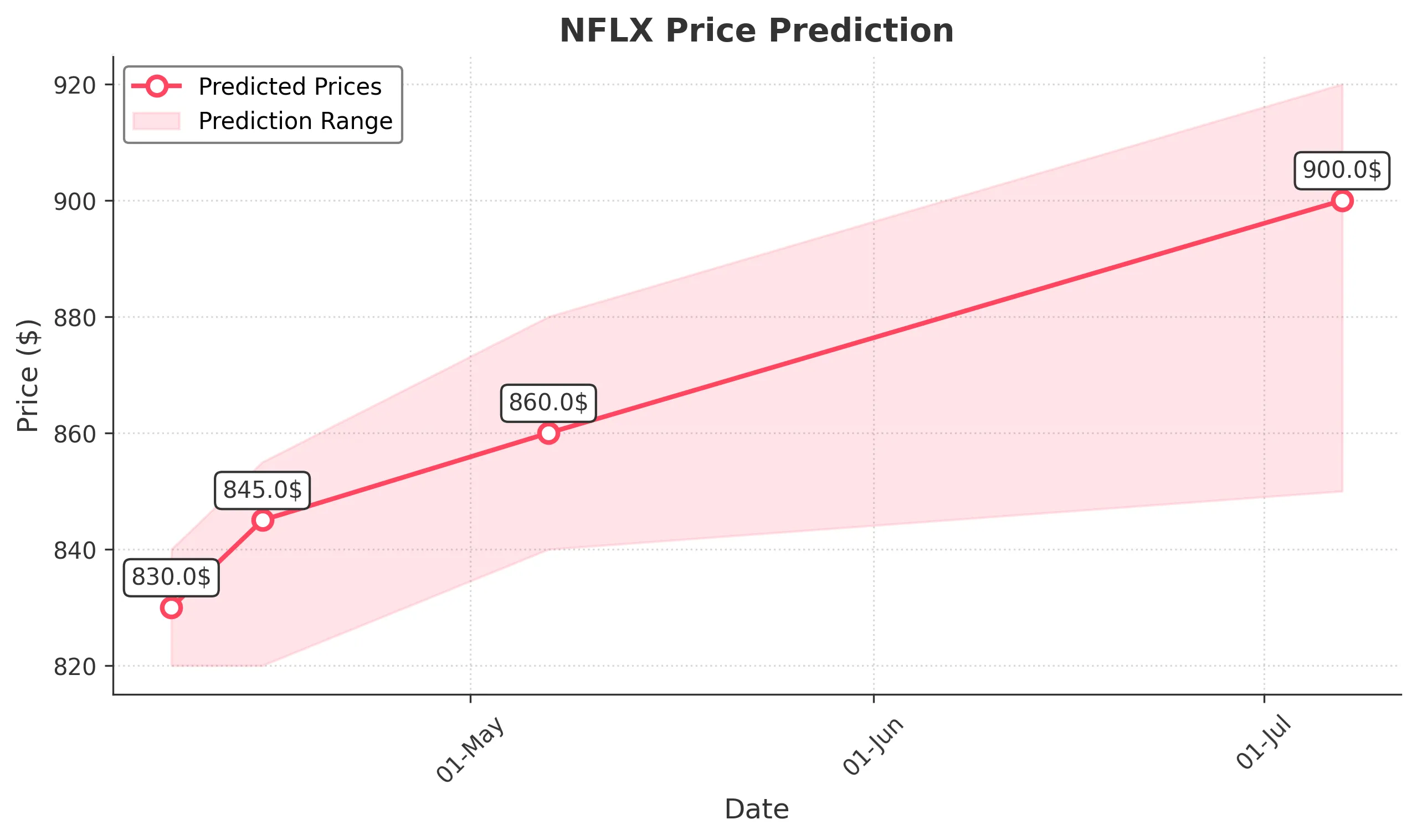

Target: April 8, 2025$830

$828

$840

$820

Description

The stock shows bearish momentum with a recent downtrend. The RSI indicates oversold conditions, suggesting a potential bounce. However, the MACD is bearish, and volume has decreased, indicating weak buying interest.

Analysis

Over the past 3 months, NFLX has experienced significant volatility, with a recent bearish trend. Key support is around 820, while resistance is near 840. The MACD is bearish, and the RSI is approaching oversold levels, indicating potential for a short-term bounce.

Confidence Level

Potential Risks

Market volatility and external news could impact the stock's performance. A sudden positive catalyst could reverse the trend.

1 Week Prediction

Target: April 15, 2025$845

$830

$855

$820

Description

A slight recovery is expected as the stock may find support at 820. The RSI is showing signs of recovery, and a potential bullish divergence is forming. However, the overall trend remains bearish.

Analysis

The stock has been in a bearish trend, with significant support at 820. The recent price action suggests a potential short-term recovery, but the overall sentiment remains cautious. Volume patterns indicate reduced buying interest, which could limit upward movement.

Confidence Level

Potential Risks

Continued bearish sentiment in the market could hinder recovery. External factors such as earnings reports or macroeconomic data may also influence price.

1 Month Prediction

Target: May 7, 2025$860

$845

$880

$840

Description

The stock may stabilize around 860 as it approaches key resistance levels. The RSI is expected to normalize, and if bullish momentum builds, it could push prices higher. However, macroeconomic factors remain a concern.

Analysis

NFLX has shown a mixed performance with bearish tendencies. Key resistance is at 880, while support remains at 840. The stock's volatility is high, and external factors could significantly impact its trajectory in the coming month.

Confidence Level

Potential Risks

Unforeseen market events or earnings surprises could lead to volatility. The bearish trend may still dominate if broader market conditions do not improve.

3 Months Prediction

Target: July 7, 2025$900

$860

$920

$850

Description

A gradual recovery is anticipated as the stock may find support and begin to trend upwards. The market sentiment could improve, but caution is advised due to potential macroeconomic headwinds.

Analysis

Over the last three months, NFLX has faced significant challenges, with a bearish trend dominating. Key support is at 850, while resistance is at 920. The stock's future performance will heavily depend on market sentiment and external economic factors.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic conditions. Earnings reports and competitive pressures could also impact performance.