NFLX Trading Predictions

1 Day Prediction

Target: April 12, 2025$925

$920

$935

$910

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is around 50, suggesting a neutral momentum. A potential bounce from support at 920 could lead to a close around 925.

Analysis

Over the past 3 months, NFLX has shown a bearish trend with significant fluctuations. Key support is at 900, while resistance is around 950. The MACD is bearish, and volume has been inconsistent, indicating uncertainty in market sentiment.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: April 19, 2025$910

$920

$925

$895

Description

Expect a bearish trend as the stock may retest lower support levels. The MACD shows a bearish crossover, and the RSI is trending downwards, indicating potential selling pressure.

Analysis

The stock has been in a downtrend, with significant resistance at 950. Recent volume spikes suggest profit-taking. The ATR indicates increased volatility, and the market sentiment remains cautious.

Confidence Level

Potential Risks

Unexpected earnings reports or macroeconomic events could lead to volatility.

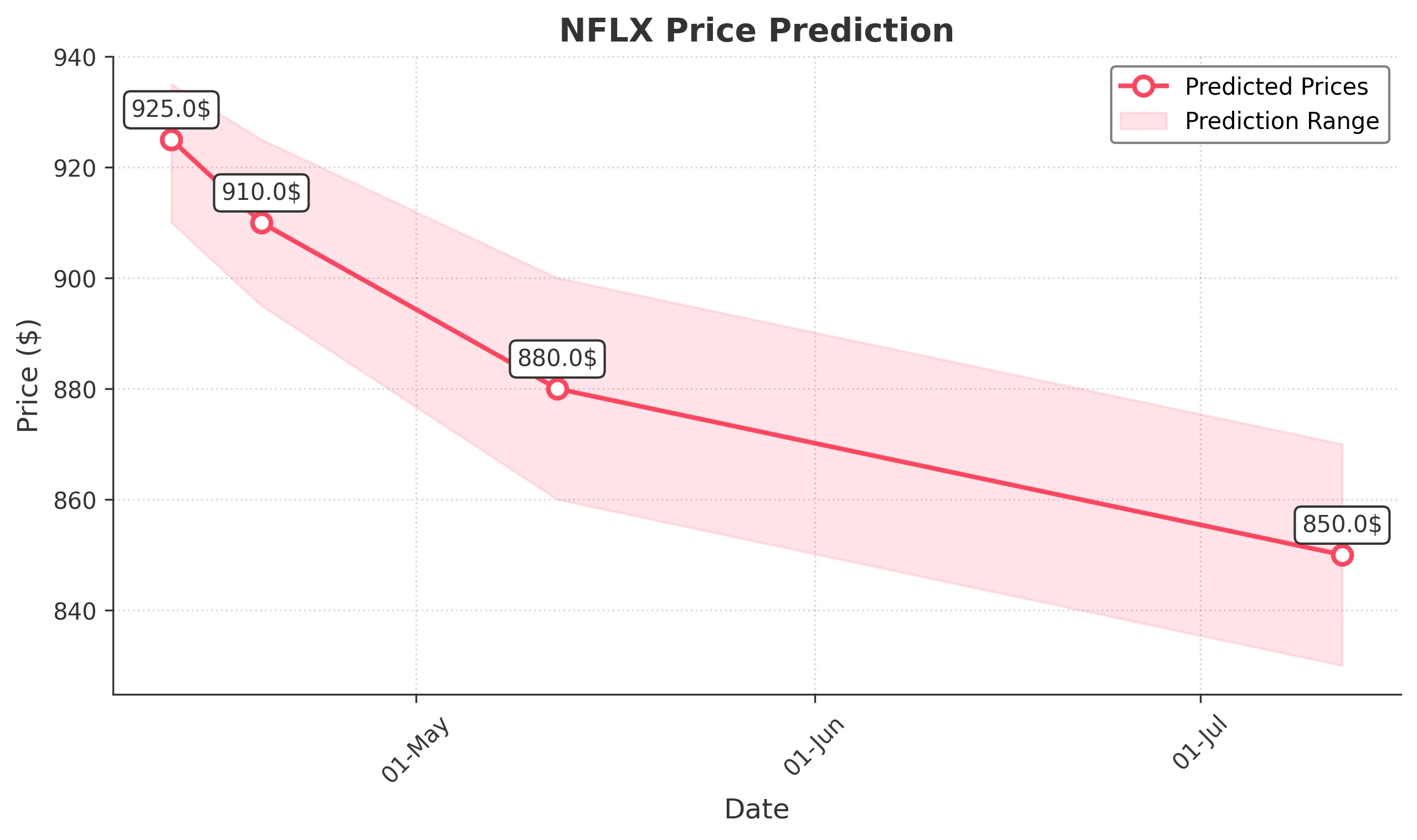

1 Month Prediction

Target: May 12, 2025$880

$895

$900

$860

Description

A bearish outlook is anticipated as the stock may continue to decline towards the 860 support level. The Bollinger Bands are tightening, indicating potential volatility, while the RSI suggests oversold conditions.

Analysis

NFLX has faced downward pressure with key support at 860. The MACD remains bearish, and the recent candlestick patterns indicate selling pressure. Volume has been high during declines, suggesting strong bearish sentiment.

Confidence Level

Potential Risks

Market sentiment could shift with new product announcements or changes in subscriber growth.

3 Months Prediction

Target: July 12, 2025$850

$860

$870

$830

Description

The stock may stabilize around 850, but bearish trends persist. The Fibonacci retracement levels indicate potential support at 840. The market remains cautious, and external factors could influence performance.

Analysis

Over the last three months, NFLX has shown a bearish trend with significant resistance at 900. The stock's volatility is high, and the market sentiment is mixed. Key support levels are critical for future performance.

Confidence Level

Potential Risks

Long-term trends could be affected by changes in the competitive landscape or economic conditions.